Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

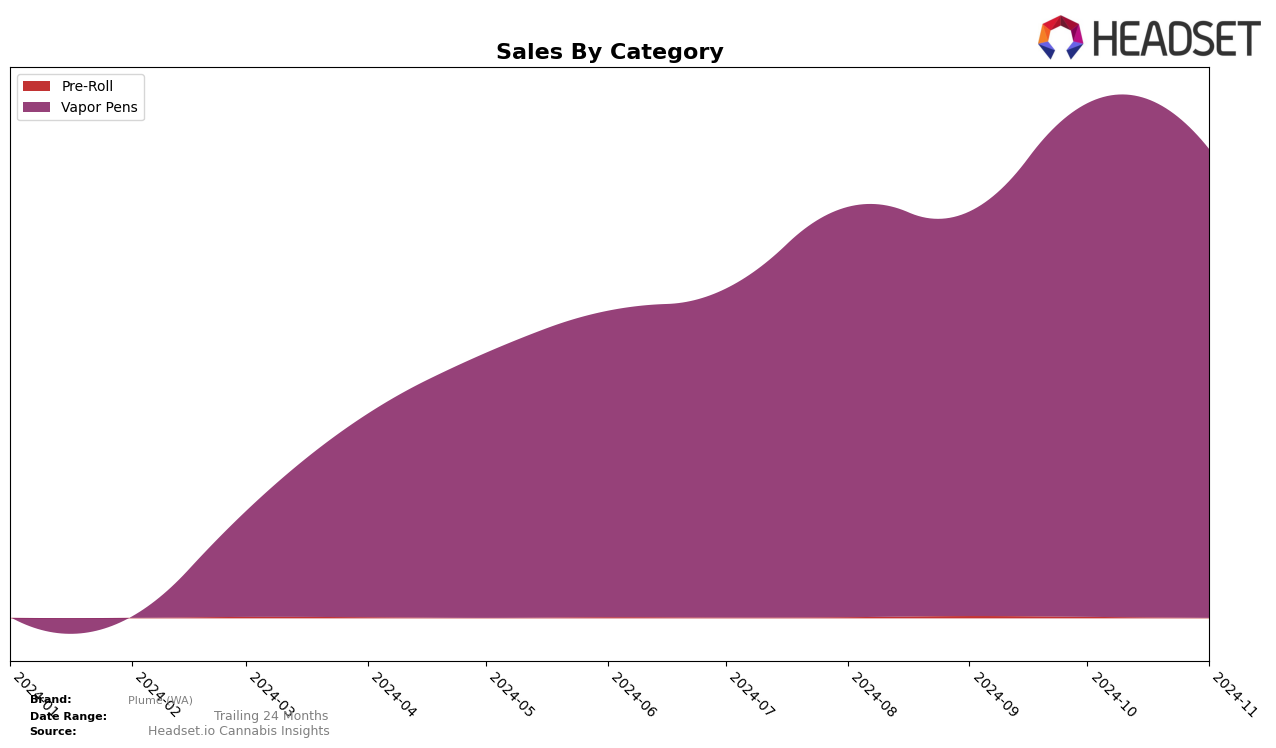

Plume (WA) has shown a notable upward trend in the Vapor Pens category in Washington. While the brand was not in the top 30 in August 2024, it managed to climb to the 30th position by September and further improved to the 27th spot by October, maintaining this rank in November. This consistent upward movement suggests a strengthening presence in the market, likely driven by strategic efforts to enhance product offerings or brand visibility. The increase in sales from September to October, followed by a slight dip in November, indicates potential seasonal or promotional influences impacting consumer purchasing behavior.

Despite these positive movements in Washington, it is important to note that Plume (WA) did not make it to the top 30 in any other states or provinces during this period, which could be seen as a limitation in their current market reach. This absence from other rankings might point to a focus on regional dominance or perhaps challenges in expanding beyond their home state. Analyzing the reasons behind their concentrated success in Washington could provide insights into potential strategies for broader market penetration and growth. Understanding these dynamics will be crucial for stakeholders interested in the brand's future trajectory and potential for scaling operations.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Plume (WA) has shown a steady improvement in its market position over recent months, moving from a rank of 33 in August 2024 to 27 by October and November 2024. This upward trend indicates a positive reception and growing consumer preference. However, Plume (WA) faces significant competition from brands like Hellavated, which maintained a stable rank of 26 in both October and November, slightly ahead of Plume (WA). Meanwhile, Leafwerx experienced a notable jump from 35 in October to 25 in November, surpassing Plume (WA) in the rankings. On the other hand, Treehaus Cannabis and Hitz Cannabis have shown fluctuating ranks, with Treehaus Cannabis dropping to 28 in November and Hitz Cannabis improving to 29. These dynamics suggest that while Plume (WA) is gaining traction, it must continue to innovate and enhance its offerings to maintain and improve its competitive standing in the Washington vapor pen market.

Notable Products

In November 2024, Cherry Crasher Live Resin Disposable (1g) from Plume (WA) maintained its position as the top-performing product with sales of 1232 units, continuing its lead from October. Gorilla Sundae Live Resin Disposable (1g) remained steady at the second position, showing consistent performance over the past months. Super Buff Lemons Live Resin Disposable (1g) entered the rankings at third place, indicating a strong debut. Guava Cake Hash Rosin Disposable (1g) climbed to fourth place after not being ranked in the previous months, highlighting a notable increase in popularity. Gelato Jack Live Resin Disposable (1g) dropped to fifth place, showing a decline from its previous third-place ranking in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.