Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

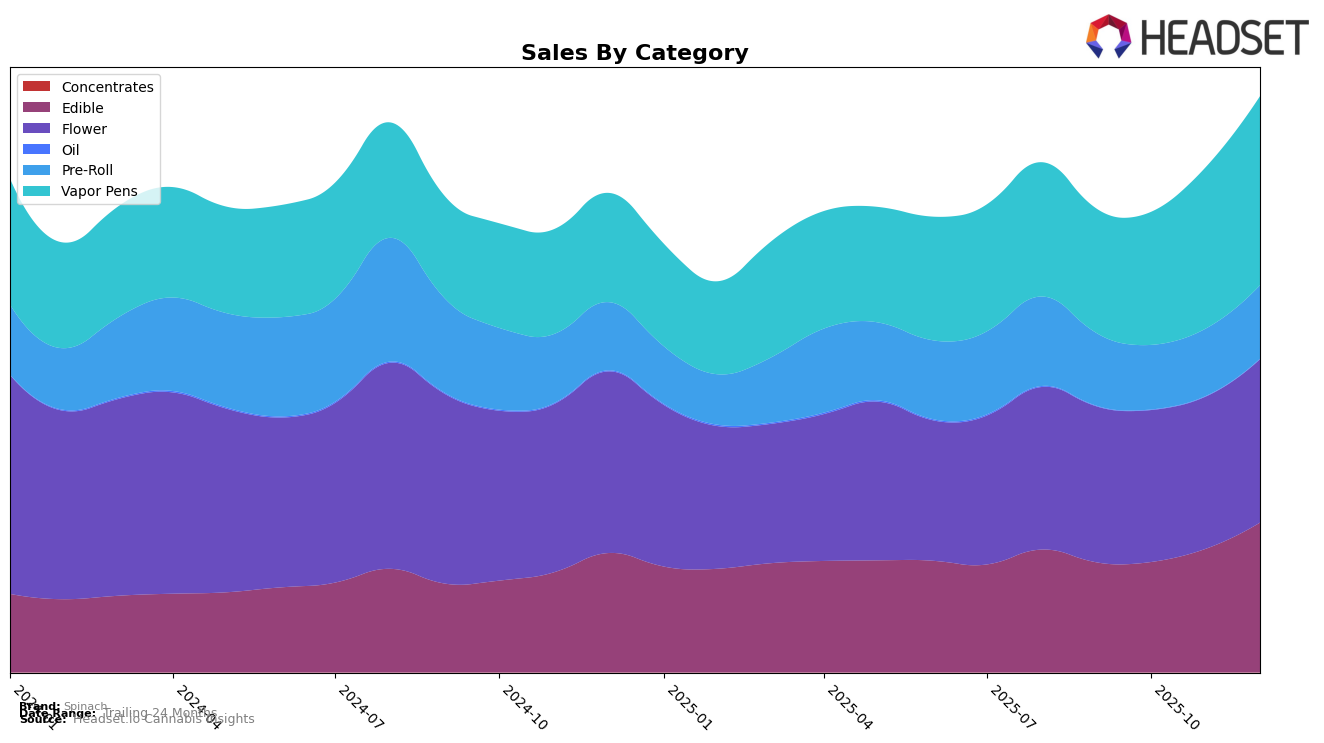

Spinach has demonstrated a strong performance across various categories in Alberta, consistently leading in the Edible and Vapor Pens categories where it maintained the top rank from September to December 2025. Notably, sales in the Vapor Pens category saw a significant increase, indicating a growing consumer preference in this segment. In the Flower category, Spinach improved its ranking from 7th in October to 5th in December, showing a positive trend. However, the Pre-Roll category remained stagnant at 7th place throughout the same period, suggesting potential areas for growth or reevaluation of market strategies.

In British Columbia, Spinach faced challenges in maintaining visibility across categories, as evidenced by its absence from the top 30 in October for Edibles, Flower, and Vapor Pens. Despite this, Spinach made a notable entry at 20th place in the Pre-Roll category by December, suggesting a breakthrough in this segment. Meanwhile, in Ontario, Spinach excelled in the Edible category, holding onto the number one spot consistently, and saw a slight improvement in the Pre-Roll category, moving from 17th to 15th place by November and December. The brand's performance in Saskatchewan was marked by a brief ascent to the top rank in Vapor Pens in November, although it returned to the second position by December, indicating competitive pressure in this market.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Spinach has demonstrated a robust performance, consistently maintaining a top-tier position. Throughout the last quarter of 2025, Spinach fluctuated between the first and second rank, indicating a strong market presence. In September 2025, Spinach was ranked second, but it climbed to the top spot in October, only to return to second place in November and December. This dynamic positioning highlights a competitive rivalry with Back Forty / Back 40 Cannabis, which mirrored Spinach's ranking fluctuations but ultimately secured the first position in three out of the four months. Despite this, Spinach's sales figures remained robust, with a notable peak in October. Meanwhile, Shred and Big Bag O' Buds consistently held the third and fourth ranks, respectively, without threatening Spinach's position. This stability in the rankings suggests that while Spinach faces strong competition from Back Forty, it remains a dominant player in the Ontario Flower market.

Notable Products

In December 2025, the top-performing product from Spinach was Sourz - Blue Raspberry Watermelon Gummies 5-Pack (10mg), maintaining its first-place ranking from November with sales reaching 87,736 units. Following closely, the Sourz - Fully Blasted Blue Raspberry Watermelon Gummy (10mg) held the second position, a slight drop from its previous first-place ranking in September and October. Sourz - Fully Blasted Pink Lemonade Gummy (10mg) consistently remained in third place since November, showing steady performance. The Sourz - CBD/THC 1:1 Peach Orange Gummies 5-Pack (10mg CBD, 10mg THC) also maintained its fourth-place ranking from October onwards. Notably, the Sourz - CBG/THC 4:1 Strawberry Watermelon Gummies 5-Pack (40mg CBG, 10mg THC) re-entered the rankings in December at fifth place, highlighting a resurgence in interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.