Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

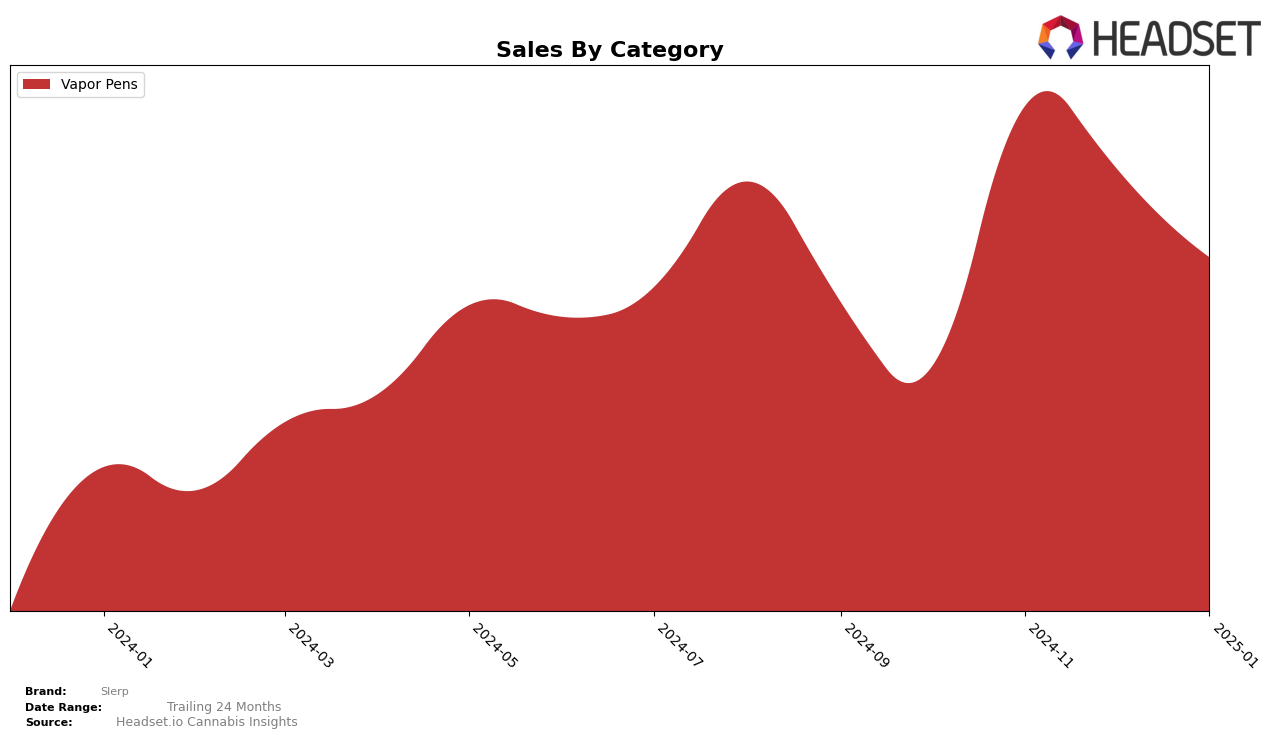

In the province of Alberta, Slerp has shown a fluctuating performance in the Vapor Pens category. Over the last four months, the brand has not managed to secure a spot in the top 30, with rankings ranging from 51st to 70th. Notably, there was a significant sales surge in December 2024, where sales more than doubled compared to November, although this was not enough to break into the top 30. This indicates a potential for growth, but consistency seems to be a challenge for Slerp in Alberta.

Meanwhile, in British Columbia, Slerp's performance has been more stable within the top 30 rankings in the same category. The brand peaked at 23rd in November 2024, but has since seen a slight decline, ending January 2025 at 27th. Despite this, Slerp has maintained a relatively strong presence in the market, with sales figures showing a decrease from the November peak but remaining robust overall. This suggests that while there is room for improvement, Slerp has established a foothold in British Columbia's Vapor Pens market.

Competitive Landscape

In the competitive landscape of vapor pens in British Columbia, Slerp has shown a dynamic performance over the months from October 2024 to January 2025. Initially ranked 33rd in October, Slerp made a significant leap to 23rd in November, indicating a strong upward trend in sales and market presence. However, this momentum slightly waned as Slerp's rank dipped to 28th in December before stabilizing at 27th in January. This fluctuation suggests a competitive market environment, particularly against brands like Palmetto, which consistently improved its rank from 26th in October to 20th in December, before slightly dropping to 25th in January. Meanwhile, Uncle Bob and Woody Nelson also demonstrated notable movements, with Uncle Bob peaking at 25th in December and Woody Nelson reaching 24th the same month. These shifts highlight the intense competition Slerp faces, emphasizing the need for strategic marketing and product differentiation to maintain and enhance its market position.

Notable Products

In January 2025, the top-performing product for Slerp was the Baked Blueberry Liquid Diamond Cartridge (1g) from the Vapor Pens category, which climbed to the number one spot with impressive sales of 1976 units. The Vanilla Cherry Liquid Diamond Cartridge (1g) followed closely, dropping from its previous top position in December to second place. The Raspberry Peach Cured Resin Cartridge (1g) maintained a steady presence, securing the third rank after being fourth in the preceding months. The Strawberry Melon Cured Resin Cartridge (1g) experienced a notable decline, falling from first in October to fourth in January. A new entrant, the Bubble Cured Resin Cartridge (1g), debuted at fifth place, indicating potential future growth in its category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.