Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

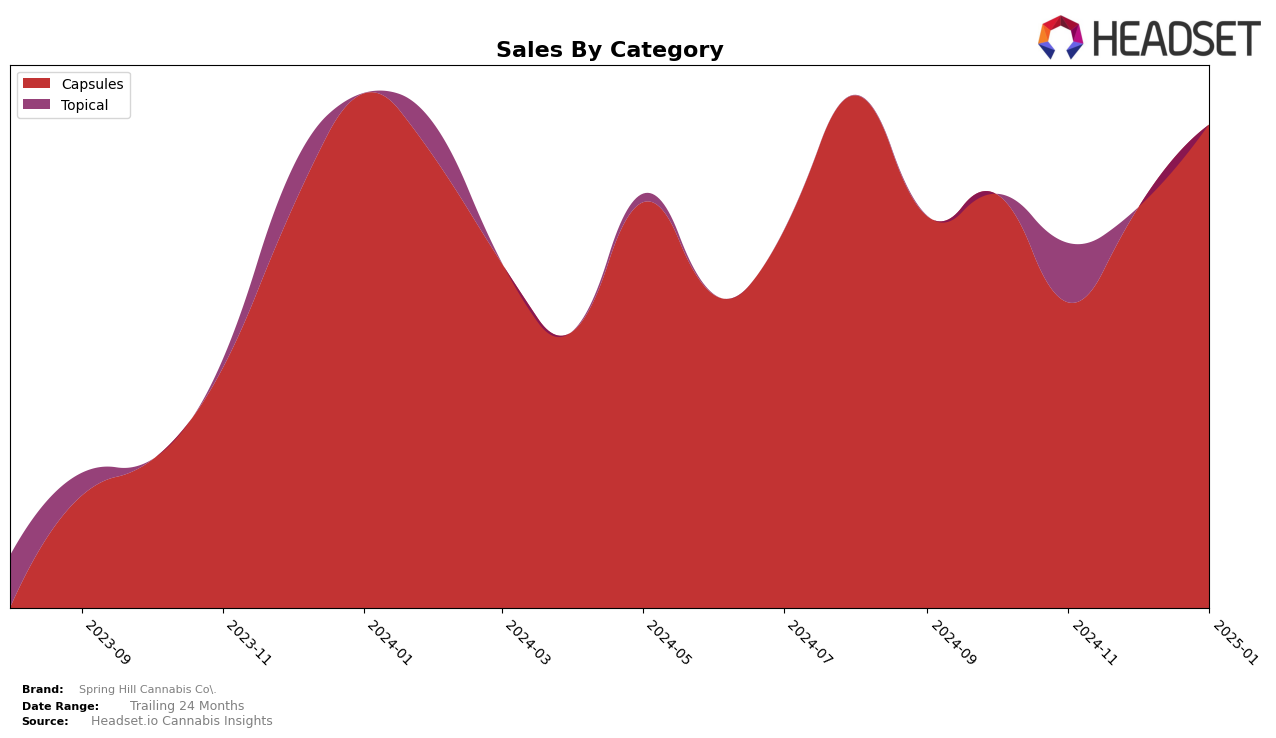

Spring Hill Cannabis Co. has shown a steady performance in the Capsules category within Ontario. Over the four-month period from October 2024 to January 2025, the brand has consistently improved its ranking, moving up from 17th to 15th place. This upward trend indicates a strengthening presence and possibly an increase in consumer preference for their capsule products. The sales figures reflect a slight fluctuation, with a notable dip in November but a recovery in December, suggesting seasonal or promotional influences that may have impacted consumer purchasing behavior.

While Spring Hill Cannabis Co. maintains a solid position in Ontario's capsules market, the absence of rankings in other categories or states/provinces suggests that the brand has yet to break into the top 30 brands elsewhere. This could be seen as an opportunity for growth and expansion into new markets. The consistent improvement in Ontario may serve as a foundation for strategic efforts to replicate success in other regions, potentially by leveraging their strengths in product quality or brand recognition. The focus on capsules might also indicate a strategic niche that the company could further exploit to differentiate itself from competitors.

Competitive Landscape

In the competitive landscape of the Ontario cannabis capsules market, Spring Hill Cannabis Co. has shown a steady improvement in rank from October 2024 to January 2025, moving from 17th to 15th position. This upward trend suggests a positive reception of their products amidst a dynamic market. Notably, Frank has been a consistent competitor, maintaining a higher rank than Spring Hill Cannabis Co. throughout the same period, with a notable increase in sales in January 2025. Meanwhile, Nutra has also outperformed Spring Hill Cannabis Co., consistently ranking higher and showing strong sales figures. On the other hand, Mood Ring and Collective Project have experienced fluctuations, with Mood Ring dropping out of the top 20 by December 2024. These dynamics highlight the competitive pressure Spring Hill Cannabis Co. faces, but also the potential for further growth as they continue to climb the ranks.

Notable Products

In January 2025, the top-performing product from Spring Hill Cannabis Co. was CBD Capsules 30-Pack (3000mg CBD) in the Capsules category, maintaining its first-place rank for four consecutive months. This product achieved notable sales of 473 units, marking an increase from December 2024. The High CBD Coconut, Grapefruit & Mint Relief Cream (1250mg CBD, 56ml) in the Topical category was not ranked in January, following its second-place position in November 2024. The consistent performance of the CBD Capsules highlights strong consumer demand and brand loyalty. The upward trend in sales for the Capsules indicates effective marketing strategies or increased consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.