Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

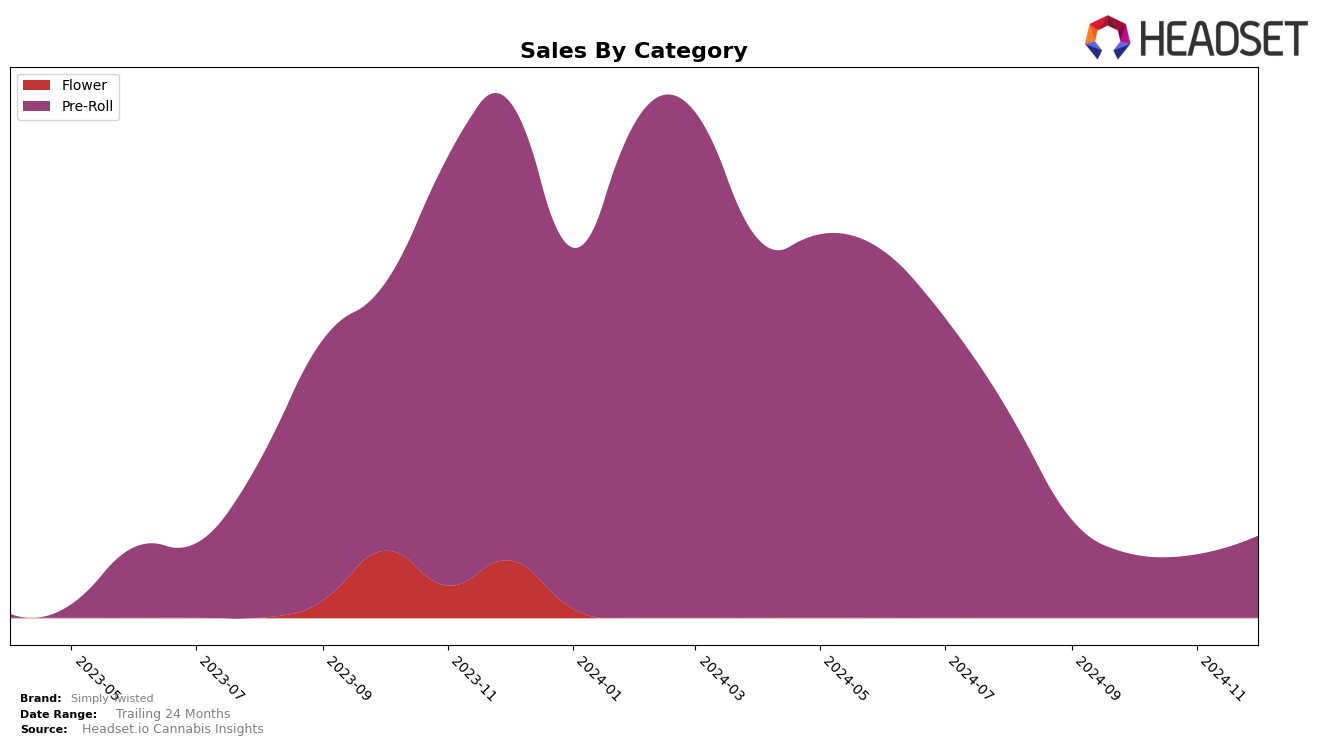

Simply Twisted has demonstrated a fluctuating presence in the Arizona cannabis market, particularly within the Pre-Roll category. Starting in September 2024, the brand held the 20th rank but saw a decline to the 27th position by October. Despite this dip, Simply Twisted managed to maintain a spot within the top 30, with a slight improvement back to 27th place in December. This indicates a potential recovery or stabilization after a challenging period. The brand's sales followed a similar pattern, with a notable decrease in October but rebounding by December, suggesting efforts to regain market share or optimize product offerings were somewhat effective.

The absence of Simply Twisted from the top 30 rankings in other states or categories during these months could be seen as a limitation in their market penetration or diversification strategy. This may indicate a focus on maintaining their presence in Arizona rather than expanding into new territories or categories. While their performance in the Pre-Roll category shows resilience, the lack of ranking in other segments could suggest an opportunity for growth or a need to reassess their market approach to capitalize on broader trends within the cannabis industry.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Arizona, Simply Twisted has experienced notable fluctuations in its ranking over the last few months. Starting from a strong position at 20th in September 2024, Simply Twisted saw a decline to 27th in October and November, before slightly recovering to 27th again in December. This shift in rank suggests a dynamic market environment where brands like Caviar Gold and Connected Cannabis Co. have shown varying performances, with Caviar Gold maintaining a relatively stable position in the mid-20s, while Connected Cannabis Co. improved its rank from 31st in September to 26th by December. Meanwhile, Shorties (AZ) has demonstrated a consistent upward trend, moving from 30th to 25th, indicating a potential threat to Simply Twisted's market share. Despite these challenges, Simply Twisted's sales figures in December show a significant recovery from the previous months, suggesting resilience and potential for regaining higher ranks in the near future.

Notable Products

In December 2024, Simply Twisted's top-performing product was the Jealousy Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its leading position from November with sales reaching 1636 units. The Platinum Kush Pre-Roll 2-Pack (1g) emerged as the second best-seller, while the Banana Punch Pre-Roll 2-Pack (1g) secured the third spot. Sunshine Pre-Roll 2-Pack (1g) followed closely in fourth position. Notably, the Forbidden Fruit Pre-Roll 2-Pack (1g) dropped to fifth place from second in November, indicating a shift in consumer preference. This month marks a consistent demand for Simply Twisted's pre-rolls, with Jealousy Pre-Roll consistently leading the pack over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.