Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

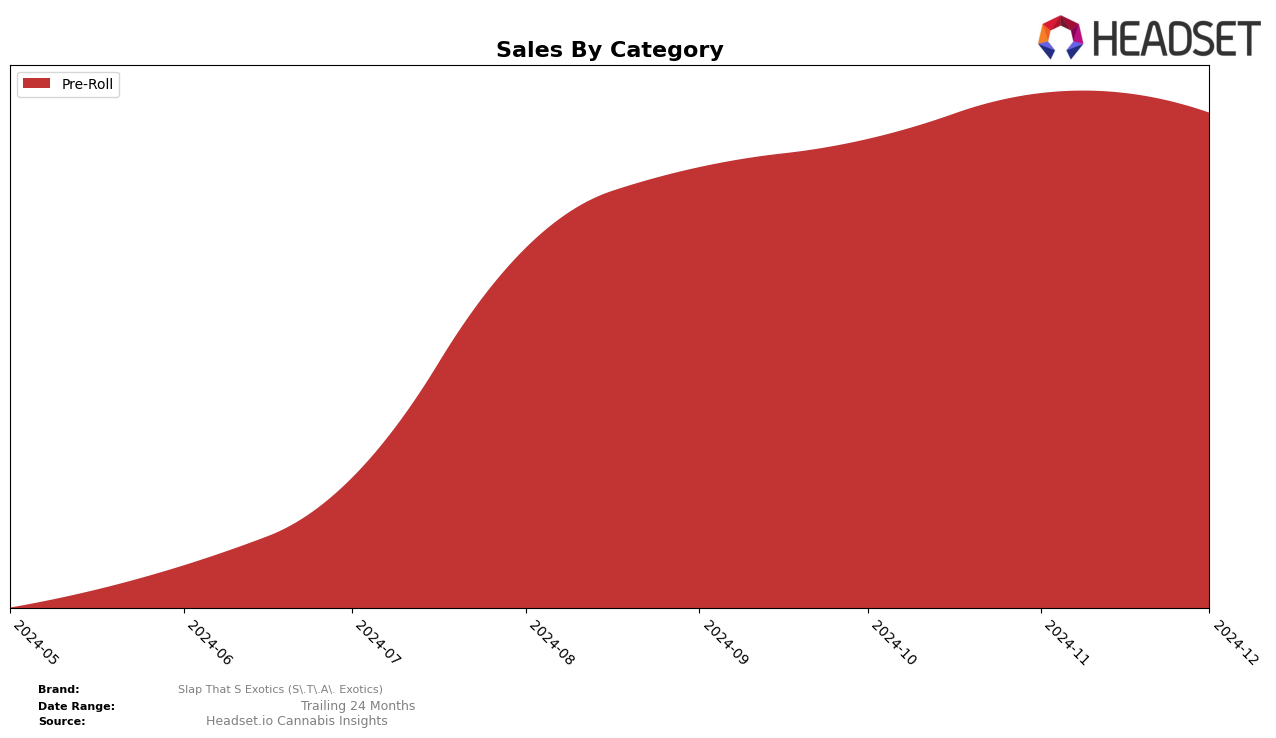

Slap That S Exotics (S.T.A. Exotics) has shown a consistent presence in the New York pre-roll category rankings from September to December 2024. Although their rank has slightly declined from 23rd in September to 29th in both November and December, the brand has managed to maintain its position within the top 30. This consistency indicates a stable demand for their products in the New York market. Despite the slight drop in rankings, the sales figures tell a different story, with a noticeable increase from $180,951 in September to over $210,000 in November, suggesting that while competition may be intensifying, S.T.A. Exotics is successfully growing its sales volume.

It's notable that S.T.A. Exotics did not appear in the top 30 rankings in any other state or category during this period, which could be seen as a missed opportunity or a strategic focus on enhancing their presence in New York. This concentration might allow them to tailor their offerings more specifically to the preferences of New York consumers, but it also limits their exposure and potential growth in other markets. The brand's ability to maintain its rank amidst a competitive landscape in New York, while not breaking into other state categories, suggests a strong regional foothold but also highlights the potential for expansion into other states and categories to diversify their market presence.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in New York, Slap That S Exotics (S.T.A. Exotics) has experienced fluctuations in its market position, which could impact its sales trajectory. Over the last few months of 2024, S.T.A. Exotics saw a decline in rank from 23rd in September to 29th by December, indicating increased competition and potential challenges in maintaining its market share. Notably, Back Home Cannabis Co. demonstrated a strong performance, improving its rank to 24th in November before settling at 27th in December, with sales peaking significantly in November. Meanwhile, Weekenders and OHHO also showed upward trends in sales, with Weekenders consistently improving its rank to 28th by December. These shifts suggest that while S.T.A. Exotics maintains a competitive presence, it faces pressure from brands like Weekenders and Back Home Cannabis Co., which are gaining traction and could potentially outpace S.T.A. Exotics if current trends continue.

Notable Products

In December 2024, the top-performing product for Slap That S Exotics (S.T.A. Exotics) was the Notorious THC Infused Pre-Roll (1g), maintaining its number one rank from the previous two months with notable sales of 1809 units. The Notorious THC Infused Pre-Roll 5-Pack (2.5g) secured the second spot, consistently holding its position from October and November with increasing sales figures. The Mac x Cruffin Infused Pre-Roll 5-Pack (2.5g) improved its ranking to third place from fourth in November, showing a steady sales increase. The Mac x Cruffin Infused Pre-Roll (1g) re-entered the rankings in December at fourth place, while the THC Bomb Infused Pre-Roll (1g) maintained its fifth position from November. Overall, these products demonstrate a strong and consistent performance in the Pre-Roll category for the brand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.