Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

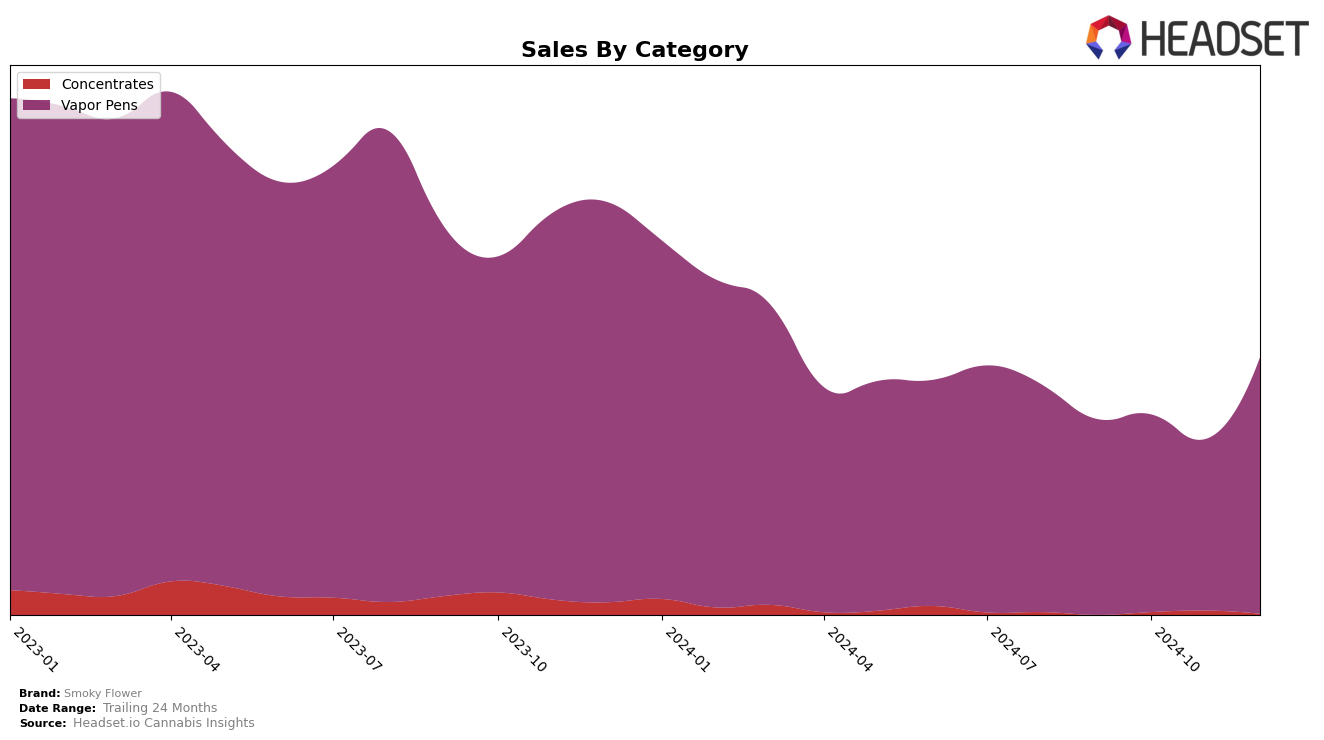

Smoky Flower has demonstrated a notable performance in the Vapor Pens category within Oregon. Over the last few months of 2024, the brand has shown an upward trajectory, particularly in December, where it climbed to the 28th position from being outside the top 30 in September and November. This improvement is indicative of a strategic push or perhaps a successful product launch or promotion that resonated well with consumers in this region. The December sales figure of $179,744 reflects this positive momentum, marking a significant increase from previous months.

While Smoky Flower's presence in the Oregon market's Vapor Pens category is strengthening, it's important to note that the brand has not yet broken into the top 30 in other states or categories. This suggests that while they are gaining traction in Oregon, there might be untapped potential in other markets or categories that the brand could explore. The variability in rankings and sales figures could be due to numerous factors, such as regional preferences or competitive dynamics, which would be valuable areas for further exploration to understand Smoky Flower's broader market potential.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Smoky Flower has shown a notable improvement in its market position, climbing from a rank of 34 in September 2024 to 28 by December 2024. This upward momentum is significant, especially when compared to competitors like Orchid Essentials and Punch Bowl, which maintained relatively stable ranks around the mid-20s throughout the same period. Despite not being in the top 20, Smoky Flower's sales trajectory indicates a positive trend, particularly in December where it saw a substantial increase, surpassing Willamette Valley Alchemy in sales. This suggests that Smoky Flower's strategic initiatives may be effectively capturing consumer interest, positioning it as a rising contender in the Oregon vapor pen market.

Notable Products

In December 2024, Pineapple Express Liquid Live Resin Cartridge (1g) emerged as the top-performing product for Smoky Flower, maintaining its number one rank from the previous month and achieving sales of 1146 units. Tropicanna Cookies Live Resin Distillate Cartridge (1g) secured the second position, debuting in the rankings with notable sales figures. Blueberry Muffin Live Resin Distillate Cartridge (1g) experienced a slight decline, dropping to fourth place from its previous second-place ranking in November. Meanwhile, Mac #4 Live Distillate Cartridge (1g) saw a decrease in its standing, moving from the top position in September and October to fifth place in December. Raspberry Parfait Live Resin Distillate Cartridge (1g) entered the rankings in third place, showcasing a strong performance for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.