Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

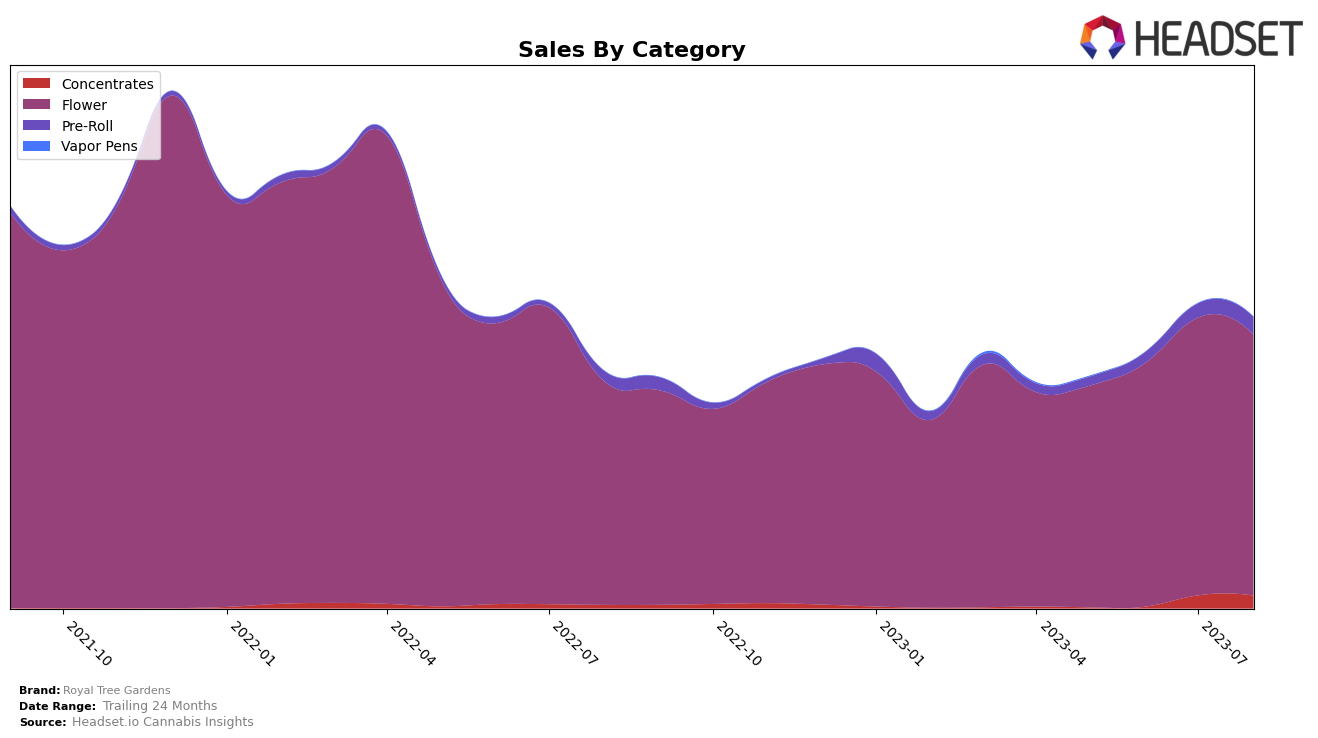

In the state of Washington, Royal Tree Gardens has demonstrated a consistent performance in the Concentrates category. Although the brand did not make it to the top 20 in this category for the past few months, it maintained its ranking at the 99th position in both August and July 2023. This could indicate a stable, albeit not leading, presence in this category. On a positive note, the sales numbers showed a slight increase from July to August, suggesting a potential for growth.

On the other hand, Royal Tree Gardens has shown remarkable progress in the Flower category. Over the period from May to August 2023, the brand managed to climb up the ranks, moving from the 23rd position to the 16th. This upward trend indicates a growing popularity and increasing market share in the Flower category within Washington. The sales figures corroborate this trend, showing a steady growth month over month, with the most significant jump observed between June and July 2023. However, the exact sales numbers will be kept confidential in this analysis.

Competitive Landscape

In the Flower category in Washington state, Royal Tree Gardens has shown a consistent improvement in its ranking over the past four months, moving from not being in the top 20 in May 2023 to the 16th position in August 2023. This upward trend indicates a positive growth in sales, despite facing stiff competition from brands like Fireline Cannabis, Blue Roots Cannabis, INDO, and Cowlitz Gold. Notably, Blue Roots Cannabis, despite a dip in rank from 9th to 14th between July and August 2023, has consistently higher sales than Royal Tree Gardens. INDO, on the other hand, has seen a significant drop in rank from 11th to 18th over the same period, indicating a decrease in sales. Cowlitz Gold and Fireline Cannabis have maintained relatively stable positions and sales, with Fireline Cannabis slightly lower in rank and sales than Royal Tree Gardens in August 2023.

Notable Products

In August 2023, the top-performing product from Royal Tree Gardens was Middlefork (3.5g), with sales reaching 2097 units. This product rose from the third position in July to become the best seller. The second best-selling product was Ice Cream Cake (3.5g), which had been the top seller for the previous three months but fell to second place with sales of 1718 units. Oreoz (3.5g) moved up two places to secure the third position, while Do-Lato #8 (3.5g) maintained its fourth place ranking. Gary Payton (3.5g), despite a drop in sales, managed to remain in the top five, moving down from second to fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.