Oct-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

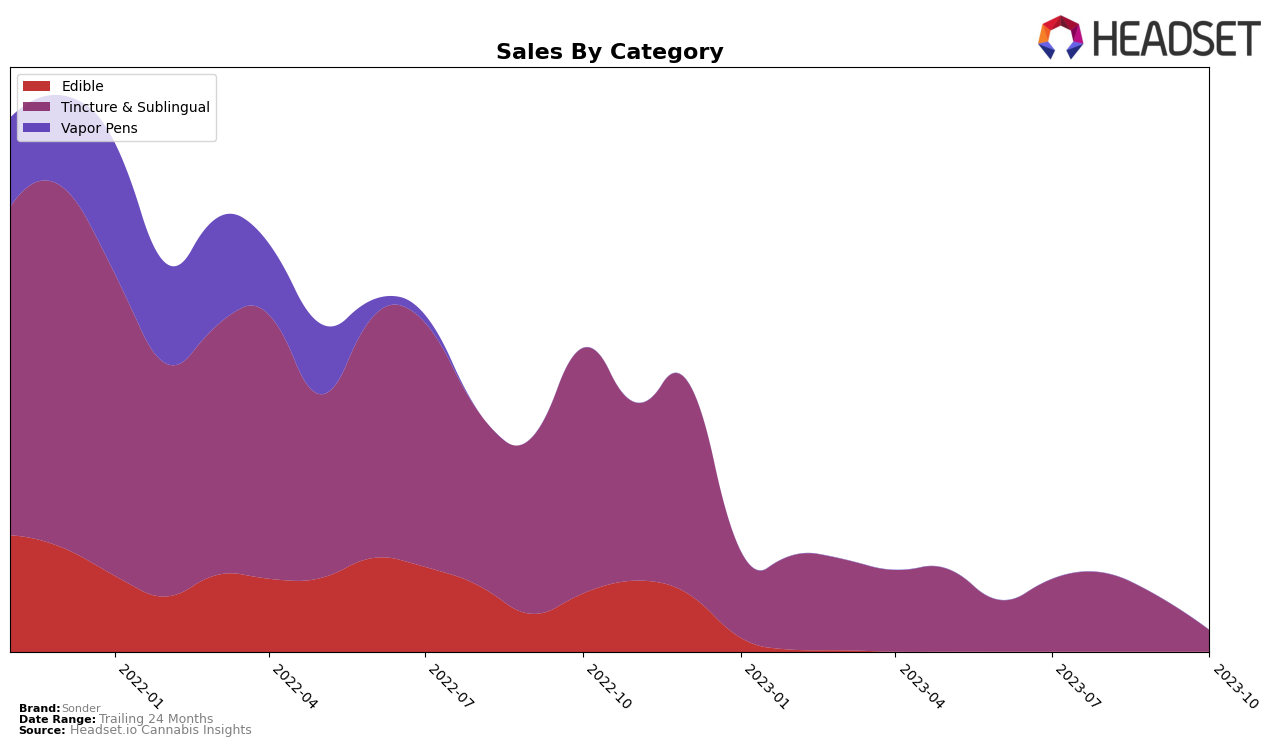

In the Tincture & Sublingual category, Sonder has shown a fluctuating performance in Nevada. The brand started in a decent position in July 2023, ranking 12th among the top 20 brands. They managed to climb up the ranks to 8th place in August 2023, reflecting a positive trend. However, in September 2023, they slightly slipped to the 10th rank. This could be due to various factors such as increased competition or changes in consumer preferences. Nevertheless, it's worth noting that despite the slight drop, Sonder remained within the top 10 brands for that month.

October 2023 was a challenging month for Sonder in Nevada. The brand saw a significant drop in its ranking, falling to the 17th position. This is a clear indication that they were outperformed by other brands in the Tincture & Sublingual category during this period. On the positive side, Sonder still managed to stay within the top 20 brands, which suggests that they still hold a significant market presence. However, the downward trend in their ranking is something that should be closely monitored. It could signal a need for the brand to reassess their market strategies or to innovate their product offerings to regain their competitive edge.

Competitive Landscape

In the Tincture & Sublingual category in Nevada, Sonder has experienced a fluctuating performance over the recent months. In July 2023, Sonder was ranked 12th, rising to 8th in August, then dropping slightly to 10th in September, and further down to 17th in October. This indicates a downward trend in rank, despite an initial rise. In comparison, Mary's Medicinals has maintained a relatively stable rank around the 15th position, while Experience Premium Cannabis (EPC) has seen a decline similar to Sonder. TRYKE and Cannalean have also experienced a drop in rank, ending up lower than Sonder in October. Despite the changes in rank, it's important to note that the specific sales numbers are not disclosed, but the trend suggests that Sonder's competitors are also facing challenges in this category.

Notable Products

In October 2023, Sonder's top-performing product was the 'Wake N' Bacon Space Crystals (10mg)' under the Tincture & Sublingual category, maintaining its first-place ranking from September with an impressive sales figure of 967 units. The 'Spooky Oooky Space Crystals (10mg)' also from the same category, held the second position, dropping one place from its previous month's ranking. The 'Pina Colada Pinata Space Crystals (10mg)' secured the third spot in October, maintaining its position from September. The 'Cheers Queers Space Crystals (10mg)' moved down to the fourth position from its previous third place. Notably, the 'Stoned Fruit Space Crystals (10mg)' did not feature in the top rankings for October, despite holding the first position in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.