Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

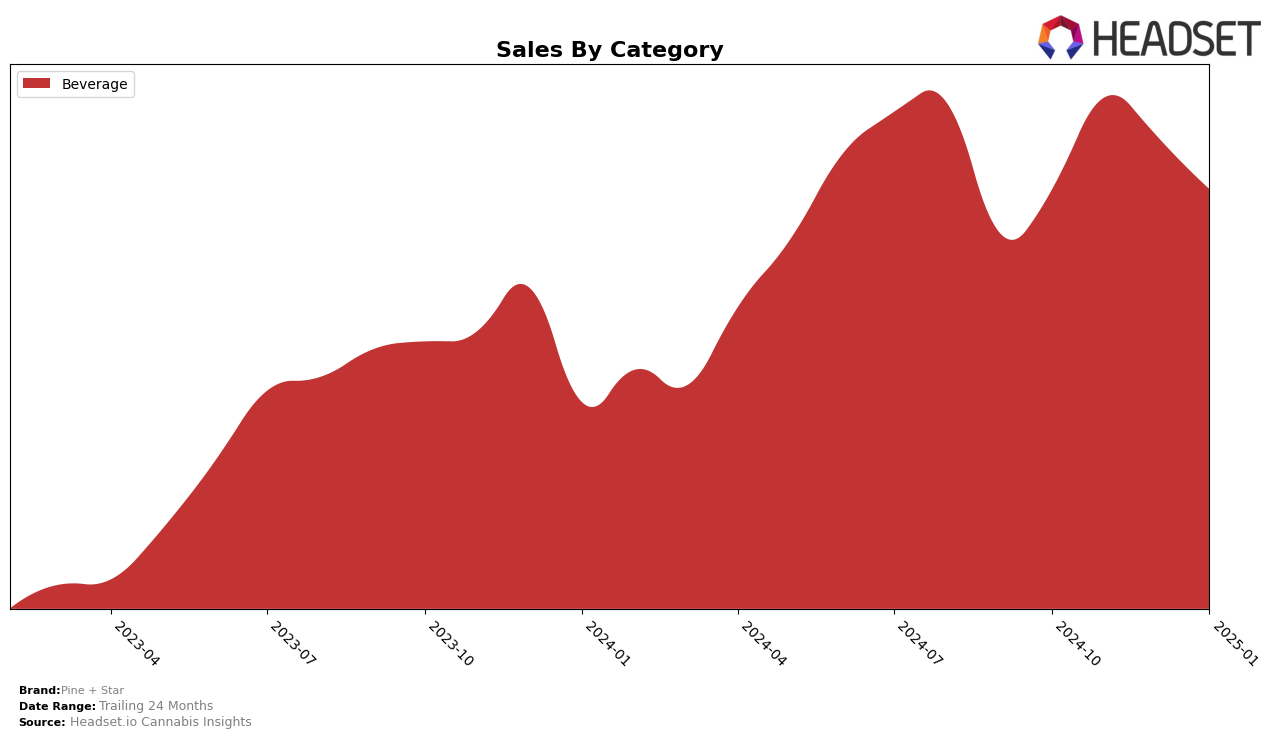

Pine + Star has demonstrated consistent performance in the Beverage category within the state of Massachusetts. Over the four-month period from October 2024 to January 2025, the brand maintained a steady presence, ranking 6th in both October and November, and slightly dropping to 7th in December and January. This stability in rankings suggests a strong foothold in the Massachusetts market, with sales peaking in November 2024. The fluctuation in sales from October to January indicates a seasonal trend that could be worth exploring further for insights into consumer behavior.

In terms of broader market presence, Pine + Star's absence from the top 30 in other state categories could be seen as a potential area for growth or a strategic focus on the Massachusetts market. The brand's consistent performance in Massachusetts might suggest a targeted approach or a strong brand loyalty in that region. However, expanding their reach to other states could provide opportunities for growth and diversification. Understanding the competitive landscape and consumer preferences in these other regions could be key to identifying potential markets where Pine + Star could replicate their Massachusetts success.

Competitive Landscape

In the Massachusetts beverage category, Pine + Star has maintained a consistent presence, ranking 6th in October and November 2024, before slipping slightly to 7th in December 2024 and January 2025. Despite this minor decline, Pine + Star's sales remained relatively stable, peaking in November 2024. Notably, Chill Medicated consistently outperformed Pine + Star, holding a strong position within the top 5 throughout the same period. Meanwhile, Squier's Elixirs showed a positive trend, surpassing Pine + Star in December 2024 and January 2025, indicating a potential shift in consumer preference. The competitive landscape also features Vibations, which improved its rank from 11th to 8th by January 2025, suggesting increasing competition for Pine + Star. These dynamics highlight the importance for Pine + Star to innovate and adapt to maintain its market position amidst growing competition.

Notable Products

In January 2025, Pine + Star's top-performing product was the Blueberry Lemonade Sparkling Beverage, maintaining its number one rank since October 2024 with a sales figure of 6,337 units. The Cape Cod Cranberry Sparkling Beverage consistently held the second position across these months. Tea & Lemonade climbed to the third rank in December 2024 and remained steady in January 2025. The Sparkling Cinnamon Cider Seltzer saw a drop from third to fourth position from December to January. Watermelon Limeade Sparkling Beverage consistently ranked fifth throughout the observed months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.