Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

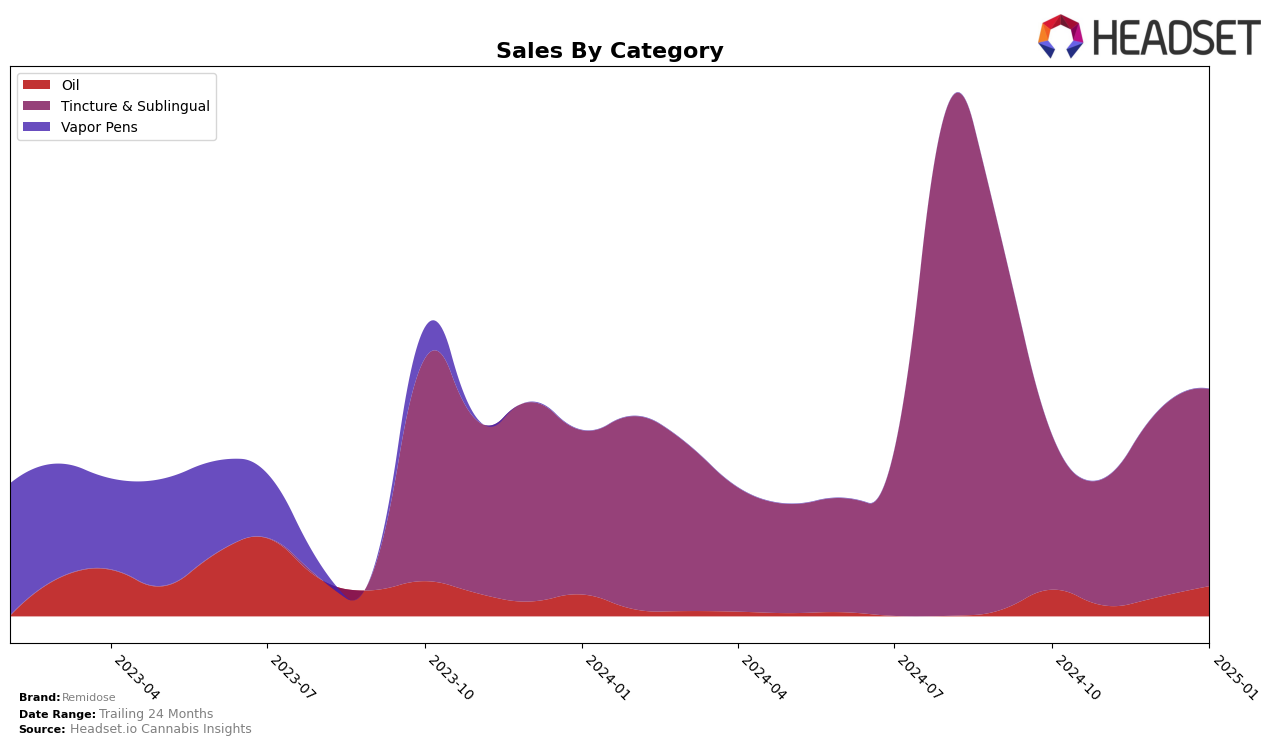

In the Ohio market, Remidose has shown consistent performance in the Tincture & Sublingual category. The brand maintained a steady presence in the top 10 rankings, starting at 9th place in October 2024, briefly dropping to 10th in November, and then climbing back to 8th position by December and January. This upward trajectory suggests a positive reception of their products in this category, supported by a notable increase in sales from November to January. The ability to regain and sustain a higher ranking by the end of January indicates effective market strategies and consumer satisfaction.

However, it's important to note that Remidose's presence in other states and categories is not highlighted in the top 30 rankings, which could suggest either a focus on the Ohio market or potential areas for growth in other regions. The absence of rankings in additional states or categories might be viewed as a missed opportunity or an indication of strategic concentration. While the Ohio market shows promising results, exploring performance in other regions could provide a more comprehensive understanding of Remidose's market positioning and potential for expansion.

Competitive Landscape

In the Ohio Tincture & Sublingual category, Remidose has experienced notable fluctuations in its competitive positioning over recent months. Starting from October 2024, Remidose was ranked 9th, experiencing a slight dip to 10th in November, before climbing back to 8th in December and maintaining that position into January 2025. This upward trend in rank coincides with a steady increase in sales, particularly from December to January, suggesting a positive reception to their offerings. In contrast, Standard Farms has seen a decline, dropping from 8th to being out of the top 20 by January, with a corresponding decrease in sales. Meanwhile, Avexia and Tinctible have maintained stronger positions, consistently ranking higher than Remidose, though Tinctible's sales have shown a downward trend. This competitive landscape highlights the importance for Remidose to continue capitalizing on its recent momentum to further improve its market position.

Notable Products

In January 2025, Grape Sublingual Oral Spray (500mg) maintained its position as the top-performing product for Remidose, achieving sales of 147 units. Berry Sublingual Oral Spray (500mg) held steady in the second rank, continuing its strong performance from the previous months. Strawberry Sublingual Oral Spray (500mg) climbed to the third position, showing an improvement from its fourth-place finish in December 2024. Citrus Live Resin Drops Oil (30ml) rose to fourth place from fifth in the previous month, indicating a positive trend in sales. Pomegranate Sublingual Oral Spray (500mg) dropped to fifth place, showing a decline from its earlier higher rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.