Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

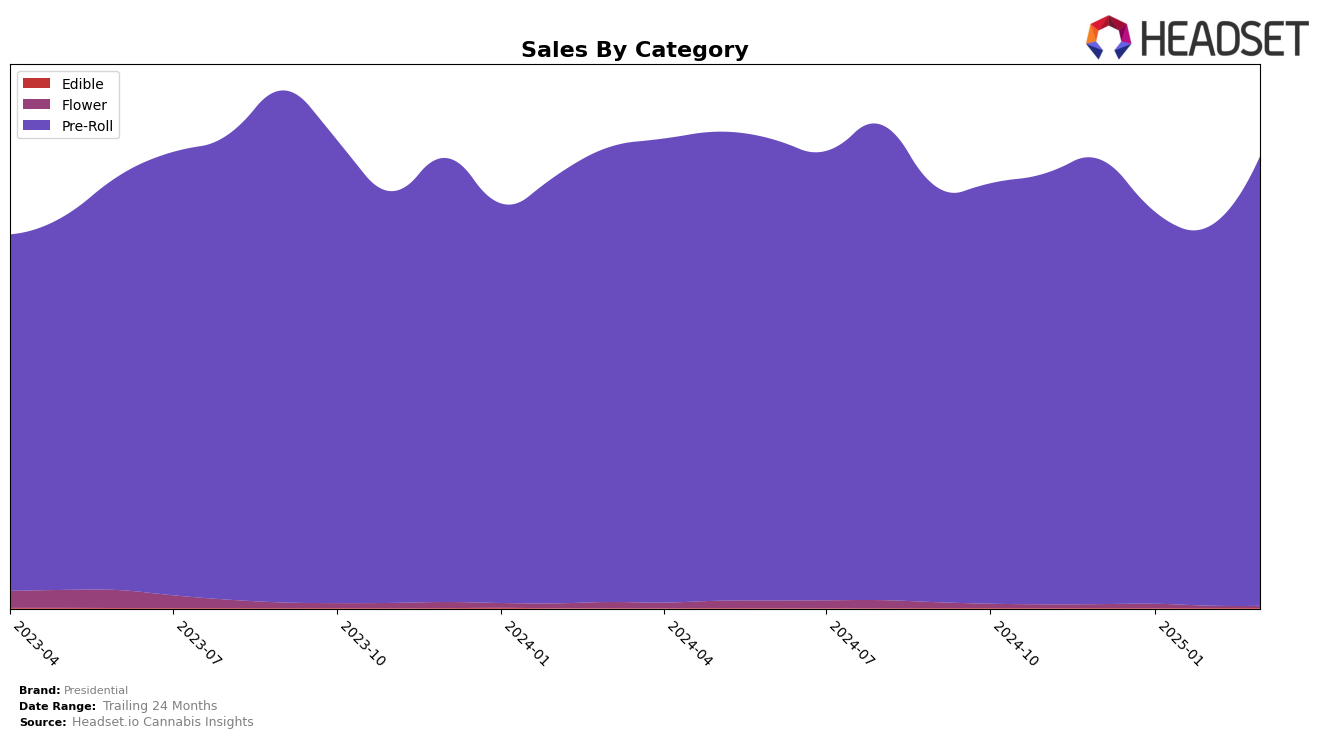

Market Insights Snapshot

Presidential's performance in the Pre-Roll category has shown notable variations across different states in early 2025. In California, the brand has maintained a strong and consistent presence, holding steady at the third position from December 2024 through March 2025. This indicates a robust market position in one of the largest cannabis markets. Conversely, in Michigan, Presidential experienced a more volatile ranking, dropping to 28th in February 2025 before recovering to 23rd in March. This fluctuation could suggest competitive pressures or changes in consumer preferences within the state.

In Arizona, Presidential's presence in the Pre-Roll category has been more consistent, with rankings fluctuating slightly between 25th and 28th. Although these rankings indicate that the brand is not among the top contenders, the steady presence suggests a loyal customer base. Meanwhile, in Nevada, Presidential has consistently held the second position, highlighting its strong market penetration and consumer appeal in the state. The brand's stability in Nevada contrasts with its more dynamic performance in Michigan, offering insights into its varying strategies and consumer engagement across different markets.

Competitive Landscape

In the competitive landscape of the California pre-roll category, Presidential consistently holds the third rank from December 2024 through March 2025, demonstrating a stable position amidst fluctuating sales figures. Despite a dip in sales from December to February, Presidential rebounds in March, indicating resilience and potential for growth. The brand trails behind Jeeter and STIIIZY, which maintain their first and second positions respectively, with significantly higher sales. Notably, Claybourne Co. remains a close competitor, consistently ranking fourth, while Pure Beauty shows improvement by climbing from sixth to fifth rank by February. This competitive analysis highlights Presidential's need to strategize for increased market share, especially against top competitors with robust sales figures.

Notable Products

In March 2025, the top-performing product for Presidential was the Blue Raspberry Moonrock Infused Pre-Roll (1g), which climbed to the number one rank with sales of $9,052. Following closely was the Grape Moonrock Triple Threat Infused Pre-Roll (1g), which improved its rank from third in February to second. The Presidential x Rove - Skywalker Moonrock Infused Pre-Roll (1g) saw a slight drop, moving from second in February to third in March. The Presidential x THC Design - Pink Cookies Moonrock Infused Blunt (1.5g) maintained a steady presence, ranking fourth in March after being fifth in February. Notably, the Strawberry Moonrock Infused Pre-Roll (1g) entered the rankings in March, securing the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.