Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

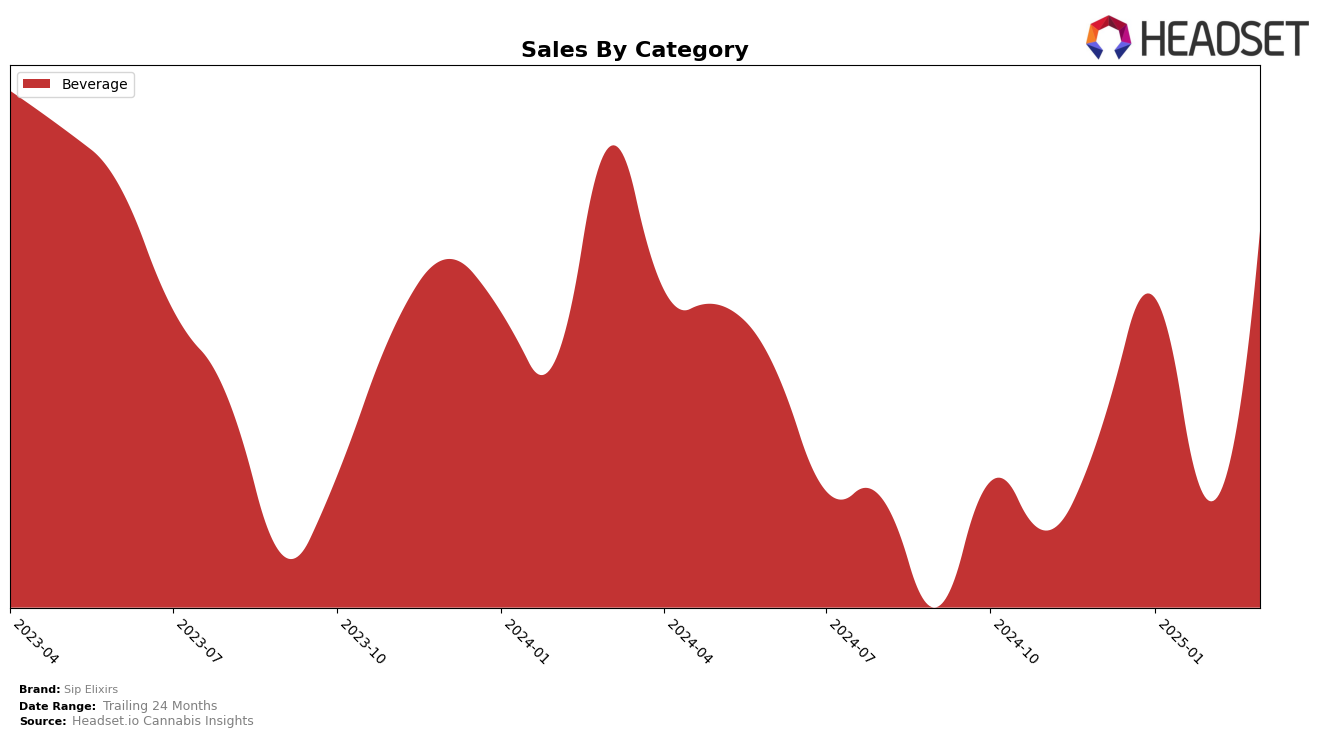

Sip Elixirs has maintained a strong presence in the Nevada beverage category, consistently holding the top spot from December 2024 through March 2025. This stability at the number one position highlights the brand's dominance and popularity in the state, with sales showing an upward trend, peaking at over 408,000 in March 2025. Similarly, in Arizona, Sip Elixirs has secured the second position throughout the same period, indicating a solid foothold in the region. Despite a slight dip in February 2025, sales rebounded in March, suggesting resilient consumer demand. These performances signify strong brand loyalty and effective market strategies in these states.

In contrast, Sip Elixirs' performance in the California market shows a more varied trajectory. The brand fluctuated between the 11th and 12th ranks in the beverage category from December 2024 to March 2025. Although there was a noticeable decline in sales in February, March saw a recovery, indicating potential growth opportunities. The brand's absence from the top 10 in California might imply challenges in competing with other local brands or a need for strategic adjustments to enhance its market presence. This mixed performance across different states highlights the varied dynamics and competitive landscapes that Sip Elixirs navigates within the cannabis beverage sector.

Competitive Landscape

In the Nevada beverage category, Sip Elixirs has consistently maintained its top position from December 2024 through March 2025, showcasing a strong brand presence and customer loyalty. Despite fluctuations in sales, with a notable dip in February 2025, Sip Elixirs rebounded impressively in March 2025, indicating resilience and effective marketing strategies. In contrast, Keef Cola and HaHa have been vying for the second and third positions, with Keef Cola advancing to second place in February and March 2025, suggesting a competitive push that could challenge Sip Elixirs if trends continue. This competitive landscape highlights the importance for Sip Elixirs to innovate and maintain its market-leading strategies to fend off these emerging threats and sustain its sales momentum.

Notable Products

In March 2025, Sip Elixirs' top-performing product was Party - Electric Lemon Elixir (100mg) in the Beverage category, reclaiming its top position from February with sales of 15,818 units. Party - Hurricane Elixir (100mg) ranked second, maintaining its strong performance after leading in February. CBN:THC 2:1 Sleep Dreamberry Mixes (100mg CBN, 50mg THC) consistently held the third position, showing stable demand over the months. Chill - Watermelon Elixir (100mg) dropped to fourth place from its consistent second-place ranking in prior months. Sleep - Wild Berry Elixir (100mg) returned to the rankings in fifth place, after not being ranked in February, indicating a resurgence in consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.