Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

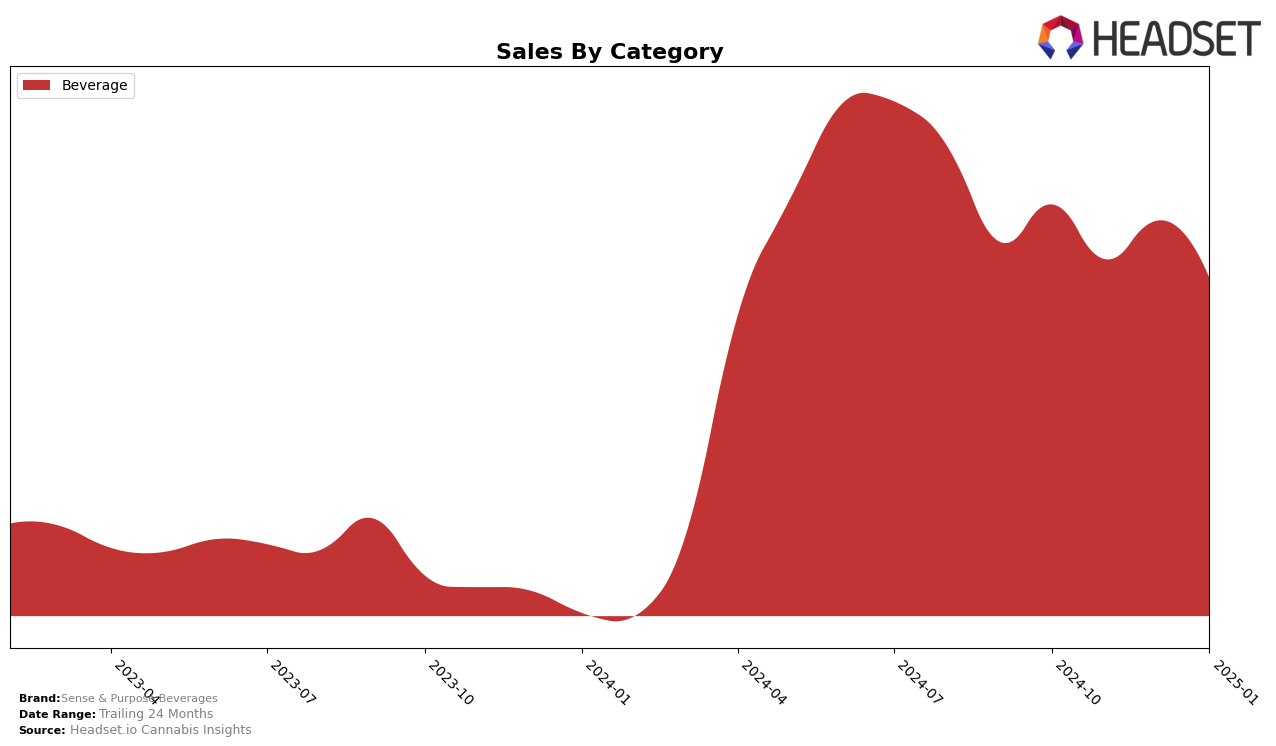

In Alberta, Sense & Purpose Beverages has maintained a consistent presence in the beverage category, holding steady at rank 7 from October 2024 through January 2025. This stability suggests a strong market position and possibly a loyal customer base that has kept the brand within the top 10. Although there was a slight dip in sales in January 2025 compared to the previous months, the brand's ability to retain its ranking indicates resilience against competitive pressures in the region's beverage market.

Conversely, in Ontario, the brand faced more challenges, with its ranking fluctuating and even dropping out of the top 30 in November and December 2024. This inconsistency in ranking could highlight issues with market penetration or competition in the Ontario beverage sector. The slight recovery to rank 31 in January 2025 does suggest some positive movement, yet it also underscores the need for strategic adjustments to regain a stronger foothold. The variation in rankings between these two provinces provides an interesting contrast in market dynamics and brand performance.

Competitive Landscape

In the competitive landscape of the beverage category in Alberta, Sense & Purpose Beverages has maintained a consistent rank of 7th from October 2024 through January 2025. This stability in rank suggests a steady performance amidst a dynamic market. Notably, Deep Space and Summit (Canada) have shown slight improvements, moving up to 8th and 9th positions respectively, indicating a competitive push just below Sense & Purpose Beverages. Meanwhile, Bubble Kush has demonstrated a strong upward trajectory, climbing from 6th to 4th place, which could pose a future threat if this trend continues. Zele, despite fluctuating ranks, remains a formidable competitor with higher sales figures, although its rank dropped from 4th to 6th in January 2025. These dynamics highlight the importance for Sense & Purpose Beverages to innovate and differentiate to maintain its position and potentially climb higher in this competitive market.

Notable Products

In January 2025, the top-performing product for Sense & Purpose Beverages was Recharge - CBD/THC 1:1 Orange, Pineapple & Passionfruit Sparkling Water and Juice, maintaining its number one ranking from December 2024 with sales of 2827 units. Relax - CBD/THC 1:1 Grapefruit Yuzu Sparkling Water & Juice held the second position, moving up from third place in December. Refocus - CBD/THC 10:1 Green Tea Lemonade Ginger Sparkling Beverage dropped from its second-place position in December to third in January. Notably, Recharge has consistently been a strong performer, previously holding the second rank in both October and November 2024. Overall, the rankings reflect a stable performance for these top products, with minor shifts in their standings over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.