Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

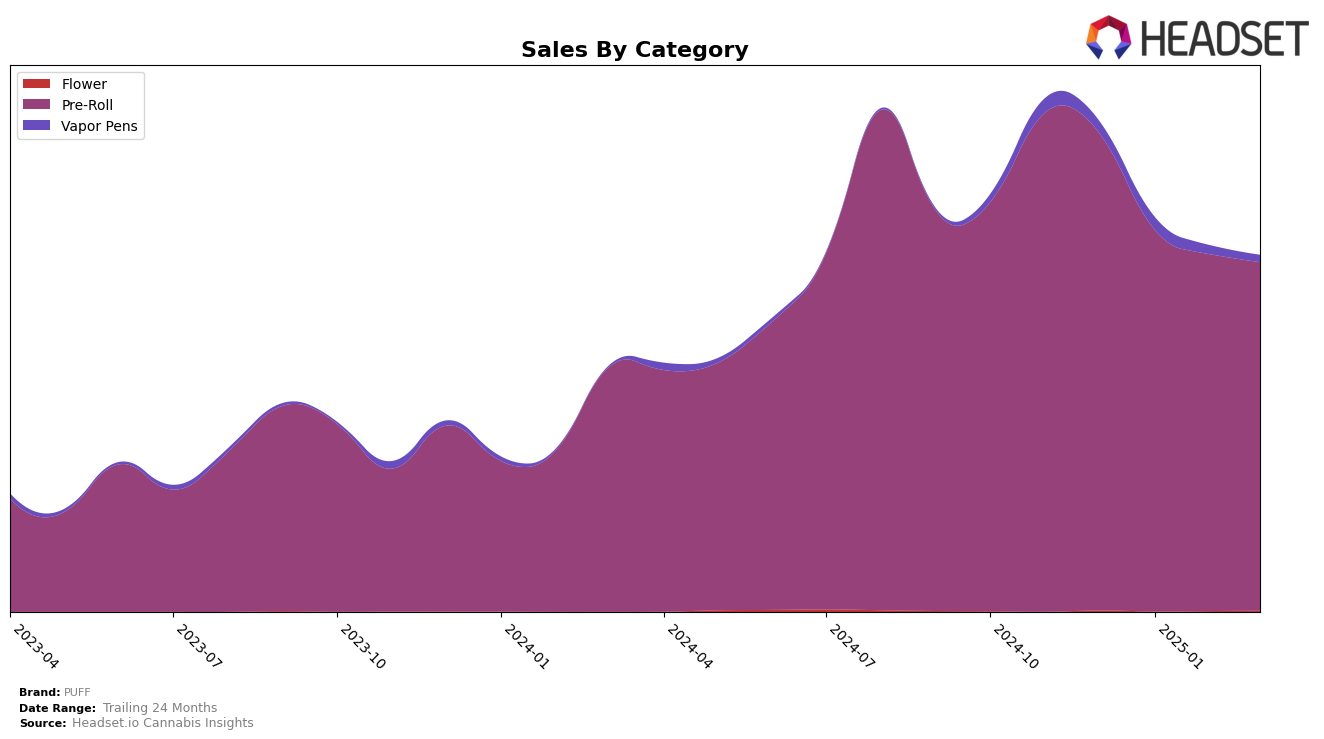

In the competitive landscape of cannabis brands, PUFF has shown varying performance across different states and categories. In the California market, PUFF's presence in the Pre-Roll category has been somewhat inconsistent. Starting at 16th place in December 2024, the brand slipped to 21st in January 2025, bounced back to 16th in February, and then fell again to 22nd in March. This fluctuation indicates a struggle to maintain a steady position within the top tier of brands, which could be attributed to various market dynamics or internal strategic shifts. The sales figures reflect this volatility, with a noticeable decline from December to March. However, despite these ups and downs, maintaining a presence in the top 30 throughout the months suggests a resilient brand that is still a significant player in the California market.

Meanwhile, in New York, PUFF has demonstrated a more stable performance in the Pre-Roll category, consistently ranking within the top 10. Holding the 5th position in both December 2024 and January 2025, the brand experienced a slight decline to 7th in February and further to 8th in March. This steady presence in the upper echelons of the rankings highlights PUFF's stronger market position in New York compared to California. The sales figures support this, showing a smaller decline over the months, which could be indicative of a more loyal customer base or effective marketing strategies tailored to the New York market. The ability to remain within the top 10 suggests that PUFF has a solid foothold and potentially greater brand recognition in this state.

Competitive Landscape

In the competitive landscape of the California pre-roll market, PUFF has experienced fluctuations in its ranking and sales over the past few months. Starting in December 2024, PUFF ranked 16th, but by January 2025, it had dropped out of the top 20, only to return to 16th in February and then fall to 22nd in March. This volatility in rank is mirrored by its sales performance, which saw a decline from December's figures to March 2025. Notably, Grizzly Peak Farms consistently hovered around PUFF's ranking, showing a slightly more stable performance with a peak rank of 17th in December and March. Meanwhile, Sunset Connect exhibited a similar pattern of fluctuation, peaking at 17th in January and February before dropping to 24th in March. Interestingly, Selfies showed a positive trend, improving from 24th in December to 21st in March, suggesting a potential rise in consumer preference. These dynamics indicate a highly competitive environment where PUFF faces challenges in maintaining a consistent market position, highlighting the importance of strategic adjustments to capture and sustain consumer interest in this evolving market.

Notable Products

In March 2025, Lemon Wreck Pre-Roll (1g) maintained its position as the top-performing product for PUFF, leading the sales with $5,202. Headband Pre-Roll (1g) made a significant leap, securing the second rank after not being ranked in the previous two months. Grape Drink Pre-Roll (1g) experienced a slight drop from the second position in February to third place in March, indicating a decrease in sales momentum. Blue Cheese Pre-Roll (1g) consistently held the fourth rank, showing stable performance across the months. Banana OG Pre-Roll (1g) entered the rankings at fifth place, marking its first appearance in the top five this year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.