Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

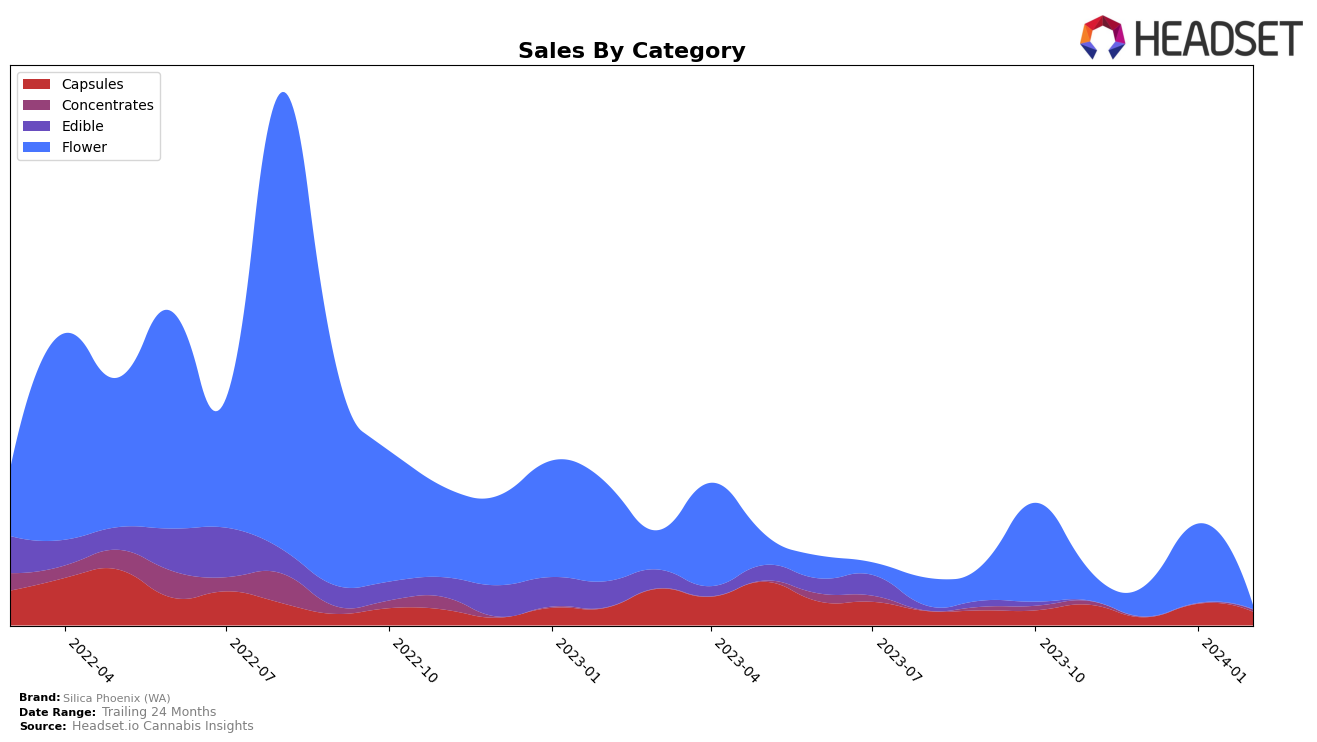

In the competitive cannabis market of Washington, Silica Phoenix (WA) has shown a consistent performance in the Capsules category, maintaining its position in the top 10 across several months. Specifically, the brand held the 8th rank from November 2023 through January 2024 before slightly slipping to the 9th position in February 2024. This minor shift in ranking could indicate a highly competitive environment within the Capsules category, where small changes in sales or market dynamics can affect rankings. Notably, their sales in November 2023 were recorded at 1411.0, providing a glimpse into their market presence during that period. The consistency in ranking, despite a notable dip in sales in December 2023 to 543.0, followed by a rebound, suggests resilience and a stable consumer base.

While Silica Phoenix (WA) has demonstrated its ability to stay within the top 10 in Washington's Capsules category, the slight drop in ranking from 8th to 9th place could be seen as a critical juncture for the brand. This movement highlights the importance of closely monitoring market trends and consumer preferences to maintain or improve market standing. The fluctuation in sales, with a significant decrease in December followed by recovery, indicates the brand's potential volatility in consumer demand or possibly strategic adjustments in pricing or distribution. Although specific details on their performance across other categories or states were not provided, focusing on the Capsules category in Washington alone reveals a brand that, despite facing challenges, has managed to secure a significant foothold in a competitive market.

Competitive Landscape

In the competitive landscape of the cannabis capsule market in Washington, Silica Phoenix (WA) has maintained a consistent position, ranking 8th in November 2023, December 2023, and January 2024, before slightly dropping to 9th in February 2024. This indicates a stable demand for their products, despite fluctuations in sales volumes. Notably, Essence Entourage Extracts has consistently outperformed Silica Phoenix, maintaining higher ranks and showcasing a strong market presence with ranks 6th and 7th over the same period, suggesting they are a significant competitor. Conversely, Rootworx has shown remarkable growth, moving from 9th to 8th position by February 2024, surpassing Silica Phoenix with a substantial increase in sales. Northwest Cannabis Solutions and Verdure also remain notable competitors, with Northwest Cannabis Solutions climbing in rank and Verdure dropping out of the rankings after November 2023. This dynamic competition underscores the importance for Silica Phoenix to innovate and adapt to maintain and improve its market position in Washington's cannabis capsule category.

Notable Products

In February 2024, Silica Phoenix (WA) saw its Indica Capsule (50mg) from the Capsules category reaching the top rank with impressive sales figures, peaking at 50 units sold. Following closely, the Extreme Capsules 10-Pack (500mg), also from the Capsules category, secured the second position, marking a notable shift as it re-entered the rankings to secure a high spot. The Purple Punch 2.0 (5g) from the Flower category made a surprising entry into the rankings, landing directly in the second place without prior appearances in the previous months. Sour Tsunami RSO (1g) in the Concentrates category also made its first ranking appearance, securing the third spot. The Capsules - Sativa (100mg) product, despite not having sales figures disclosed for February, showed a significant ranking improvement, indicating a positive reception in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.