Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

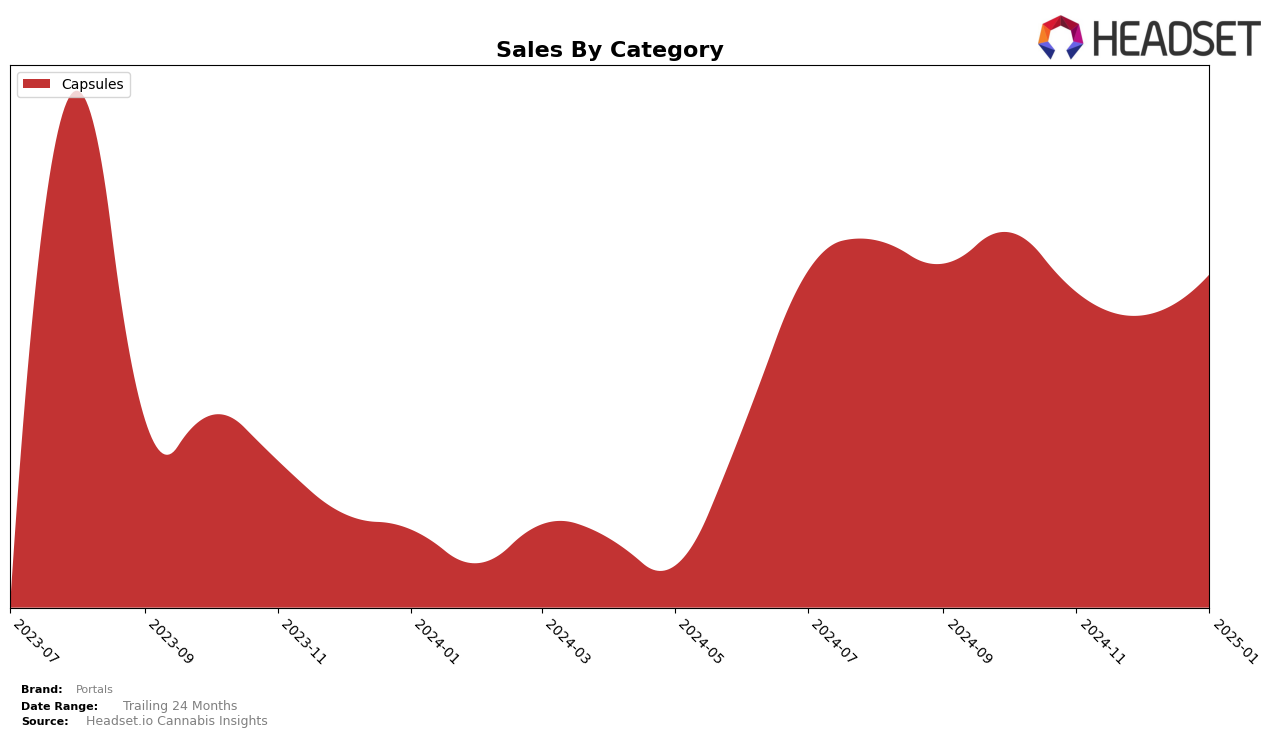

Portals has shown a consistent presence in the Capsules category within Alberta, maintaining a spot in the top 10 throughout the observed months. Notably, the brand improved its ranking from 9th in October 2024 to 8th in November 2024, with a brief drop to 10th in December before climbing back to 8th in January 2025. This fluctuation corresponds with their sales performance, which saw a dip in December but rebounded strongly in January. The ability to regain their position in a competitive market highlights the brand's resilience and adaptability.

In contrast, Portals' performance in British Columbia presents a mixed picture. While they secured the 9th position in October and returned to the top 10 by December, their absence from the rankings in November and January suggests challenges in maintaining consistent visibility. This inconsistency in rankings might indicate market volatility or increased competition within the region. Despite these challenges, the brand's return to the top 10 in December suggests potential for strategic adjustments to regain and sustain a stronger market presence in the future.

Competitive Landscape

In the competitive landscape of cannabis capsules in Alberta, Portals has experienced fluctuating rankings over the past few months, indicating a dynamic market presence. While Portals was ranked 9th in October 2024, it improved to 8th in November 2024, only to slip back to 10th in December 2024, and then recover to 8th in January 2025. This volatility suggests that Portals is facing stiff competition from brands like Indiva, which consistently maintained a higher rank, peaking at 6th place in both November and December 2024. Additionally, Frank has been a formidable competitor, consistently ranking in the top 5, which may have influenced Portals' sales performance. Despite these challenges, Portals' ability to regain its 8th position in January 2025 demonstrates resilience and potential for growth in the Alberta capsules market.

Notable Products

In January 2025, the top-performing product from Portals was the THC/CBG/CBD 5:1:1 Watermelon Lemonade Paradise Max Tablets 40-Pack, maintaining its number one rank from the previous month with sales of 942 units. Following closely, the THC/CBN/CBD 5:1:1 Raspberry Sunset Max Tablets 40-Pack held the second spot, consistent with its ranking from December 2024. The THC/CBG Watermelon Lemonade Paradise Bliss Orally Dissolving Tablet 20-Pack climbed to third place, improving from its consistent fourth-place rank in the prior months. The CBD:CBN:THC Midnight Berry Dreamland Tablets and the THC:CBG 2:1 Downtown Cherry Punch Orally Dissolving Tablets tied for fourth place, with both products experiencing a drop in their rankings compared to December. Notably, the Midnight Berry Dreamland Tablets saw a significant decrease in sales in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.