Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

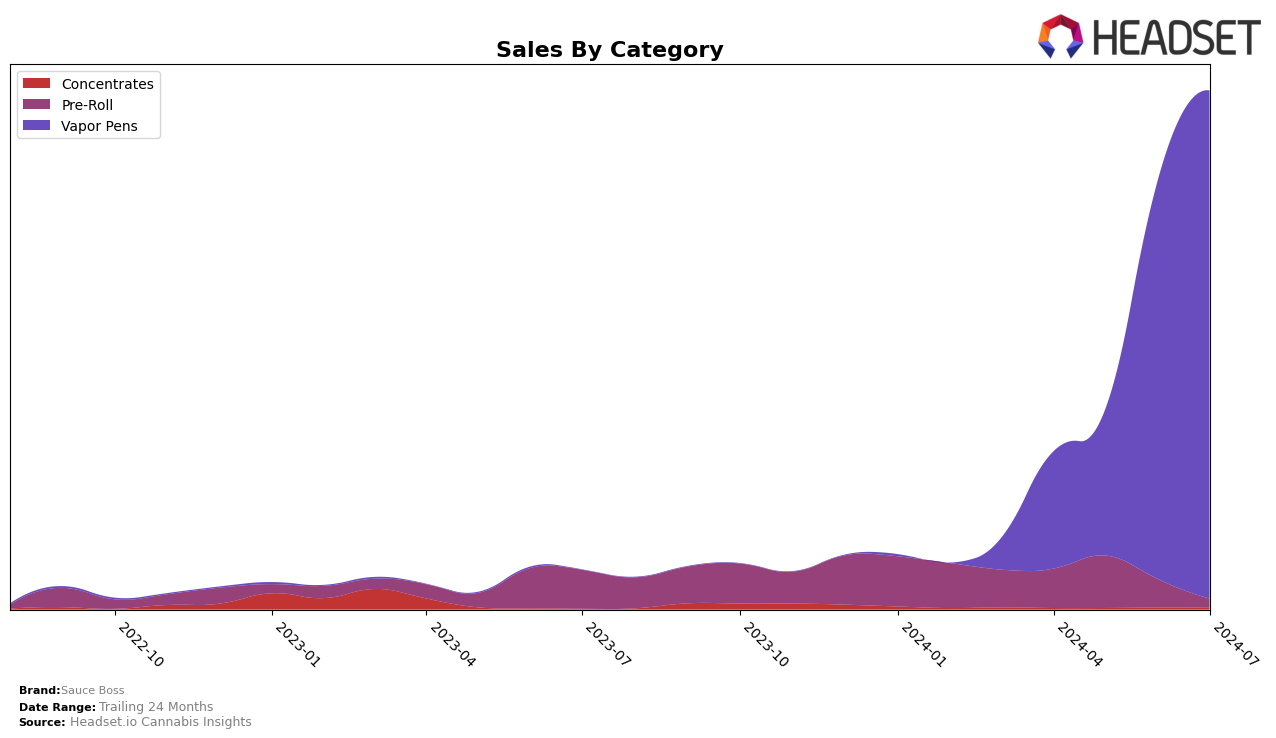

In the state of Colorado, Sauce Boss has demonstrated a fluctuating performance in the Vapor Pens category. For April 2024, the brand was not in the top 30 rankings, indicating a challenging market presence. However, by May, they made a significant leap to rank 88th and further improved to 74th in June. Despite not having a ranking in July, the upward trend from May to June suggests a positive movement. This indicates that Sauce Boss is gradually gaining traction in Colorado, although the absence from the top 30 in April and July highlights areas for potential growth and market penetration.

In contrast, Sauce Boss has shown a more consistent and improving performance in Nevada. Starting at the 39th position in April 2024, the brand experienced a slight dip to 41st in May but quickly rebounded to 25th in June and further improved to 23rd in July. This steady climb in rankings reflects a strong and growing presence in the Nevada market, particularly in the Vapor Pens category. The sales figures also support this trend, with a notable increase from $38,644 in May to $179,706 in July, indicating robust consumer demand and successful market strategies in Nevada.

Competitive Landscape

In the highly competitive Nevada vapor pens market, Sauce Boss has shown notable fluctuations in rank over the past few months. Starting from a rank of 39 in April 2024, Sauce Boss improved its position to 23 by July 2024. This upward trend indicates a positive reception and growing market presence. However, competitors like Alternative Medicine Association / AMA and Panna Extracts have also been active, with AMA initially ranking higher but dropping out of the top 20 by July, while Panna Extracts maintained a more stable and slightly better ranking. Another competitor, Dime Industries, experienced a drop in rank from 13 in June to 24 in July, which could present an opportunity for Sauce Boss to capitalize on. The data suggests that while Sauce Boss is gaining traction, the market remains dynamic with significant movements among the top brands.

Notable Products

In July 2024, the top-performing product from Sauce Boss was Ghost Train Haze Live Resin Disposable (1g), maintaining its rank at number one with sales reaching 1290. Blueberry Kush Live Resin Disposable (1g) held steady at the second position with notable sales of 1025. Essentials - Apple Fritter Live Resin Disposable (1g) advanced to third place from fourth in June 2024. White Widow Live Resin Disposable (1g) dropped to fourth place from third, showing a slight decline in its rank. Strawberry Cough Live Resin Disposable (1g) entered the rankings at fifth place, indicating a new entry among the top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.