Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

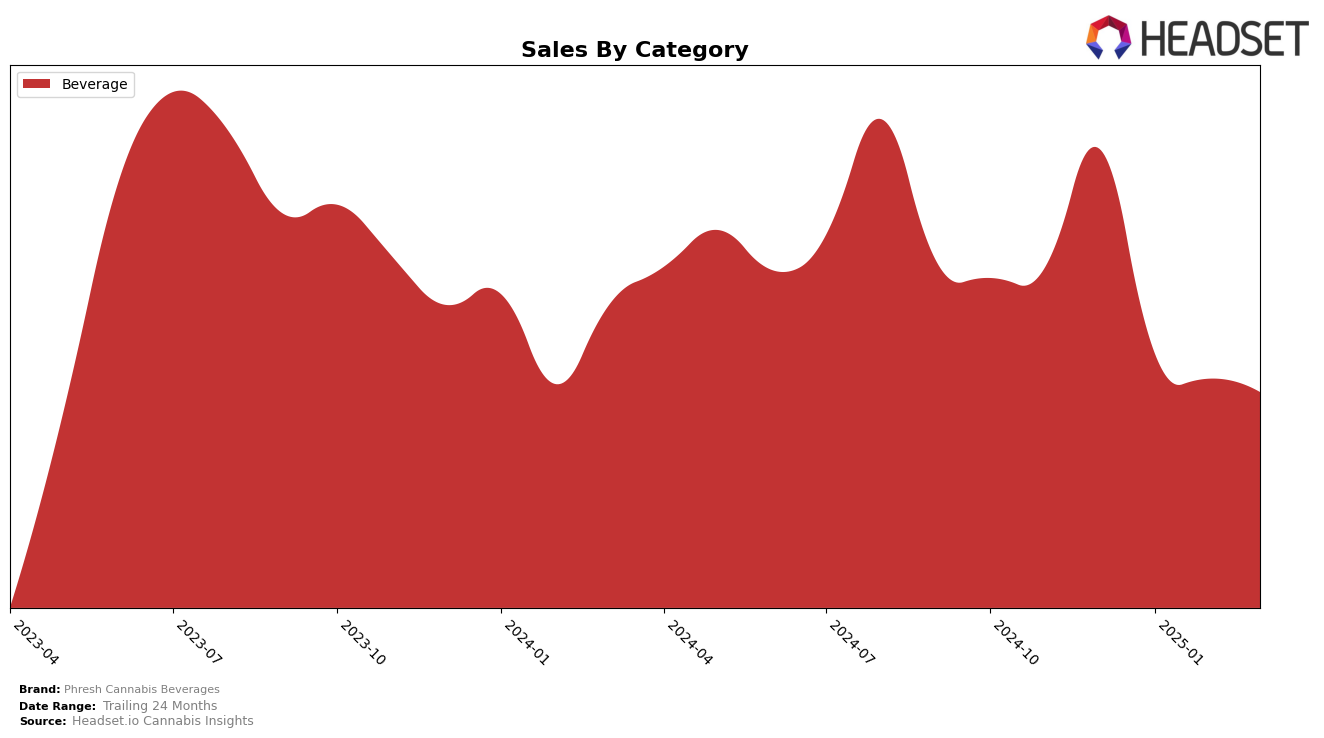

Phresh Cannabis Beverages has shown a dynamic performance in the Ontario market, particularly within the beverage category. Over the months from December 2024 to March 2025, the brand has maintained a presence within the top ten, albeit with some fluctuations. In December 2024, Phresh held a strong fifth position, but experienced a slight dip in January 2025, dropping to sixth. February saw a recovery back to fifth, only for the brand to fall to seventh in March. This suggests a competitive landscape where Phresh is consistently battling to maintain its standing among the top players. The brand's ability to stay within the top ten is indicative of a resilient market presence, though the slight downward trend in rankings warrants attention.

In terms of sales, Phresh Cannabis Beverages experienced a notable decline from December 2024 to March 2025. Starting with sales of 333,816 in December, the numbers decreased steadily each month, reaching 221,947 by March. This downward trajectory in sales, despite maintaining a top ten ranking, highlights potential challenges in consumer retention or market saturation. The absence of Phresh from the top 30 in other states or provinces might indicate areas for growth or improvement. However, the consistent presence in the Ontario market suggests a strong brand loyalty and potential for strategic adjustments to regain upward momentum.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Phresh Cannabis Beverages has experienced fluctuations in its market position, reflecting the dynamic nature of this sector. From December 2024 to March 2025, Phresh Cannabis Beverages saw its rank shift from 5th to 7th, indicating a slight decline in its competitive standing. This change is particularly notable when compared to Sweet Justice, which maintained a relatively stable position, only dropping from 4th to 6th over the same period. Meanwhile, Ray's Lemonade improved its rank from 7th to 5th, surpassing Phresh Cannabis Beverages in March 2025. Despite these shifts, Phresh Cannabis Beverages' sales figures remained competitive, closely trailing those of Sweet Justice and Ray's Lemonade, suggesting that while its rank has declined, its sales performance remains robust. This indicates potential for Phresh Cannabis Beverages to reclaim higher rankings with strategic marketing and product innovation.

Notable Products

In March 2025, Grape Sparkling Water (10mg THC, 355ml) from Phresh Cannabis Beverages topped the sales chart, reclaiming its number one position with a notable sales figure of 7575 units, despite slipping to fourth place in February. Blue Raspberry Sparkling Water (10mg THC, 100ml), which had dominated in February, fell to the second position. Strawberry Kiwi Sparkling Water (10mg THC, 355ml) maintained a consistent presence in the top three, ranking third this month. Summer Punch Sparkling Water (10mg THC, 355ml) held the fourth position, showing steady performance compared to previous months. Mango Peach Sparkling Water (10mg THC, 355ml) remained in fifth place, reflecting stable but lower sales compared to its peers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.