Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

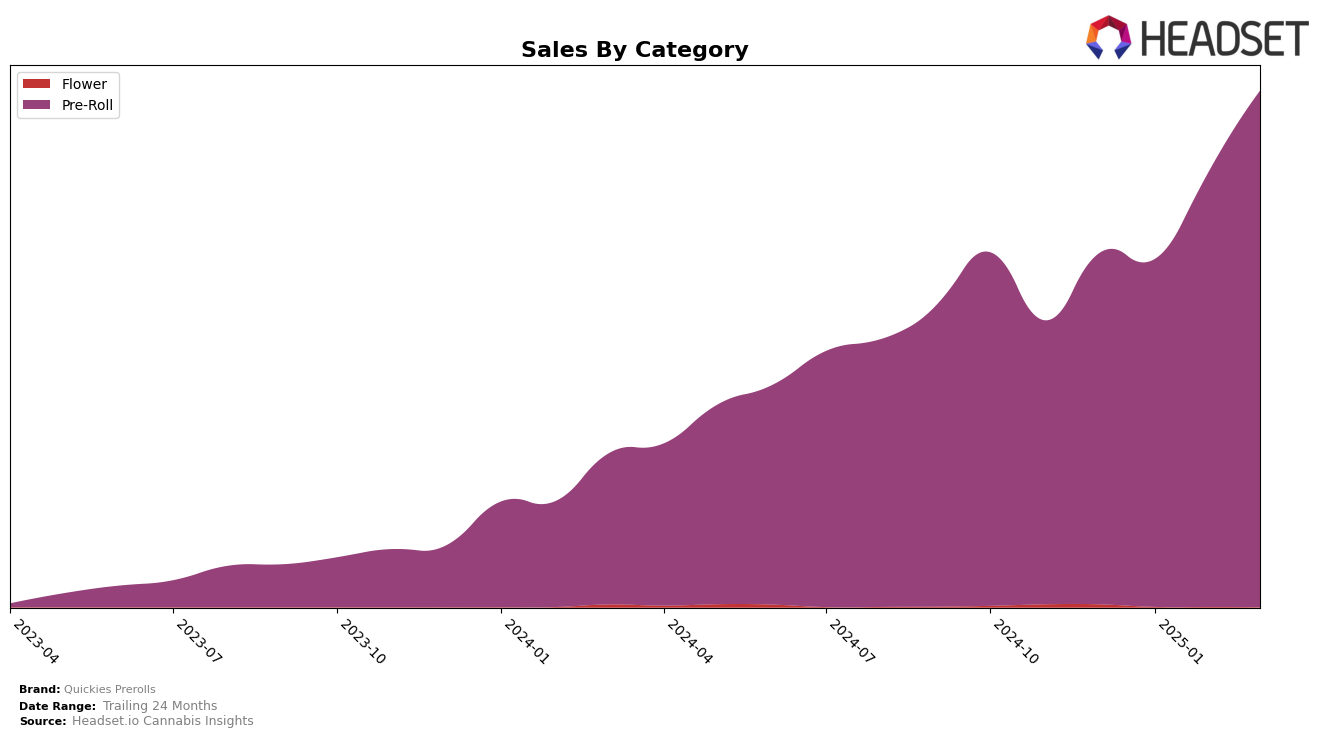

Quickies Prerolls has shown a notable upward trajectory in the California market, particularly within the Pre-Roll category. Starting at the 19th position in December 2024, they ascended to the 10th spot by March 2025. This significant climb within just a few months highlights their growing popularity and market penetration in California. The brand's sales figures reflect this positive movement, with a substantial increase from December 2024 to March 2025. While specific sales numbers are not disclosed here, the trend suggests a robust growth pattern that could be indicative of successful marketing strategies or product innovations.

Interestingly, Quickies Prerolls' performance in other states or categories is not mentioned, implying that they may not have been in the top 30 brands outside California during this period. This absence in other rankings could be interpreted as a potential area for growth or a focus on the California market. Their concentrated success in California suggests that they have a strong foothold in this region, but there's an opportunity for expansion into other states or product categories. This could be a strategic consideration for the brand as they look to build on their current momentum.

Competitive Landscape

In the competitive landscape of the California pre-roll category, Quickies Prerolls has demonstrated a significant upward trajectory in rank and sales over the past few months. Starting from a rank of 19 in December 2024, Quickies Prerolls climbed to the 10th position by March 2025, showcasing a notable improvement compared to its competitors. This rise is particularly impressive when juxtaposed with brands like Caviar Gold, which maintained a steady rank of 12, and Time Machine, which fluctuated slightly but ended at the same rank as Quickies Prerolls in March. Meanwhile, Lime consistently held a higher rank, albeit with a slight dip in March. The most significant competition comes from Sluggers Hit, which, despite a decline in sales, maintained a higher rank throughout the period. Quickies Prerolls' sales surge, particularly in March, suggests a growing consumer preference and market penetration, positioning it as a formidable contender in the California pre-roll market.

Notable Products

In March 2025, the top-performing product from Quickies Prerolls was the Indica Pre-Roll (1g), maintaining its consistent number one rank from previous months and achieving notable sales of $94,026. The Sativa Pre-Roll (1g) climbed back to the second position, showing a significant increase in sales compared to February. The Hybrid Pre-Roll (1g) dropped to the third position, despite strong sales figures. The Sativa Diamond Infused Pre-Roll (1g) remained steady at fourth place, while the newly introduced Skywalker OG Infused Pre-Roll (1g) debuted at fifth. Overall, the rankings indicate a stable preference for traditional pre-rolls over infused variants among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.