Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

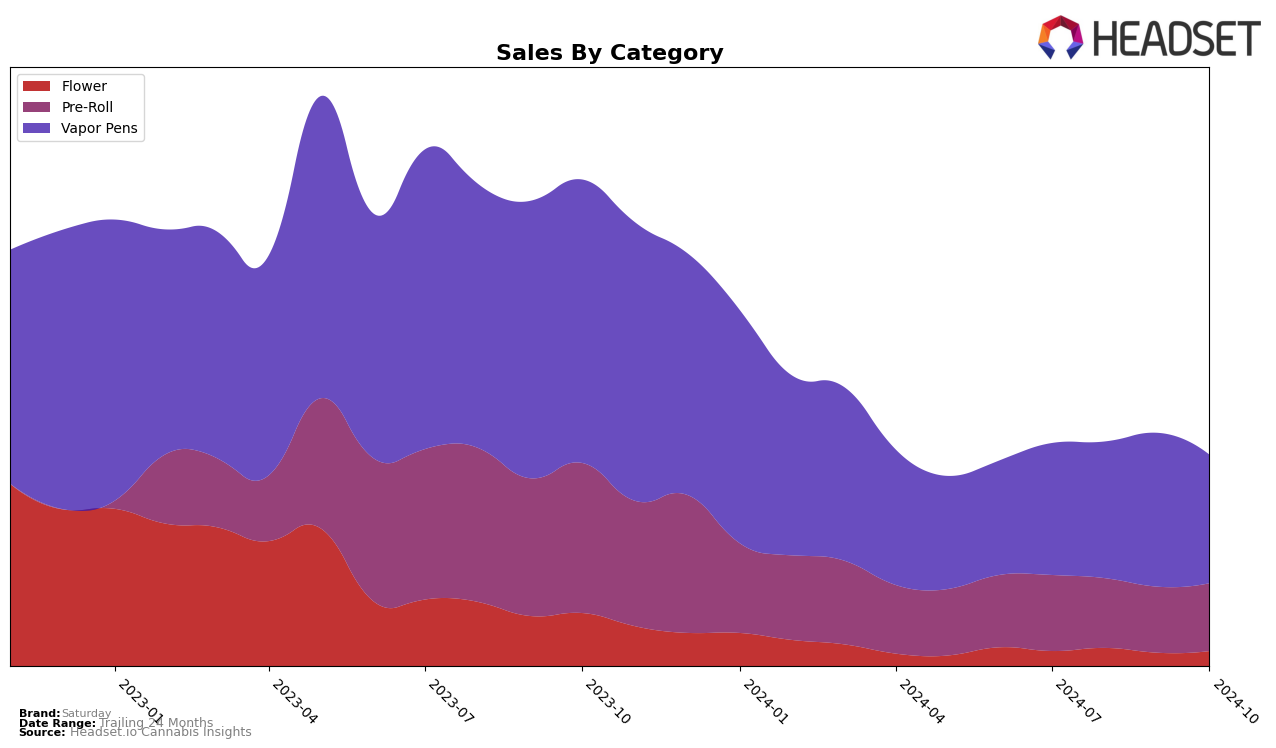

In Alberta, Saturday has experienced a noticeable decline in its ranking within the Pre-Roll category over recent months. Starting at the 70th position in July 2024, the brand's ranking slipped to 73rd by October 2024, indicating a consistent downward trend. This movement is accompanied by a decrease in sales, from 88,336 CAD in July to 78,125 CAD in October. It's important to note that Saturday's performance in the Vapor Pens category in Alberta has not been strong enough to maintain a top 30 ranking since August 2024, which may be a cause for concern regarding their market presence in this category.

Conversely, Saturday's performance in the Vapor Pens category in Ontario has shown a more positive trajectory. The brand maintained a steady 34th position in July and August 2024, before improving significantly to 26th in September, although it slightly declined to 29th in October. This fluctuation in ranking is reflective of the sales trend, which peaked at 235,120 CAD in September before slightly decreasing to 197,531 CAD in October. Saturday's ability to break into the top 30 in Ontario's Vapor Pens category highlights its potential for growth in this market despite the minor setback in October.

Competitive Landscape

In the Ontario vapor pens category, Saturday has shown a notable improvement in its market position over recent months. Despite starting at rank 34 in July 2024, Saturday climbed to rank 26 by September before slightly dropping to rank 29 in October. This upward trend in rank is mirrored by a significant increase in sales, peaking in September. In contrast, Sherbinskis experienced a decline, dropping from rank 19 in July to 32 in October, indicating a potential opportunity for Saturday to capture more market share from this competitor. Meanwhile, Palmetto made a remarkable leap from rank 63 in September to 27 in October, suggesting a competitive threat that Saturday should monitor closely. RAD (Really Awesome Dope) maintained a relatively stable position, hovering around rank 30, while Vortex Cannabis Inc. saw a slight decline from rank 24 in September to 28 in October. These dynamics highlight a competitive landscape where Saturday's strategic improvements in sales and rank position it well against its peers, but continued vigilance is necessary to maintain and enhance its standing.

Notable Products

In October 2024, Saturday's top-performing product was the Night XL Infused Blunt (1g) in the Pre-Roll category, maintaining its consistent first-place ranking throughout the year with sales of 6806 units. The Sour Blueberry Co2 Cartridge (1g) in the Vapor Pens category also held steady in second place, showing an increase in sales from September. Beached Mango Co2 Cartridge (1g) remained in third position, although its sales slightly declined compared to the previous month. Notably, the Watermelon CO2 Cartridge (1g) debuted in the rankings in September and maintained fourth place in October. Raspberry Ice CO2 Cartridge (1g) re-entered the rankings in October, securing the fifth spot, despite experiencing a decrease in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.