Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

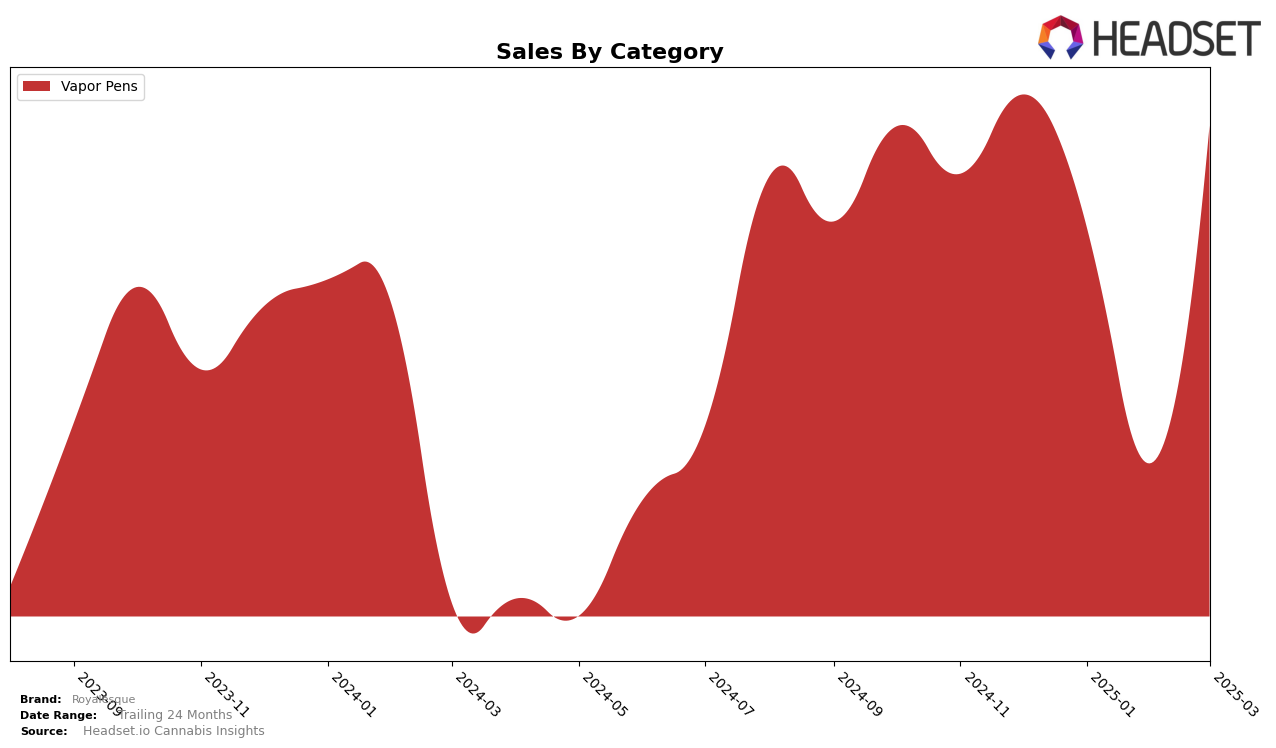

Royalesque's performance in the Vapor Pens category within Nevada exhibited notable fluctuations over the observed months. In December 2024, the brand secured the 20th position, maintaining a steady presence by slightly dropping to 21st in January 2025. However, February brought a significant dip, as Royalesque fell out of the top 30, indicating a potential challenge in maintaining consumer interest or facing heightened competition. By March, the brand made a commendable recovery, climbing back to the 17th position, which suggests strategic adjustments or renewed consumer engagement. This movement highlights Royalesque's resilience in a competitive market, though the absence in February's top 30 is a point of concern.

While specific sales figures provide a glimpse into Royalesque's market dynamics, the overall trend suggests a volatile performance with a promising rebound. The brand's sales saw a sharp decline from December to February, with a low point in February, before recovering in March. This recovery, despite the earlier dip, indicates the brand's potential for adaptability and growth in a competitive landscape. The ability to regain a top 20 position after such a drop is a testament to Royalesque's potential strategies in product offerings or marketing efforts. However, the absence from the top 30 in February serves as a reminder of the challenges faced in maintaining consistent brand visibility and consumer loyalty.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Royalesque has experienced fluctuating rankings and sales over the past few months, highlighting both challenges and opportunities in this dynamic market. From December 2024 to March 2025, Royalesque's rank shifted from 20th to 17th, with a notable dip to 31st in February, indicating a temporary setback. This fluctuation contrasts with competitors like Srene, which consistently maintained a top 20 position, peaking at 13th in January 2025. Meanwhile, Dime Industries and Dabwoods Premium Cannabis showed variable performance, with Dime Industries missing the top 20 in February and Dabwoods entering the rankings in March. LP Exotics demonstrated a steady climb, reaching 19th in March, suggesting increasing consumer interest. Royalesque's sales mirrored these rank changes, with a significant drop in February but a recovery in March, indicating resilience and potential for growth amidst competitive pressures.

Notable Products

In March 2025, the top-performing product for Royalesque was London Pound Cake Distillate Disposable (1g) in the Vapor Pens category, achieving the number one rank with notable sales of 1141 units. Orange Apricot Distillate Disposable (1g) secured the second position, marking its first appearance in the rankings. White Runtz Distillate Disposable (0.5g) dropped to third place, having previously held the top spot in February. Animal Mintz Distillate Disposable (0.5g) maintained a strong presence, ranking fourth, consistent with its performance in January. Garlic Cookies Distillate Disposable (0.5g) entered the rankings at fifth place, showcasing a new entry for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.