Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

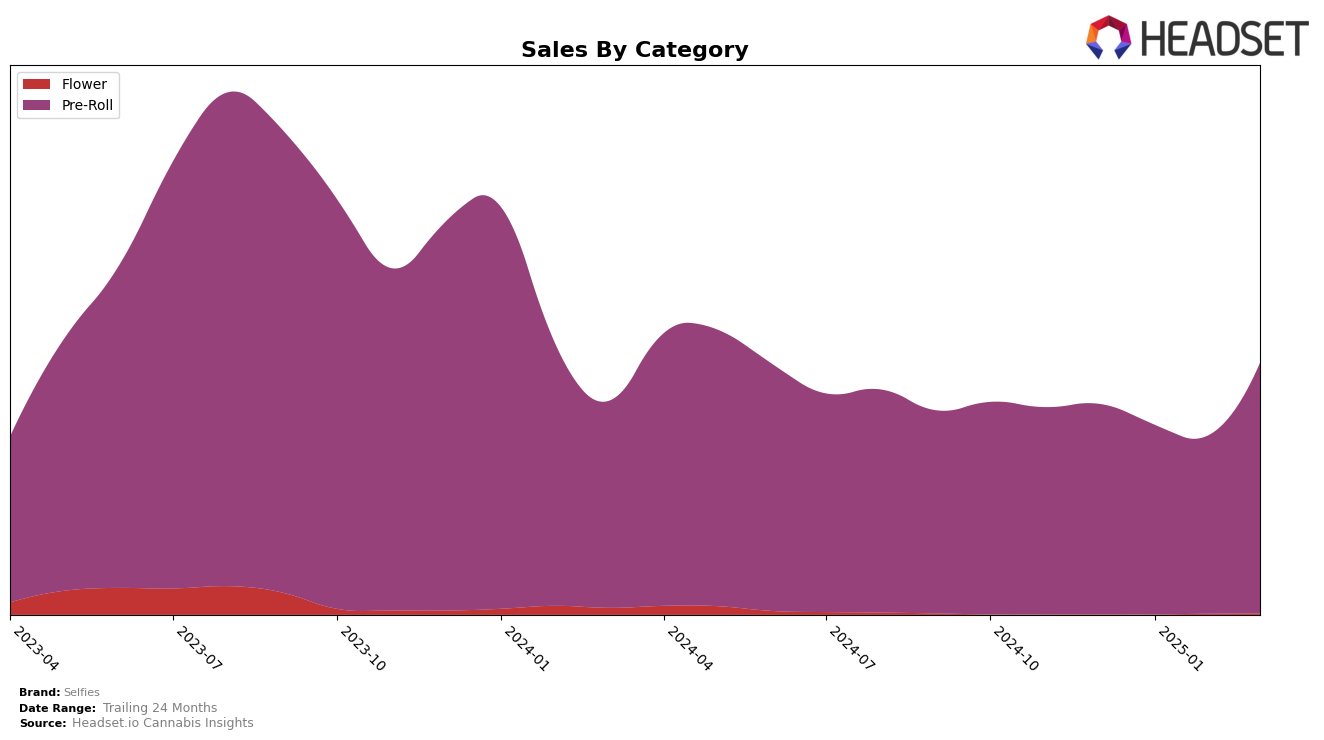

Selfies has shown a consistent presence in the Pre-Roll category within California, maintaining a steady ranking of 24th from December 2024 through February 2025. However, March 2025 witnessed a notable improvement with the brand climbing to the 21st position. This upward movement is indicative of a positive reception and possibly effective strategic changes or product enhancements. It's also worth noting that despite a dip in sales from December to February, March saw a significant rebound, suggesting a potential seasonal trend or successful marketing efforts.

In other states, Selfies did not make it into the top 30 brands for the Pre-Roll category, indicating either a lack of market penetration or competitive challenges in those regions. This absence highlights areas where the brand could focus on improving visibility or adjusting its market strategy. The performance in California could serve as a benchmark for potential growth strategies in other markets. Understanding the factors behind its success in California could provide valuable insights for expansion efforts.

Competitive Landscape

In the competitive landscape of the California pre-roll market, Selfies has shown a notable upward trend in its rank from December 2024 to March 2025. Starting at 24th place in December, Selfies climbed to 21st by March, indicating a positive trajectory in market presence. This improvement is particularly significant when compared to competitors like PUFF, which experienced a decline, dropping from 16th to 22nd in the same period. Meanwhile, Grizzly Peak Farms and UpNorth Humboldt maintained relatively stable positions, with Grizzly Peak Farms ending at 20th and UpNorth Humboldt at 23rd. The sales figures for Selfies in March 2025 also surpassed those of PUFF, highlighting Selfies' growing consumer appeal and market competitiveness. Furthermore, Paletas showed a stronger performance, moving from 23rd to 19th, which suggests a competitive edge that Selfies might need to watch closely. Overall, Selfies' ability to improve its rank amidst fluctuating competitor standings suggests effective strategies that could be further leveraged to enhance its market position.

Notable Products

In March 2025, the top-performing product from Selfies was Groupies - Durban Cookies Diamond Crumble Infused Pre-Roll (1.5g), reclaiming the number one spot with impressive sales of 3913 units. Groupies - Dosilato Infused Pre-Roll (1.5g) followed closely in second place, maintaining its February position. Groupies - Gelato Crunch Infused Pre-Roll (1.5g) dropped from first in February to third, despite a strong showing earlier in the year. The Lime Pre-Roll 2-Pack (1g) remained consistent, holding the fourth position as it did in December 2024. Superglue Mini Pre-Roll 12-Pack (3g) also showed stability, retaining its fifth-place ranking from December 2024, with a slight increase in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.