Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

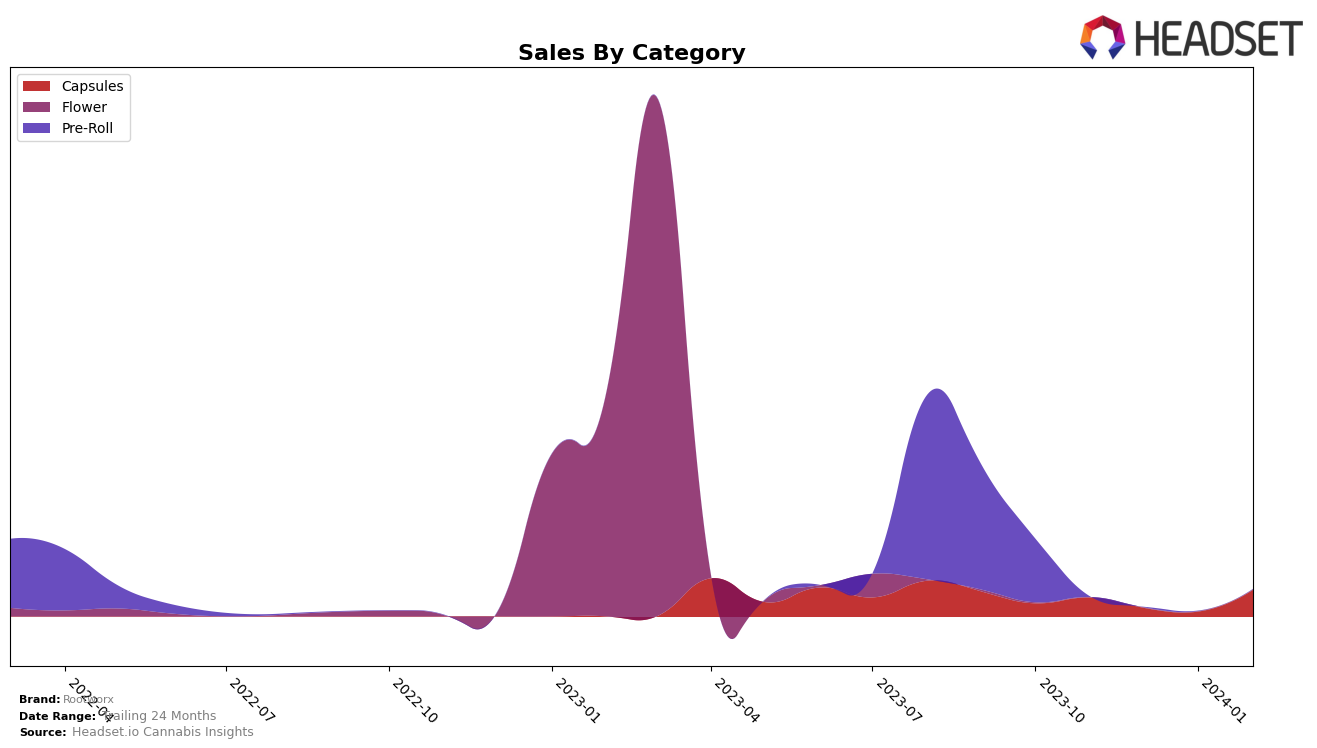

In Washington, the cannabis brand Rootworx has shown an interesting trajectory in the Capsules category over the recent months. Starting from November 2023, Rootworx ranked 9th, then slightly dropped to 10th in December, and further to 11th in January 2024, before making a notable jump back to 8th place by February 2024. This fluctuation in rankings suggests a competitive landscape in the Capsules category within the state. Despite the initial drop in rankings, the significant improvement to 8th place indicates a potential rebound or strategic adjustments by Rootworx. The sales data further illuminates this story, with sales initially decreasing from November's 950 units to 248 units in January, before surging to 1347 units in February, marking their highest sales volume in the observed period.

This performance trajectory of Rootworx in Washington's Capsules category highlights several key points. The initial decline in rankings and sales could be interpreted as a challenge in maintaining market position amidst stiff competition. However, the remarkable recovery in February 2024, both in terms of rankings and sales, suggests a successful turnaround strategy. This improvement could be attributed to various factors such as marketing efforts, product improvements, or changes in consumer preferences. The data does not detail the specific reasons behind this performance but indicates a significant positive shift for Rootworx. Not being in the top 20 brands in any state or category outside of these instances suggests a focused market presence in Washington, which could be a strategic choice or an area for potential expansion. The detailed sales and rankings movement provides a glimpse into the brand's performance but also leaves room for further analysis on the drivers behind these changes.

Competitive Landscape

In the competitive landscape of the cannabis capsule market in Washington, Rootworx has shown a notable fluctuation in its ranking and sales over the recent months. Initially ranked 9th in November 2023, Rootworx experienced a slight dip to 10th in December, before dropping further to 11th in January 2024. However, February 2024 marked a significant turnaround for the brand, as it climbed to the 8th position, surpassing competitors such as Silica Phoenix (WA) which held steady in the rankings but saw a decrease in sales. This rebound is particularly impressive considering the sales growth Rootworx achieved in February, outperforming its previous months. In contrast, leading brands like Trail Blazin Productions and Essence Entourage Extracts maintained higher ranks but showed a more consistent performance without the dramatic fluctuations seen with Rootworx. This analysis suggests that while Rootworx has faced challenges, its recent surge in sales and improvement in rank indicate a positive momentum that could disrupt the current standings if sustained.

Notable Products

In February 2024, Rootworx's top-performing product was the Sativa Capsule 10-Pack (100mg) from the Capsules category, maintaining its number one rank consistently since November 2023. This product saw a significant sales increase in February, reaching 169 units. There were no other products listed for comparison in this period, making the Sativa Capsule 10-Pack the standout item in Rootworx's lineup. Its sales trajectory shows a notable recovery from previous months, particularly from January's 32 units. This performance indicates a strong consumer preference for this product within Rootworx's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.