May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

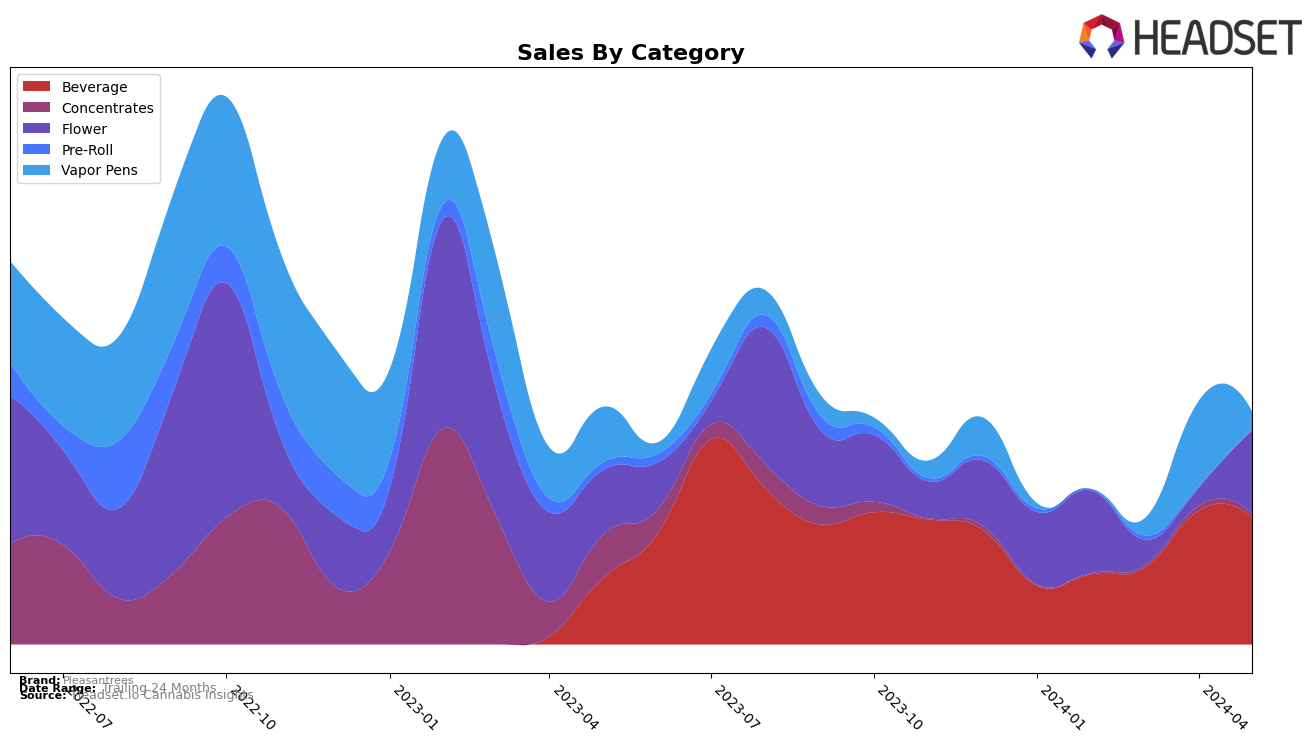

Pleasantrees has shown a consistent performance in the Beverage category within Michigan. The brand maintained its 9th position in both February and March of 2024, before climbing to 8th place in April and holding steady through May. This upward movement indicates a strengthening presence in the market, supported by a notable increase in sales from February to April. Despite a slight dip in May, the brand's ability to hold its ranking suggests a stable consumer base and effective market strategies.

However, Pleasantrees' absence from the top 30 rankings in other states and categories highlights areas for potential improvement. The lack of presence in additional markets could be seen as a missed opportunity for growth. By focusing on expanding its footprint beyond Michigan and diversifying its category offerings, Pleasantrees could capture a larger share of the cannabis market. This strategic shift could potentially replicate the success seen in Michigan across other regions.

Competitive Landscape

In the Michigan beverage category, Pleasantrees has shown a notable improvement in its competitive standing over recent months. Starting from a rank of 9th in February 2024, Pleasantrees maintained this position in March before climbing to 8th place in April and May. This upward trend is significant, especially when compared to competitors like Sweet Justice, which dropped from 8th to 11th place before slightly recovering to 10th in May. Another competitor, Detroit Edibles / Detroit Fudge Company, experienced a gradual decline from 7th to 9th place over the same period. Meanwhile, Chill Medicated saw a significant drop from 3rd in February to 7th in May, indicating a potential shift in consumer preferences. The consistent performance of Highly Casual, maintaining 6th place, suggests a stable market presence. Pleasantrees' rise in rank, coupled with a substantial increase in sales from $32,091 in February to $61,091 in April, positions it as a growing contender in the Michigan beverage market, potentially attracting more consumer interest and market share.

Notable Products

In May-2024, Pleasantrees' top-performing product was White Tahoe Cookies (1g) in the Flower category, securing the first rank with sales of 5132 units. THC Raspberry Iced Tea (10mg) from the Beverage category held the second position, showing consistent performance as it moved up from third in April. Cheetos (Bulk), also in the Flower category, ranked third, marking its debut in the top ranks. THC-infused Lemon Iced Tea (10mg) dropped to fourth place, despite strong sales figures. THC-Infused Peach Iced Tea (10mg) saw a significant drop to fifth place after previously holding the top spot in April.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.