Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

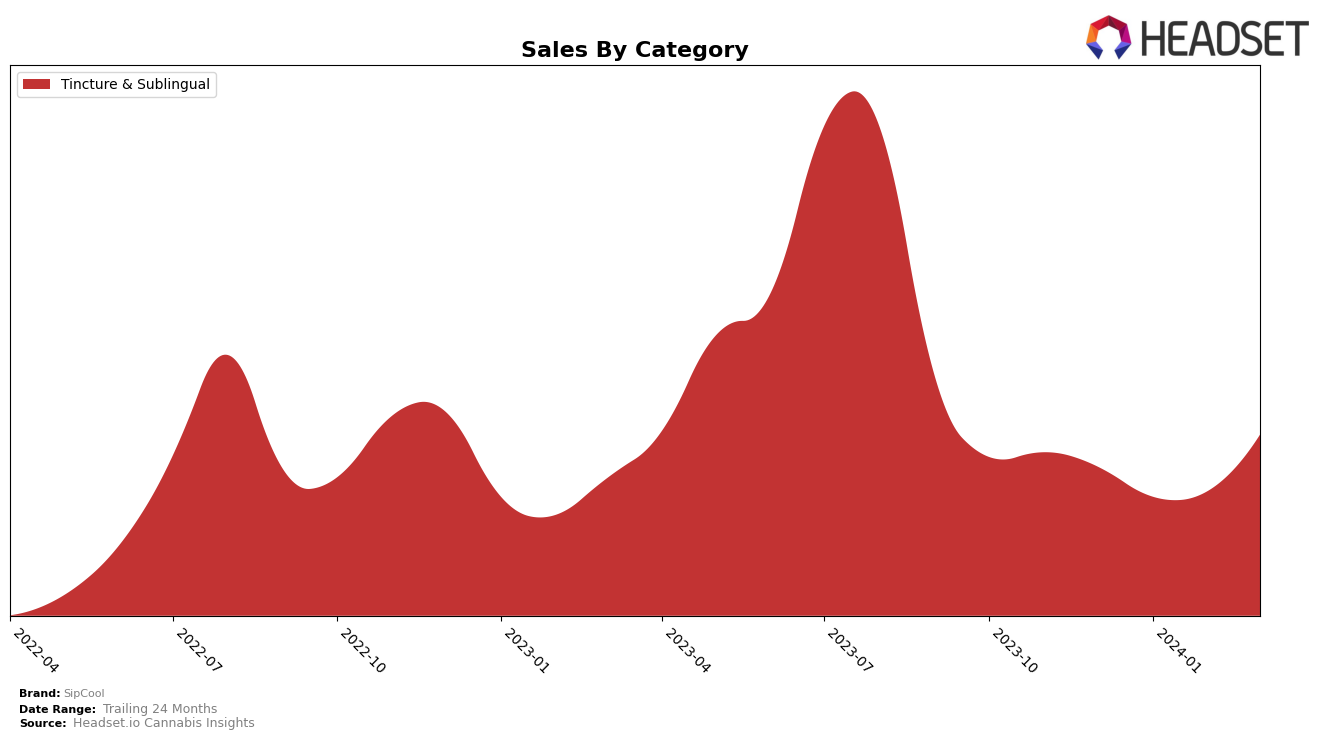

In the competitive landscape of the Washington cannabis market, SipCool has maintained a steady performance within the Tincture & Sublingual category. Consistently securing the 5th rank from December 2023 to March 2024 showcases the brand's resilience and consumer loyalty in this segment. Notably, despite a slight dip in sales from December 2023 (9613.0) to February 2024, SipCool witnessed a significant rebound in March 2024, with sales climbing to 10891.0. This upturn not only highlights a successful recovery but also suggests a growing consumer base or increased purchase volumes, a positive indicator of the brand's market strength and appeal in Washington.

However, the absence of SipCool from the top 30 brands in other states or categories within the same timeframe signals a potential area for growth or improvement. The brand's strong performance in Washington's Tincture & Sublingual category contrasts sharply with its visibility in broader markets, suggesting a concentrated success that could be leveraged for expansion. This exclusivity to one market segment, while beneficial in establishing a strong foothold, also underscores the importance of diversification and market penetration strategies to capitalize on emerging opportunities across states and categories. For SipCool, the focus on maintaining its rank and sales performance in Washington is commendable, yet the exploration into other markets or categories could unlock additional avenues for growth and brand recognition.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Washington, SipCool has maintained a consistent position at rank 5 from December 2023 through March 2024, showcasing stability in a fluctuating market. Notably, its closest competitors have shown varied performances. Ceres has firmly held the 3rd position, with sales peaking in March 2024, indicating a strong market presence and consumer preference. Polite, ranked 4th, experienced a dip in sales in February 2024 but rebounded significantly by March 2024, suggesting a resilient brand appeal. Meanwhile, Swifts and Mfused have been jockeying for the 6th and 7th positions, with Mfused showing a remarkable sales spike in February 2024, only to fall back in the following month. SipCool's steady rank amidst these dynamics, coupled with a notable sales increase in March 2024, positions it as a consistent and growing contender in the market, hinting at a potential for upward mobility should it capitalize on the observed market trends and competitor fluctuations.

Notable Products

In Mar-2024, SipCool's top-performing product was the Raspberry Rhapsody Tincture Shot 10-Pack (100mg) within the Tincture & Sublingual category, maintaining its number one rank since Dec-2023, with a notable sales figure of 372 units. Following in second place was the Mango Mambo Tincture Shot 10-Pack (100mg), which climbed from third to second place since Feb-2024, showing a significant increase in consumer preference. The Lemonade Libero Shot 10-Pack (100mg) and Presto Peach Tincture Shot 10-Pack (100mg) both tied for the third rank, despite the Lemonade variant previously outperforming the Peach in Feb-2024. A new entry in the rankings, the Guava Giocoso Tincture Shotz 2-Pack (20mg), made a notable debut at fourth place, indicating a growing interest in smaller pack sizes. These rankings highlight a stable consumer interest in SipCool's Tincture & Sublingual products, with Raspberry Rhapsody leading the pack and new products like Guava Giocoso gaining a foothold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.