Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

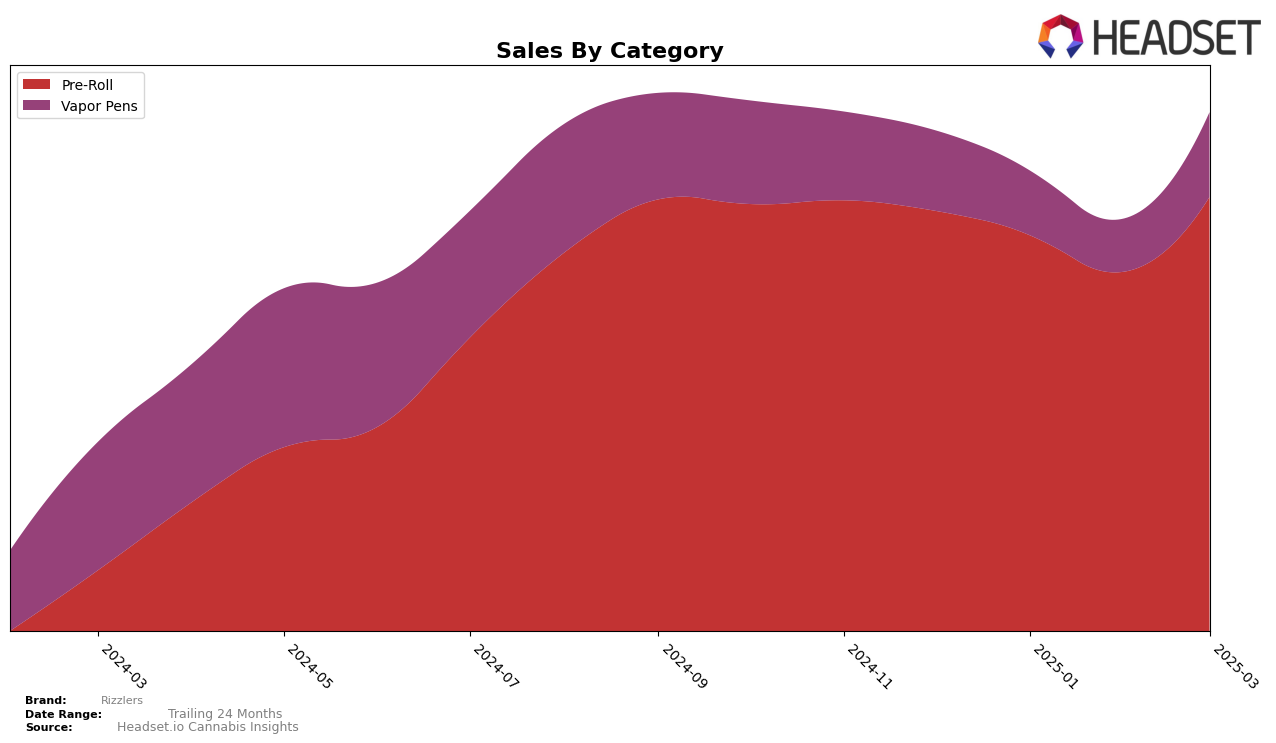

Rizzlers has demonstrated varied performance across different categories and provinces. In the Pre-Roll category, Rizzlers maintained a consistent presence in the top ranks in British Columbia, holding steady at around the 12th position in the first quarter of 2025. This consistent performance suggests a strong foothold in the market, with sales showing a positive trend, particularly in March 2025. Conversely, in Alberta, Rizzlers experienced a slight decline in the Pre-Roll category, moving from the 20th to the 22nd position by March 2025. This indicates a need for strategic adjustments to regain momentum in this region. Meanwhile, in Ontario, Rizzlers showed improvement, climbing from the 38th position in December 2024 to the 23rd position by March 2025, highlighting a successful push in this competitive market.

In the Vapor Pens category, Rizzlers faced challenges in maintaining a top 30 position in British Columbia, with the brand dropping out of the top 30 after January 2025. This suggests potential issues in market penetration or consumer preference that need to be addressed. However, the brand made a notable leap in Alberta, surging from the 59th position in February to the 27th position in March 2025, indicating a significant improvement in market acceptance or distribution strategies. In Ontario, despite not breaking into the top 30, Rizzlers maintained a stable position in the 40s range, suggesting a steady but unspectacular performance. These mixed results across provinces and categories highlight the dynamic nature of the cannabis market and underscore the importance of tailored strategies for each region.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Rizzlers has shown a promising upward trajectory in terms of rank and sales. Starting from a rank of 14th in December 2024, Rizzlers improved to 11th in January 2025 and maintained a stable position at 12th in both February and March 2025. This steady performance is noteworthy, especially when compared to competitors like Good Supply, which saw a decline from 9th to 15th place over the same period. Meanwhile, 1964 Supply Co consistently held the 10th position, indicating a stable but non-dynamic presence. Rizzlers' sales figures also reflect a positive trend, with a significant increase from December 2024 to March 2025, suggesting effective market strategies and growing consumer preference. This positions Rizzlers as a strong contender in the British Columbia Pre-Roll market, with potential for further growth if current trends continue.

Notable Products

In March 2025, the top-performing product from Rizzlers was the Twisters- Tropicoco & Watermelon Razzler Infused Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its consistent rank of 1 since December 2024, with sales reaching 18,210. The Twisters - Blud Orange & Berry Drip Infused Pre-Roll 2-Pack (1g) also held steady at the second rank, showing a slight increase in sales compared to February. The Twisters- Grape Galaxy x Sour Slapple Infused Pre-Roll 2-Pack (1g) remained at the third position, while Twisters- Citrus Cyclone & Mango Slap Infused Pre-Roll 2-Pack (1g) continued to rank fourth, both products experiencing minor sales increases. The Watermelon Razzler Distillate Infused Pre-Roll 6-Pack (3g) maintained its fifth position, showing a notable upward trend in sales since its introduction in January. Overall, Rizzlers' top products demonstrated remarkable stability in rankings across the months, with a slight positive shift in sales figures for March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.