Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

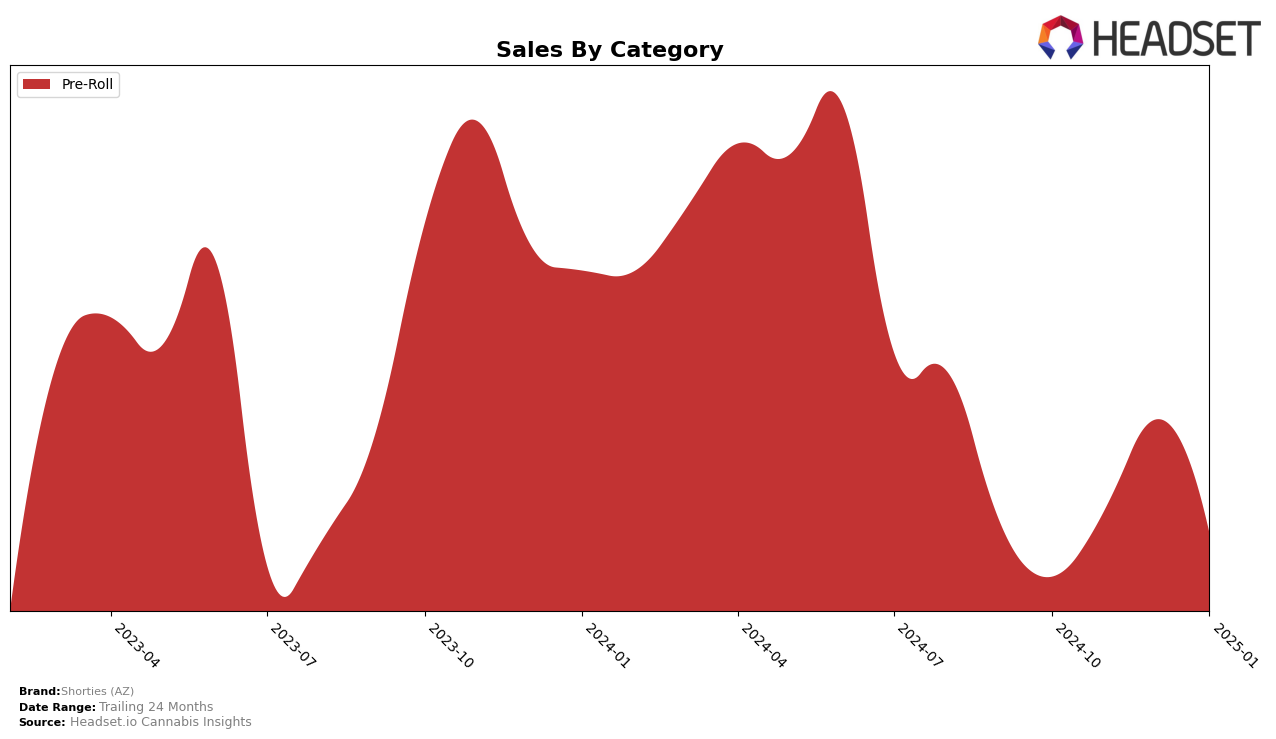

Shorties (AZ) has demonstrated a steady presence in the Pre-Roll category within Arizona, showing notable improvements in their ranking over the months. Starting from a rank of 28 in October 2024, the brand climbed to 21 by December, before slightly dipping to 24 in January 2025. This fluctuation indicates a competitive market environment where Shorties (AZ) is actively striving to maintain a strong position. The upward trajectory observed through the end of 2024 suggests effective strategies and growing consumer interest, despite the slight decrease in the following month.

While the specific sales figures for each month are not fully disclosed, it's evident from the ranking movements that Shorties (AZ) experienced a peak in sales in December 2024. This peak aligns with the holiday season, a time when cannabis sales often see an increase. However, the brand's absence from the top 20 in any of the months suggests there is significant room for growth and potential areas for improvement. Despite this, maintaining a position within the top 30 consistently reflects a stable market presence in Arizona, highlighting the brand's resilience in a competitive category.

Competitive Landscape

In the competitive landscape of the Arizona pre-roll category, Shorties (AZ) has shown a dynamic shift in rankings over recent months, reflecting its strategic positioning and market response. Notably, Shorties (AZ) climbed from a rank of 28 in October 2024 to 21 in December 2024, before settling at 24 in January 2025. This upward trajectory, particularly in December, suggests a successful campaign or product launch that resonated well with consumers. In contrast, competitors like Roaring 20s maintained a relatively stable presence, ranking 11th in October 2024 and 20th by January 2025, indicating consistent consumer loyalty. Meanwhile, Shango experienced a decline from 12th in October to 23rd in January, highlighting potential challenges in maintaining its market share. Space Rocks and Presidential also saw fluctuations, with Space Rocks dropping to 26th by January and Presidential falling out of the top 20 by January, suggesting volatility in their market strategies. These shifts underscore the competitive nature of the Arizona pre-roll market, where Shorties (AZ) is making notable strides amidst varying performances from its peers.

Notable Products

In January 2025, the top-performing product from Shorties (AZ) was the Peach Lemonaze Infused Pre-Roll 10-Pack (5g), securing the number one rank with notable sales of 404 units. The 91 Chem Pre-Roll 10-Pack (3.5g) followed closely in second place, while both Sherbatti Infused Pre-Roll 10-Pack (5g) and Velouria Pre-Roll 10-Pack (3.5g) shared the third rank. The Doc 15 x Pave #12 Pre-Roll 10-Pack (3.5g) experienced a slight drop, moving from second place in December 2024 to fourth in January 2025, despite strong sales of 353 units. This shift highlights the dynamic changes in consumer preferences within the Pre-Roll category over the months. Overall, January saw a competitive landscape with tight rankings among the top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.