Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

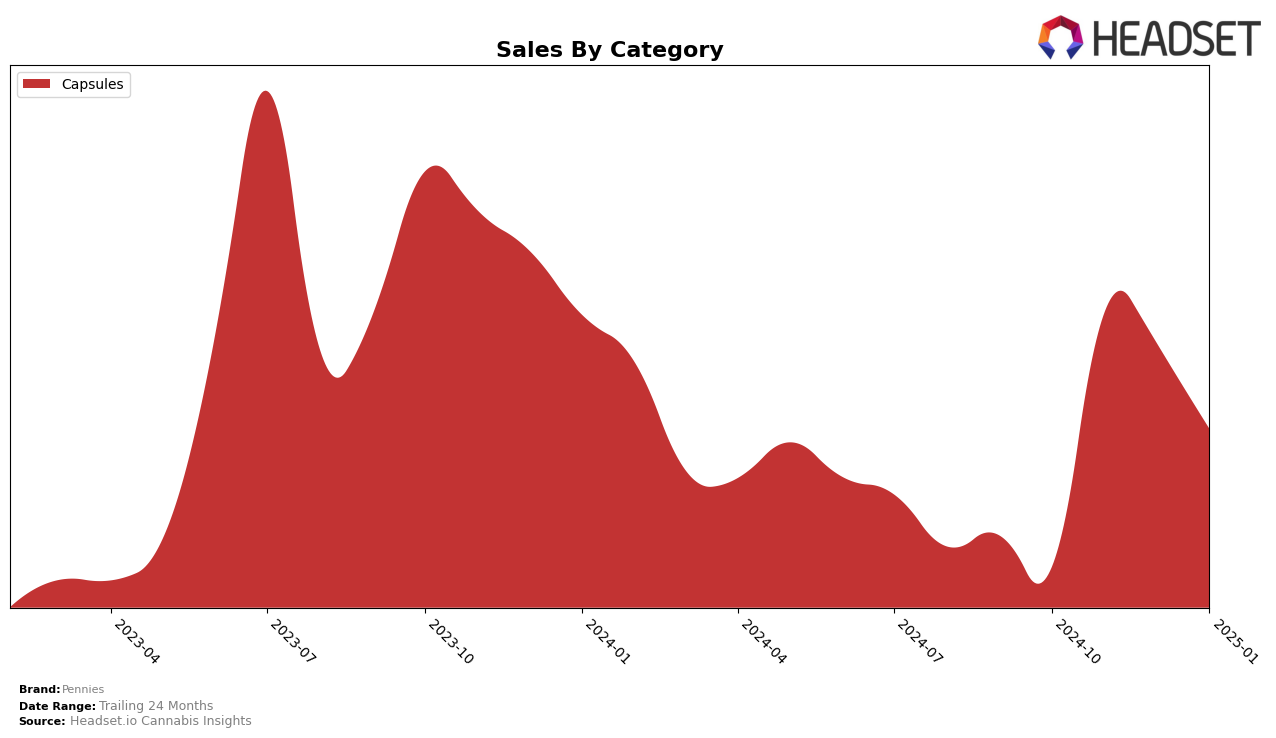

In the Canadian market, Pennies has shown varying performance across different provinces and categories. Notably, in the Capsules category, the brand has made significant strides in Ontario, where it improved its ranking from 14th in October 2024 to a consistent 11th place by January 2025. This upward trend in Ontario is indicative of growing consumer acceptance and market penetration. In contrast, British Columbia presents a more challenging landscape for Pennies, as the brand only entered the top 30 rankings in November 2024, peaking at 10th place, before dropping to 11th in December and not appearing in the rankings for January 2025. This fluctuation suggests potential volatility or increased competition in the British Columbia market.

The sales figures further underscore these trends, with Ontario showing a steady increase in sales from October to December 2024, before experiencing a slight dip in January 2025. This consistent performance in Ontario highlights the brand's successful strategies in maintaining consumer interest and loyalty. Conversely, the absence of sales data for January 2025 in British Columbia, coupled with the brand's drop from the rankings, could point to challenges Pennies faces in sustaining its market position there. Such disparities between the two provinces could be influenced by differences in consumer preferences, competitive landscape, or distribution strategies, offering a complex picture of Pennies' market performance across Canada.

Competitive Landscape

In the Ontario capsules market, Pennies has shown a promising upward trend in rankings over the last few months, moving from 14th place in October 2024 to 11th by December 2024 and maintaining this position into January 2025. This improvement in rank suggests a positive reception from consumers, likely driven by a notable increase in sales during this period. In comparison, Dosecann has consistently held a higher rank, fluctuating between 7th and 9th place, indicating a strong market presence. Meanwhile, Simply Bare re-entered the top 20 in November 2024 and has maintained a stable position at 10th, slightly ahead of Pennies. C Minor has seen a slight decline, dropping to 12th place by January 2025, which could indicate an opportunity for Pennies to further capitalize and potentially surpass them. Nutra has shown improvement but remains behind Pennies, suggesting that Pennies' strategies are effectively capturing market share. Overall, Pennies' consistent climb in rankings and sales growth highlights its increasing competitiveness in the Ontario capsules market.

Notable Products

In January 2025, the top-performing product from Pennies was THC Softgels 5-Pack (50mg) in the Capsules category, maintaining its number one rank for four consecutive months with a notable sales figure of 4,217 units. Following closely, THC Plus Softgels 20-Pack (200mg) also retained its second-place position consistently over the same period. Both products have demonstrated remarkable stability in their rankings since October 2024, with no changes in their positions. The consistent high performance of these products suggests strong customer demand and brand loyalty. Despite a slight decrease in sales figures from December 2024 to January 2025, the rankings remained unaffected, highlighting their continued dominance in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.