Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

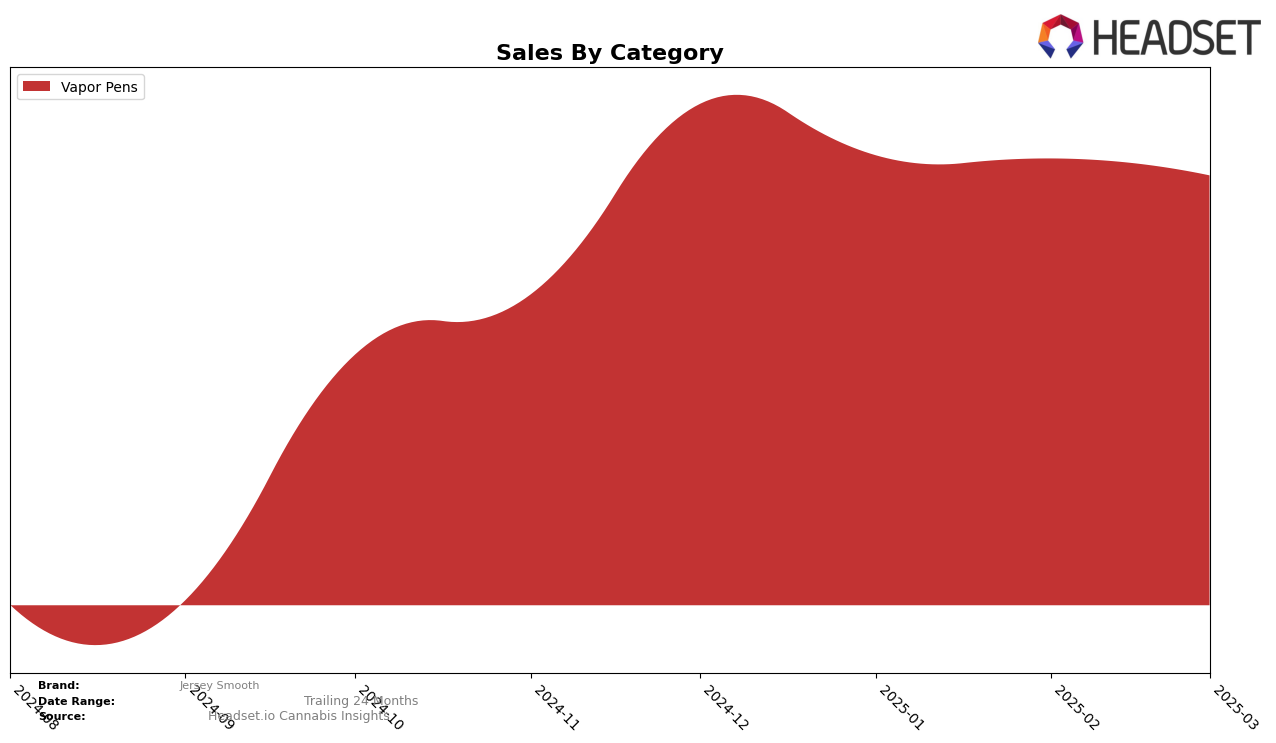

Jersey Smooth has shown a consistent presence in the Vapor Pens category in New Jersey, maintaining a steady ranking within the top 15 brands over the past few months. Starting from December 2024, where it held the 13th position, the brand experienced a slight improvement in January 2025, moving up to 12th place. By February, Jersey Smooth further climbed to 11th position, before slipping back to 13th in March. This fluctuation highlights a competitive landscape within the Vapor Pens category in New Jersey, where maintaining a top position requires constant adaptation and strategic marketing. Despite these movements, the brand's ability to stay within the top 15 is an indicator of its resilience and potential growth in this market.

While Jersey Smooth has managed to secure a spot within the top ranks in New Jersey, it is important to note that the brand does not appear in the top 30 for other states or categories, which could be seen as a limitation in its market penetration strategy. The absence of rankings in other areas might suggest a focus on strengthening its presence in New Jersey or possibly a need for expansion strategies to diversify its market reach. The sales figures also indicate a downward trend from December 2024 to March 2025, with sales dropping from $561,202 to $490,427, which could point to seasonal fluctuations or increased competition. Understanding these dynamics could provide valuable insights for stakeholders looking to capitalize on Jersey Smooth's market position and potential growth opportunities.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, Jersey Smooth has experienced notable fluctuations in its ranking from December 2024 to March 2025. Initially ranked 13th in December 2024, Jersey Smooth improved to 12th in January 2025 and further to 11th in February 2025, before slipping back to 13th in March 2025. This indicates a dynamic competitive environment where Jersey Smooth is vying for a stable position among top brands. Competitors such as &Shine consistently maintained a higher rank, ranging from 11th to 13th, highlighting a strong market presence. Meanwhile, The Clear showed a significant improvement, moving from 16th in February to 11th in March, suggesting a potential threat to Jersey Smooth's market share. Despite these shifts, Jersey Smooth's sales figures demonstrate resilience, with a relatively stable performance compared to brands like Bloom and Flower by Edie Parker, which have seen more pronounced sales fluctuations. This competitive analysis underscores the importance for Jersey Smooth to strategize effectively to maintain and improve its market position amidst a competitive and evolving market.

```

Notable Products

In March 2025, the top-performing product for Jersey Smooth was the Boardwalk Bliss Distillate Disposable (2g) in the Vapor Pens category, maintaining its leading position from the previous month with sales of 1157 units. The Boardwalk Bliss Distillate Disposable (1g) climbed to the second position from third in February, demonstrating a strong upward trend. The Full Service Gas Distillate Disposable (2g) slipped to third place, continuing its downward trajectory from the second position in February and the third in January. Highbush Blueberry Distillate Disposable (1g) entered the rankings at fourth place, marking a return after not being ranked in February. Full Service Gas Distillate Disposable (1g) remained steady at fifth place, consistent with its February ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.