Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

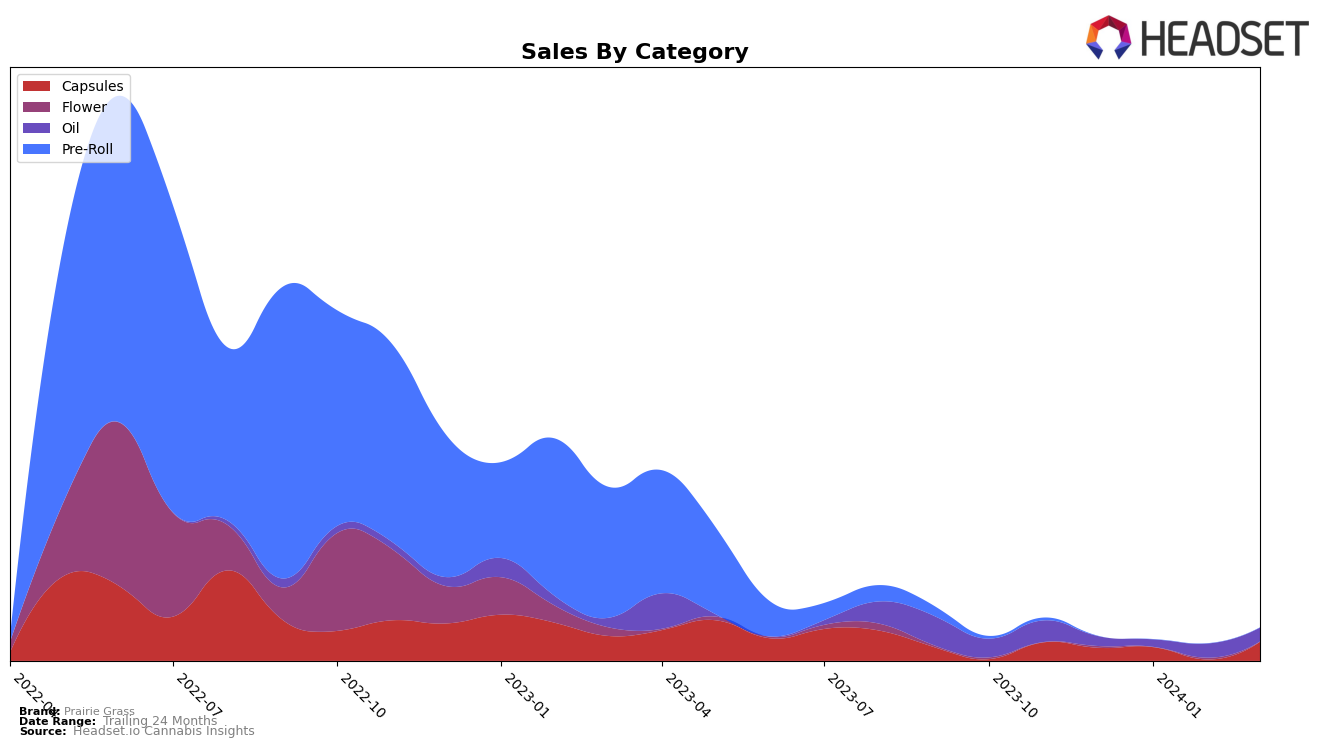

In the Alberta market, Prairie Grass has shown a varied performance across different cannabis categories, indicating a nuanced position within the province's competitive landscape. The brand's presence in the Capsules category has experienced slight fluctuations in rankings over the recent months, moving from 18th in December 2023 to 19th in January 2024, then dipping to 21st in February before climbing back to 18th in March 2024. This rollercoaster in rankings, alongside a significant sales jump in March to 2196 units, suggests a resilience and potential growth area for Prairie Grass, despite the challenges in maintaining a top 20 position consistently. In contrast, their performance in the Oil category has been more stable yet stagnant, with rankings hovering around the 22nd to 23rd positions from December 2023 to March 2024. This stability, however, did not translate to a strong upward trajectory in sales, highlighting an area where the brand could further explore strategies for growth.

What is particularly noteworthy is the brand's ability to remain within the top 30 brands in Alberta for both the Capsules and Oil categories, a feat not all brands can claim. This consistent presence within the competitive rankings underscores Prairie Grass's relevance in the Alberta market, even as the specific rankings reveal room for improvement and potential strategy shifts. The fluctuating sales figures, especially the notable increase in Capsules sales in March 2024, could indicate varying consumer preferences or the impact of strategic moves by Prairie Grass. However, without disclosing specific sales numbers beyond this one instance, it's clear that Prairie Grass's journey in the Alberta market is marked by both challenges and opportunities, with the brand maintaining a foothold amidst shifting dynamics. The stable yet modest rankings in the Oil category, in particular, suggest an area ripe for strategic innovation to capture a larger market share.

Competitive Landscape

In the competitive landscape of the capsule category within Alberta's cannabis market, Prairie Grass has experienced a fluctuating performance in terms of rank and sales over the recent months. Starting from December 2023, Prairie Grass was ranked 18th, slipping to 19th in January 2024, and was not among the top 20 in February 2024, indicating a temporary dip in its market presence. However, it saw a rebound in March 2024, securing the 18th position. This fluctuation is indicative of the brand's resilience and ability to recover, despite facing stiff competition from brands like MediPharm Labs, which consistently held ranks 16th to 17th, and Truro Cannabis Co., which moved from 15th to 16th rank over the same period. Notably, new entrants like Vortex Cannabis Inc. and Ollopa have also made their mark, with Vortex entering the rankings in March at 19th and Ollopa fluctuating in and out of the lower rankings, highlighting the dynamic nature of the market and the ongoing challenge Prairie Grass faces in maintaining and improving its market position.

Notable Products

In March 2024, Prairie Grass saw CBD Bud Spectrum Hemp Oil (30ml) in the Oil category maintaining its top position with impressive sales figures, reaching 45 units sold. Following closely, CBD Eve Pods Suppositories 5-Pack (50mg CBD) from the Capsules category climbed to the second rank, showcasing a significant recovery and interest among consumers. The Relief Pods Suppositories 5-Pack (50mg) also from Capsules, marked its entry into the top three, indicating a growing preference for health-focused cannabis products. Interestingly, Bruce Banner (3.5g) in the Flower category, which previously held a spot in the rankings, did not make it to the top three this month, reflecting shifting consumer preferences. These shifts highlight the dynamic nature of product popularity within Prairie Grass, with a notable rise in demand for wellness-oriented products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.