Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

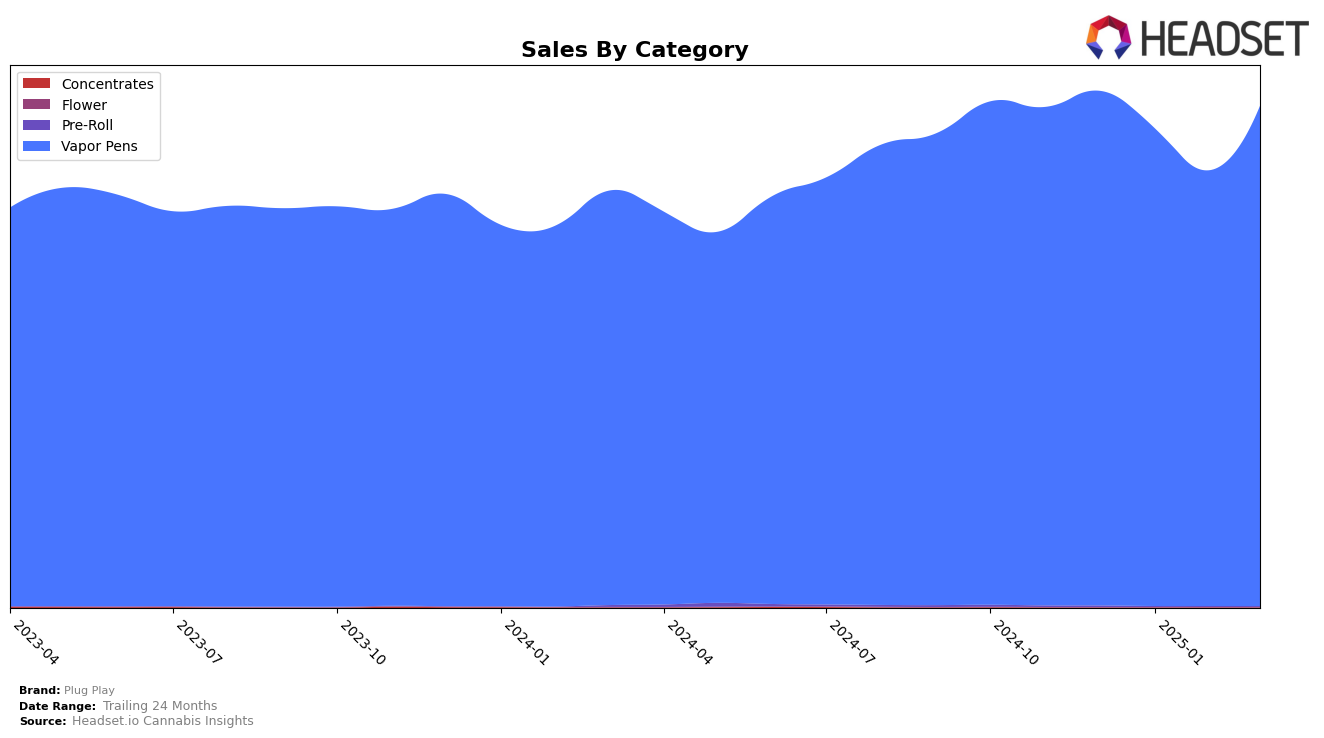

Plug Play has demonstrated a consistent performance in the Vapor Pens category in California, maintaining a steady rank of 2nd place from December 2024 through March 2025. This stability suggests a strong foothold in the market, though it is noteworthy that while the brand's sales slightly dipped in January and February, they rebounded in March 2025. This rebound indicates a potential recovery or strategic adjustment that helped regain momentum. The brand's ability to maintain its rank despite fluctuations in sales volume highlights its resilience and strong market presence in California.

In contrast, Plug Play's presence in New York is less prominent, as evidenced by its December 2024 ranking of 39th in the Vapor Pens category, after which it did not appear in the top 30 rankings for the subsequent months. This absence suggests challenges in establishing a significant market presence in New York or possibly a strategic focus elsewhere. The initial sales figure in New York was relatively modest compared to California, indicating that there might be room for growth or a need for strategic realignment to capture more market share. The differences in performance between these states provide insights into the varying market dynamics and potential areas for growth or improvement for Plug Play.

Competitive Landscape

In the competitive landscape of vapor pens in California, Plug Play consistently holds the second rank from December 2024 through March 2025. Despite a slight dip in sales from December to February, Plug Play's sales rebounded in March, indicating resilience and strong market presence. The brand is sandwiched between the market leader, STIIIZY, which maintains a firm grip on the top position with significantly higher sales, and Raw Garden, which consistently ranks third. Meanwhile, Gramlin shows volatility in rankings but demonstrates growth potential by climbing to fourth place in March. Plug Play's stable ranking amidst these dynamics suggests a loyal customer base and effective market strategies, but the brand must innovate to close the sales gap with STIIIZY and fend off rising competitors like Gramlin.

Notable Products

In March 2025, Plug Play's top-performing product was Exotics - Watermelon Sorbet Distillate Plug (1g) in the Vapor Pens category, maintaining its first-place rank for four consecutive months with a notable sales figure of 16,971. DNA - Blue Dream Distillate Plug Pod (1g) rose to second place, improving from its consistent fourth-place position in the previous months. Exotics - Kiwi Burst Distillate Plug Pod (1g) held steady at third place, showing consistent performance. Exotics - Strawberry Champagne Distillate Plug (1g) entered the rankings at fourth place, indicating a strong market entry. Exotic - Lucky Lychee Distillate Plug (1g) debuted at fifth place, showcasing its growing popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.