Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

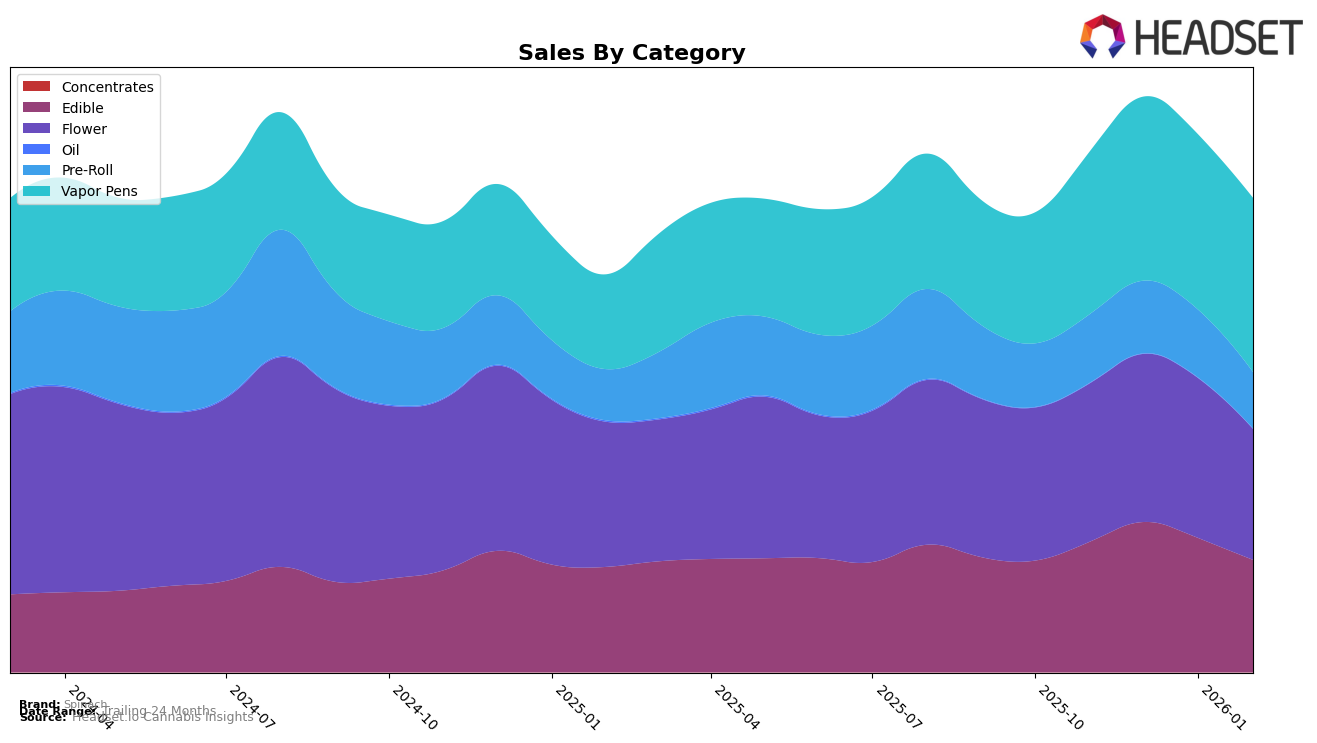

Spinach has shown a strong performance across various categories in several Canadian provinces. In Alberta, Spinach has maintained a dominant position in the Edible and Vapor Pens categories, consistently ranking at the top. However, there was a slight dip in February 2026 for Edibles, where the brand moved to the second position. In contrast, the Flower and Pre-Roll categories have seen some fluctuations, with rankings mostly staying within the top 10. The Flower category saw a minor drop from fifth to sixth place in February, while Pre-Rolls slipped back to seventh after briefly rising to sixth. This suggests that while Spinach has a strong foothold in certain categories, there is room for improvement in others.

In Ontario, Spinach has consistently held the top spot in the Edible category, indicating a strong consumer preference for their products in this segment. The Flower category also shows promising performance, maintaining a solid second place over the months. The Vapor Pens category mirrors this trend, with Spinach securing the second position consistently. However, the Pre-Roll category presents a more variable picture, with rankings ranging from 12th to 17th, suggesting potential challenges in this segment. Meanwhile, in British Columbia, while Spinach leads in Edibles and holds strong in Vapor Pens, its position in Pre-Rolls has been more volatile, indicating a less stable market presence. It's noteworthy that Spinach did not make it into the top 10 for Pre-Rolls in British Columbia, highlighting an area for potential growth.

Competitive Landscape

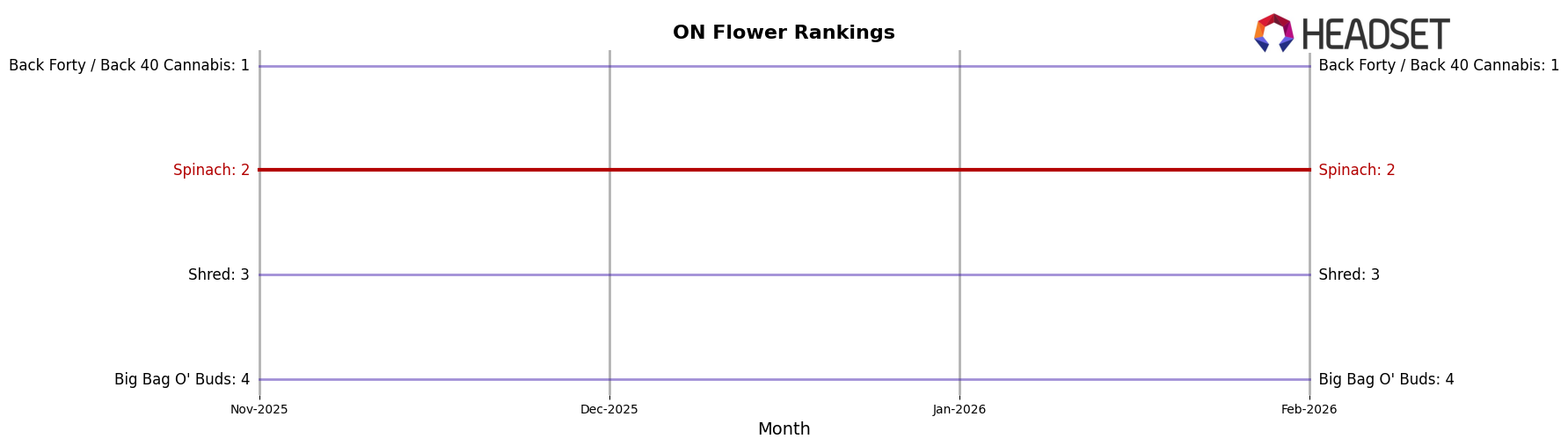

In the competitive landscape of the Flower category in Ontario, Spinach has consistently maintained its position as the second-ranked brand from November 2025 through February 2026. Despite a robust performance, Spinach trails behind Back Forty / Back 40 Cannabis, which holds the top spot with higher sales figures each month. Spinach's sales peaked in December 2025 but saw a decline by February 2026, aligning with a similar downward trend observed in the market leader. Meanwhile, Shred and Big Bag O' Buds consistently followed Spinach, ranking third and fourth, respectively, without any significant shifts in their positions. This stability in rankings suggests a relatively steady market dynamic, with Spinach firmly entrenched as a leading contender, though it faces the challenge of closing the sales gap with the frontrunner.

Notable Products

In February 2026, Spinach's top-performing product was the Sourz Blue Raspberry Watermelon Gummies 5-Pack (10mg), maintaining its number one rank from December 2025. The Sourz Fully Blasted Blue Raspberry Watermelon Gummy (10mg) ranked second, a drop from its previous top position in January 2026. The Sourz Fully Blasted Pink Lemonade Gummy (10mg) consistently held the third position across the last four months. Notably, the Sourz Blue Raspberry Watermelon Gummies 5-Pack achieved sales of 55,950 units in February. The Sourz CBD/THC 1:1 Fully Blasted Peach Orange Gummies 10-Pack remained in the fifth spot, showing consistent performance since its re-entry in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.