Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

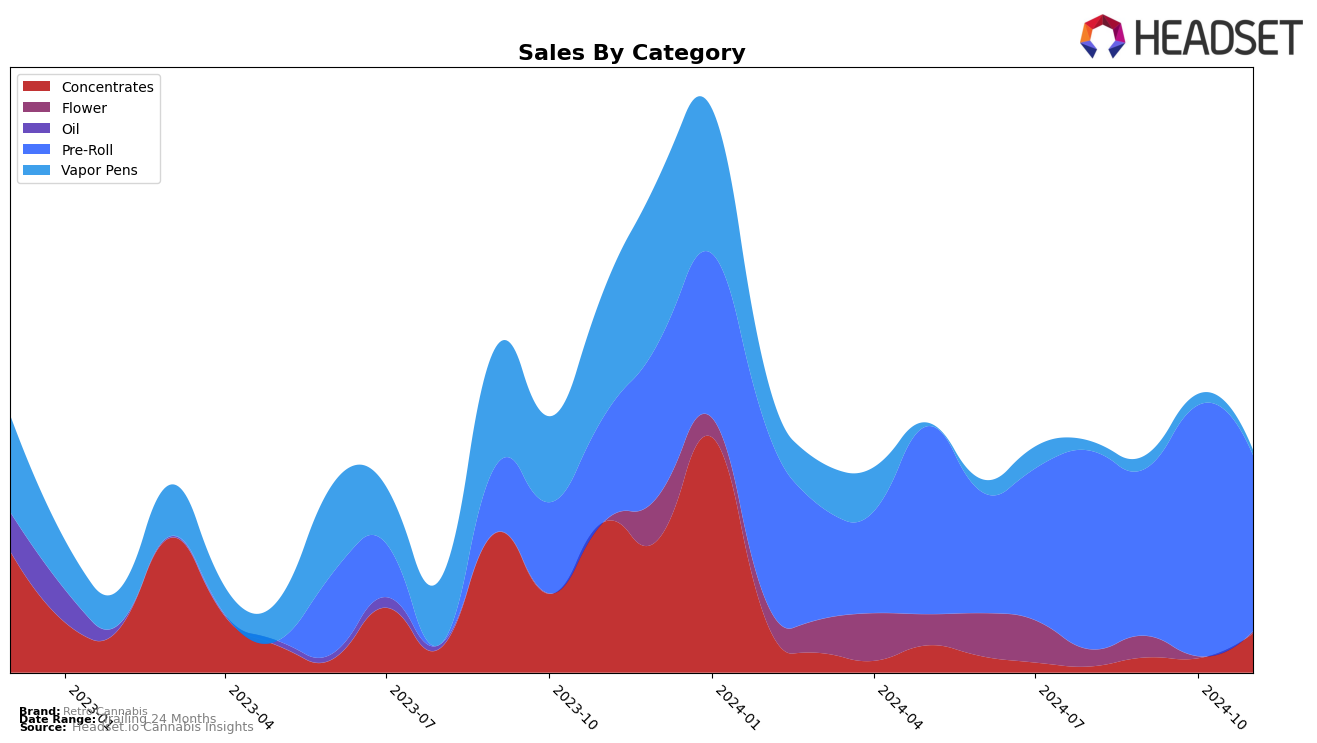

In the province of Saskatchewan, Retro Cannabis has shown a fluctuating performance in the Pre-Roll category. Despite not being in the top 30 brands, the movement in rankings from August to November 2024 reveals some interesting insights. Starting at a rank of 50 in August, Retro Cannabis experienced a slight dip to rank 52 in September, followed by an impressive climb to 43 in October. However, the brand's momentum did not sustain, as it slipped back to rank 51 in November. This variability in rankings suggests that while Retro Cannabis has potential, it faces challenges in maintaining consistent performance in the competitive Saskatchewan market.

Examining the sales data, Retro Cannabis achieved a notable peak in October with sales reaching 23,539 units, indicating a strong market presence during that month. However, the subsequent decline to 16,409 units in November reflects the brand's struggle to maintain its upward trajectory. The fluctuating sales figures and rankings highlight the brand's volatility in the Pre-Roll category within Saskatchewan. This pattern may suggest potential opportunities for growth if Retro Cannabis can stabilize its market strategy and capitalize on the factors that led to October's success.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Saskatchewan, Retro Cannabis has experienced fluctuating rankings from August to November 2024, indicating a dynamic market position. Retro Cannabis saw a notable improvement in October, climbing to the 43rd rank, but it slipped back to 51st in November. This fluctuation contrasts with competitors such as Terra Labs, which maintained a relatively stable position, ranking 37th in October and 41st in November, and Front Porch, which improved significantly from 71st in October to 39th in November. Despite the ups and downs, Retro Cannabis's sales peaked in October, suggesting a potential for growth if the brand can stabilize its market rank. Meanwhile, EXKA (XK) and Uncle Bob also showed varied performances, with EXKA (XK) entering the top 70 in October and improving to 54th in November, while Uncle Bob fluctuated around the 50s. These insights highlight the competitive pressure Retro Cannabis faces and underscore the importance of strategic positioning to capitalize on sales opportunities in this evolving market.

Notable Products

In November 2024, the top-performing product from Retro Cannabis was the Potent Pete Infused Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its consistent number one rank since August, despite a dip in sales to 366 units. The R2 Full Spectrum Honey Oil Syringe (1g) held steady at the second position in the Concentrates category, reflecting a notable increase from its introduction in October with 106 units sold. The R2 Full Spectrum Honey Oil Cartridge (1g) remained in third place in the Vapor Pens category, although its sales have decreased from previous months. Star Dust Isolate (1g) entered the rankings at fourth place in the Concentrates category, showing a slight sales figure of 10 units. The I Got 5 On It Pre-Roll 5-Pack (2.5g) returned to the rankings at fifth place, maintaining its position from October with minimal sales activity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.