Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

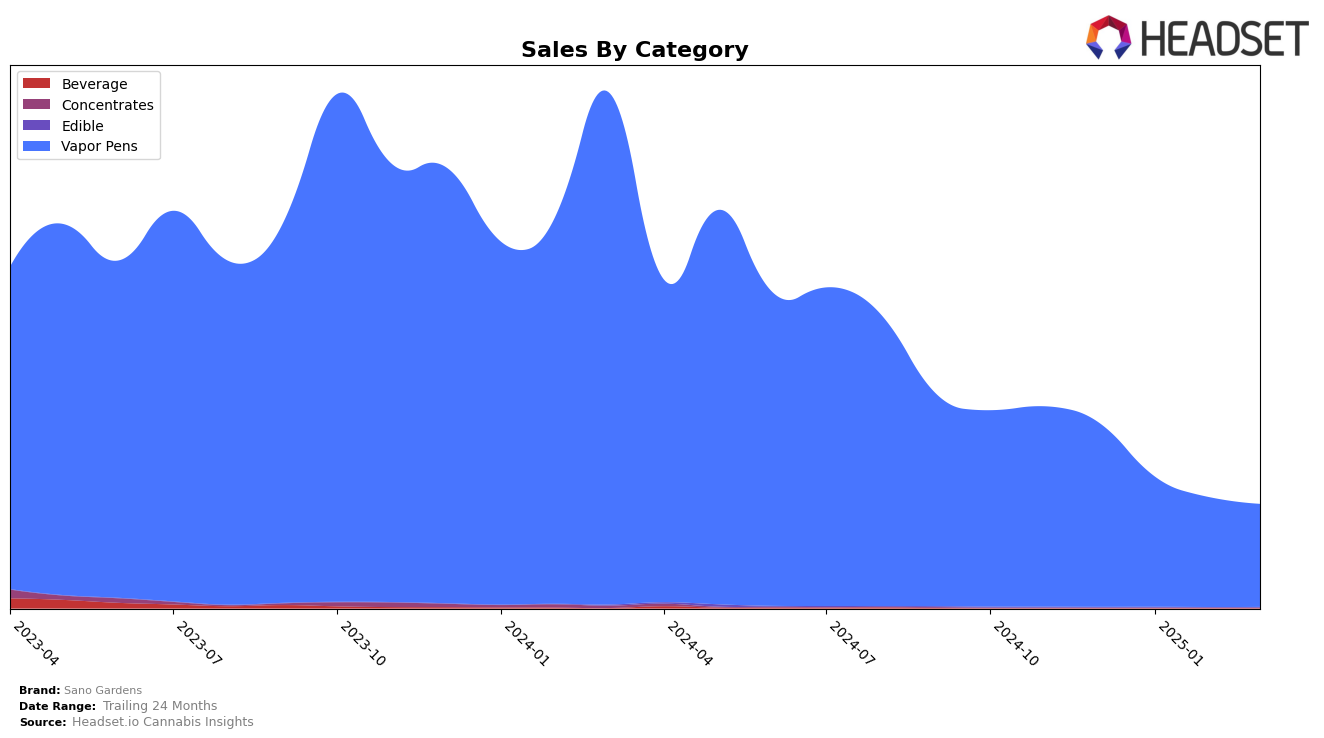

Sano Gardens has shown a notable presence in the Colorado market, particularly within the Vapor Pens category. Over the months from December 2024 to March 2025, the brand's ranking has experienced a downward trend, starting at 19th place in December and gradually moving to 30th by March. This decline in ranking coincides with a decrease in sales figures, from $417,393 in December to $233,963 in March. Such a trend suggests that while Sano Gardens remains within the top 30 brands, it faces increasing competition or market challenges that may require strategic adjustments to regain a higher standing.

Interestingly, Sano Gardens' presence in other states and categories is not reflected in the top 30 rankings, which could imply either a lack of market penetration or a focus primarily on the Colorado Vapor Pens category. The absence of rankings in other regions might be viewed as an opportunity for the brand to expand its footprint or diversify its product offerings. This concentrated performance in Colorado indicates both a strength in maintaining a foothold in a competitive category and a potential vulnerability if market dynamics continue to shift unfavorably.

Competitive Landscape

In the Colorado Vapor Pens category, Sano Gardens has experienced a fluctuating performance in recent months, with its rank slipping from 19th in December 2024 to 30th by March 2025. This decline in rank is mirrored by a decrease in sales, suggesting a challenging competitive landscape. Notably, Sunshine Extracts has shown significant upward momentum, climbing from 59th to 28th place, indicating a strong increase in consumer preference and sales. Meanwhile, West Edison and Next1 Labs LLC have also seen declines in rank, although Haze (CO) has managed a slight recovery in March. These dynamics suggest that while Sano Gardens faces stiff competition, particularly from rapidly ascending brands like Sunshine Extracts, there is potential for strategic adjustments to regain market share in this evolving market.

Notable Products

In March 2025, the top-performing product for Sano Gardens was the Mixed Berry Live Resin Disposable (1g), maintaining its first-place ranking from previous months with sales of 669 units. The Strawnana Cabana Live Resin Disposable (1g) climbed back to second place after a dip in February, with 660 units sold. The Orchard - Orange Slice Distillate Disposable (1g) held steady in third place, down slightly in sales to 501 units. The Melon Medley Live Resin Disposable (1g) dropped to fourth place, continuing its downward trend from December 2024. Notably, the Grape Escape Live Resin Disposable (1g) made its debut in the rankings at fifth place, showing promising sales figures in its first month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.