Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

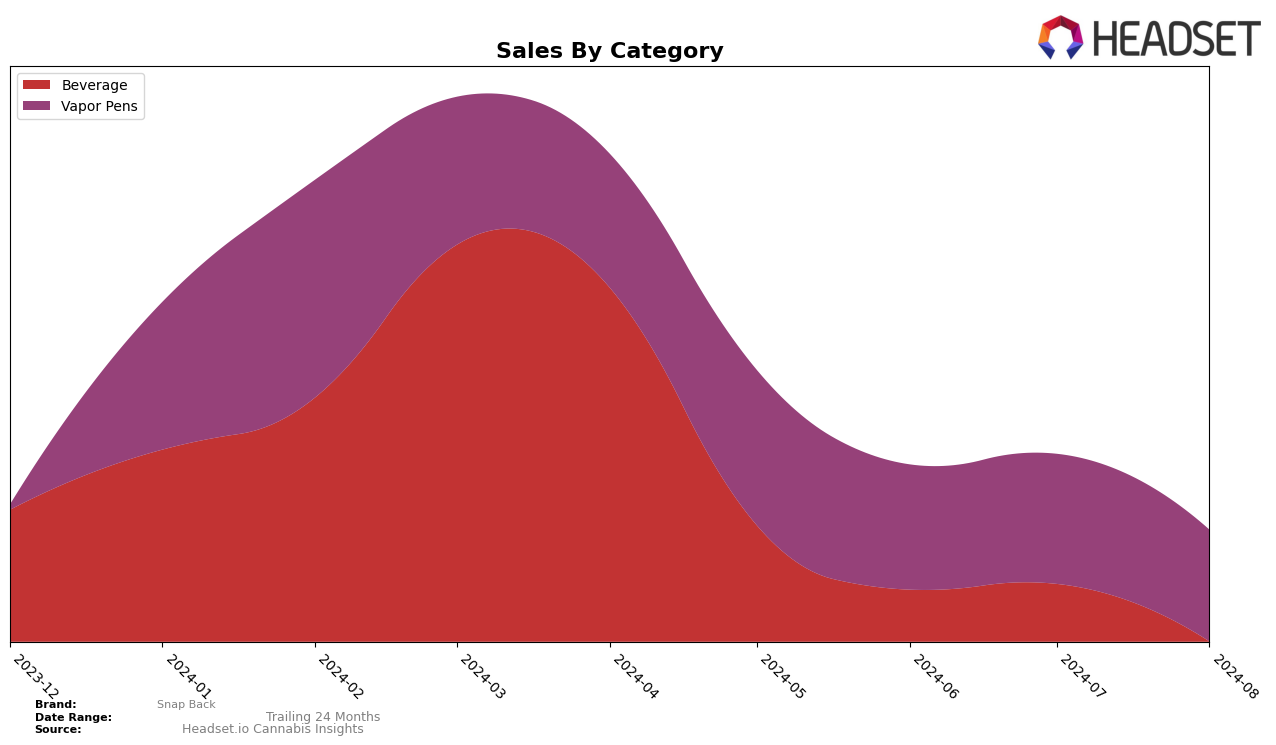

Snap Back's performance in the beverage category within Ontario has shown a notable decline over the past few months. In May 2024, Snap Back was ranked 31st, but it failed to make it into the top 30 in subsequent months, indicating a drop in its market presence. This lack of ranking in June, July, and August suggests that the brand has struggled to maintain its competitive edge in Ontario's beverage segment. This downward trend could be a cause for concern, as it implies that Snap Back is losing traction among consumers in this particular market.

Despite the challenges in Ontario, Snap Back's performance across other states and categories remains unreported, which leaves room for speculation. The absence of rankings in other states might suggest that Snap Back has not yet established a significant footprint outside Ontario or that it has not been able to break into the top 30 in other regions. This could be viewed as a negative indicator of the brand's broader market penetration. However, without additional data, it is difficult to draw definitive conclusions about its overall performance across different states and categories.

Competitive Landscape

In the Ontario beverage category, Snap Back experienced a notable fluctuation in its market rank and sales over the summer of 2024. In May, Snap Back held the 31st position, but it did not appear in the top 20 rankings for June, July, or August, indicating a significant drop in its market presence. In contrast, Proper Cannabis Company and Aspire showed more consistent performance. Proper Cannabis Company maintained its presence just outside the top 30, ranking 32nd in both June and July, and improving slightly to 31st in August. Aspire also demonstrated resilience, ranking 32nd in May and June, and reappearing in the top 32 in August. These competitors' steadier rankings suggest that Snap Back may need to reassess its market strategies to regain and sustain its position in the competitive Ontario beverage market.

Notable Products

In August 2024, the top-performing product from Snap Back was Blackberry Vanilla Cream Soda (10mg) in the Beverage category, retaining its number one rank for the fourth consecutive month with sales of 506 units. Blood Orange Vanilla Co2 Disposable (1g) in the Vapor Pens category maintained its second-place position consistently since May 2024. Similarly, Blackberry Vanilla Co2 Disposable (1g) in the Vapor Pens category held steady at third place throughout the same period. Notably, while the rankings remained unchanged, the sales figures for Blackberry Vanilla Cream Soda (10mg) experienced a significant drop from previous months. Despite this decrease, the product continued to outperform its peers, highlighting its strong market presence.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.