Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

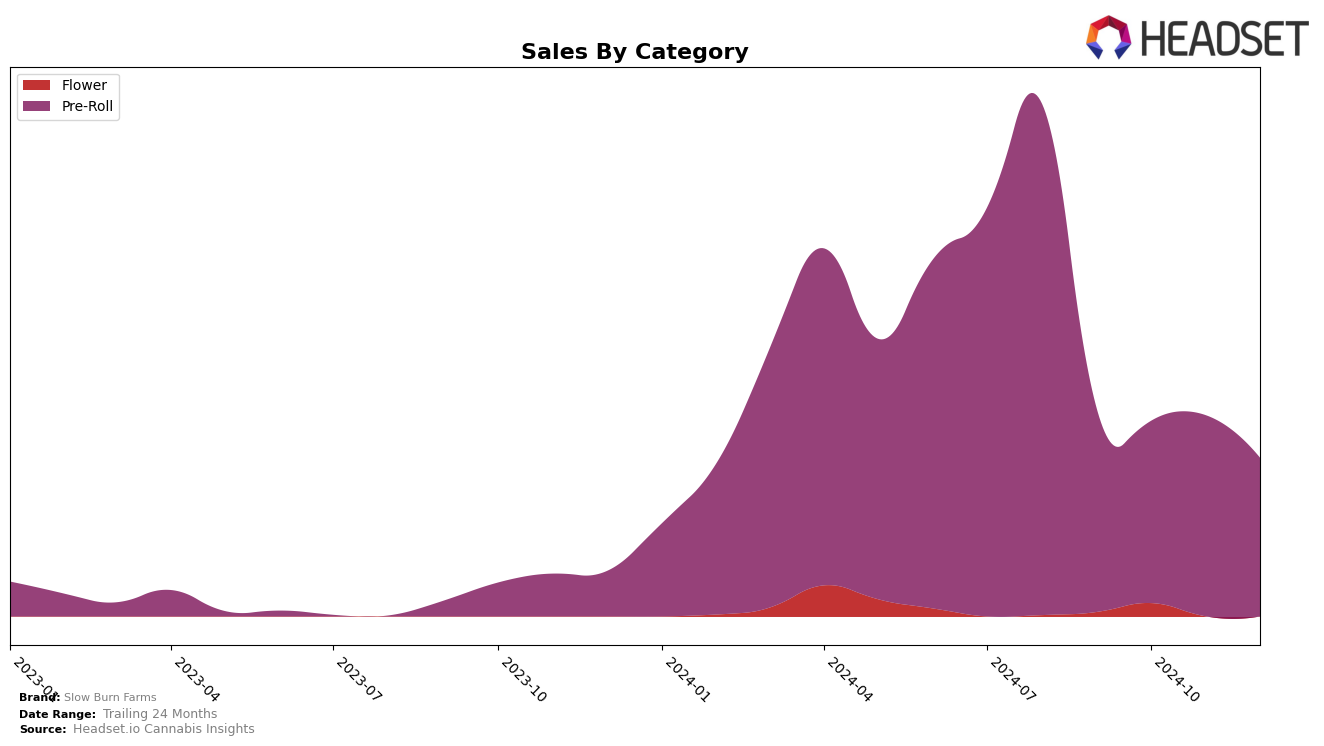

In the pre-roll category within Colorado, Slow Burn Farms has shown a fluctuating performance throughout the last quarter of 2024. Notably, the brand managed to break into the top 30 in November, securing the 29th position, a positive move from its earlier standings at 36th and 37th in September and October, respectively. However, this momentum was not sustained into December, where they slipped back to the 30th spot. This indicates a volatile presence in the competitive pre-roll market in Colorado, with their sales reflecting this trend as they peaked in November before declining again in December.

While Slow Burn Farms has demonstrated the ability to climb into the top 30 rankings in Colorado's pre-roll category, the absence of their ranking in other states or categories suggests potential areas for growth or challenges that need addressing. The brand's fluctuating sales and rankings highlight the competitive nature of the cannabis market and suggest that maintaining a stable top-tier position may require strategic adjustments. This analysis offers a glimpse into Slow Burn Farms' performance, hinting at both opportunities and obstacles that could shape their future trajectory in the market.

```Competitive Landscape

In the competitive landscape of the Colorado Pre-Roll category, Slow Burn Farms has shown a dynamic performance over the last few months. Despite facing stiff competition, Slow Burn Farms improved its rank from 37th in October 2024 to 29th in November, before settling at 30th in December. This upward trend in November suggests a successful strategy or product launch during that period. However, brands like Doinks and Shift Cannabis have maintained a relatively stable presence, with Doinks climbing from 38th to 31st and Shift Cannabis fluctuating slightly but staying within the top 30. Meanwhile, Seed and Smith (LBW Consulting) and P3 have shown significant improvements, with Seed and Smith advancing from 66th in September to 33rd in December, and P3 moving from 56th to 29th in the same period. These movements highlight a competitive market where Slow Burn Farms must continue to innovate and adapt to maintain and improve its position.

Notable Products

In December 2024, Devil Driver Pre-Roll (1g) emerged as the top-performing product for Slow Burn Farms, securing the number one rank with sales of 2144 units. Devil Driver Infused Pre-Roll (1g) consistently held the second position from November to December, showing an increase in sales to 1805 units. Tropicana Banana Infused Pre-Roll (1g) maintained its third-place ranking with steady sales improvement over the months. Lilac Diesel Pre-Roll (1g) experienced a drop from second place in October and November to fourth in December, with declining sales figures. Cheddar Cheeze Pre-Roll (1g) entered the top five in December, showcasing its growing popularity despite not being ranked in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.