Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

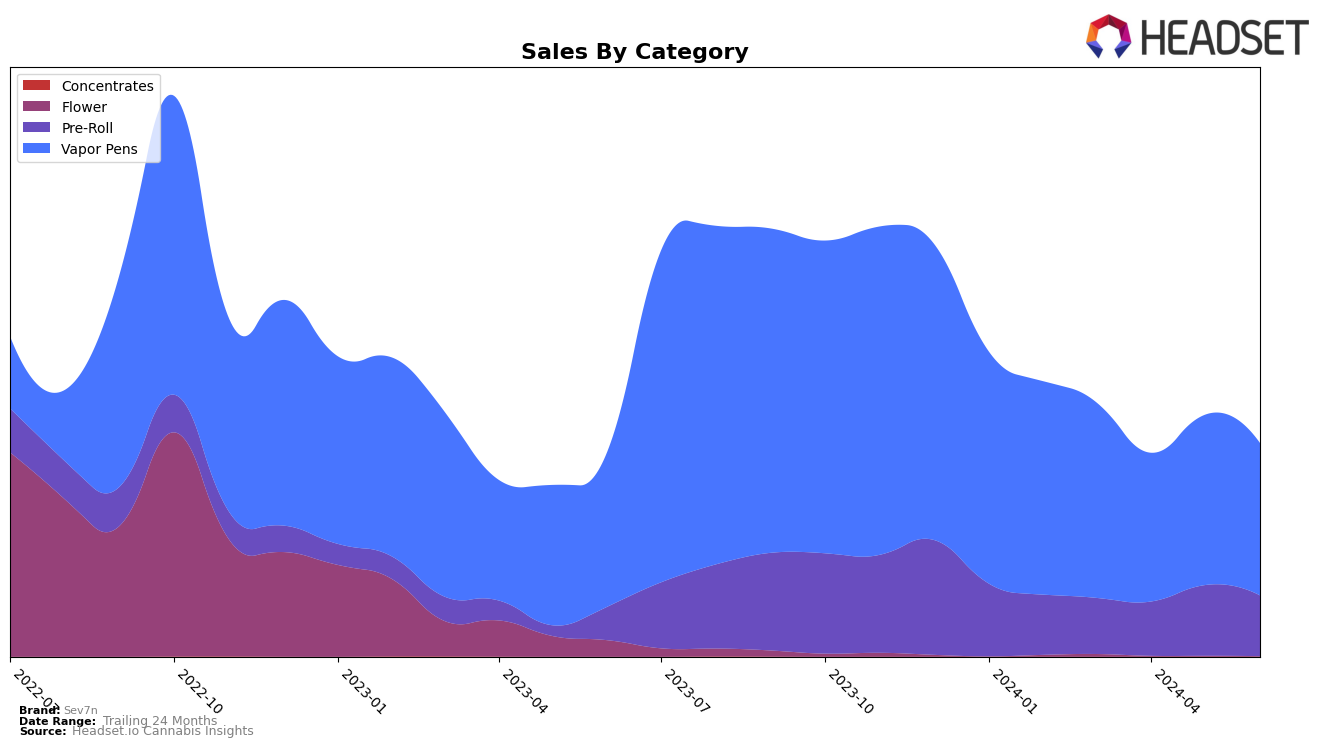

Sev7n has shown varied performance across different categories and states/provinces over the past few months. In Alberta, the brand's presence in the Pre-Roll category has been inconsistent, with rankings fluctuating from 54th in May 2024 to 63rd in June 2024. This indicates a struggle to maintain a top position in the Pre-Roll market within the province. However, in the Vapor Pens category, Sev7n has exhibited more stable performance, consistently ranking within the top 20, although there was a slight dip from 17th in May to 19th in June. This suggests that while the brand faces challenges in the Pre-Roll segment, it has a relatively stronger foothold in the Vapor Pens market in Alberta.

In contrast, Sev7n's performance in Ontario has been less prominent. The brand ranked 75th in the Vapor Pens category in March 2024 and did not appear in the top 30 rankings for the subsequent months. This absence from the top rankings indicates a significant challenge for Sev7n in gaining traction in Ontario's competitive market. The lack of consistent presence in the rankings could be a point of concern for the brand's market strategy in Ontario, especially when compared to its relatively stronger performance in Alberta.

Competitive Landscape

In the Alberta Vapor Pens category, Sev7n has experienced notable fluctuations in its ranking and sales over the past few months. Starting at rank 17 in March 2024, Sev7n dropped to 20th in April, recovered to 17th in May, but slipped again to 19th in June. This volatility contrasts with the more stable performance of competitors like Jonny Chronic, which maintained a higher rank despite a slight dip in sales from April to June. Meanwhile, LITTI showed a significant improvement, climbing from 28th in March to 17th in June, indicating a strong upward trend. Lord Jones also showed a steady improvement, moving from 23rd to 20th place over the same period. These shifts suggest that while Sev7n remains a competitive player, it faces increasing pressure from brands that are either stabilizing or improving their market positions, highlighting the need for strategic adjustments to maintain and enhance its market share.

Notable Products

In June 2024, the top-performing product for Sev7n was Island Cherry Distillate Cartridge (1g) in the Vapor Pens category, maintaining its rank from the previous month with notable sales of 3695 units. Island Sugar Co2 Cartridge (1g), also in the Vapor Pens category, held the second position, consistent with its ranking in May 2024. Space Tang Distillate Infused Pre-Roll 3-Pack (1.5g) remained steady at the third rank across all months from March to June 2024. Milk & Cookiez Pre-Roll (1g) debuted in June 2024 at the fourth position. Very Cherry Distillate Infused Pre-Roll 3-Pack (1.5g) dropped to the fifth rank after being in the fourth position in May 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.