Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

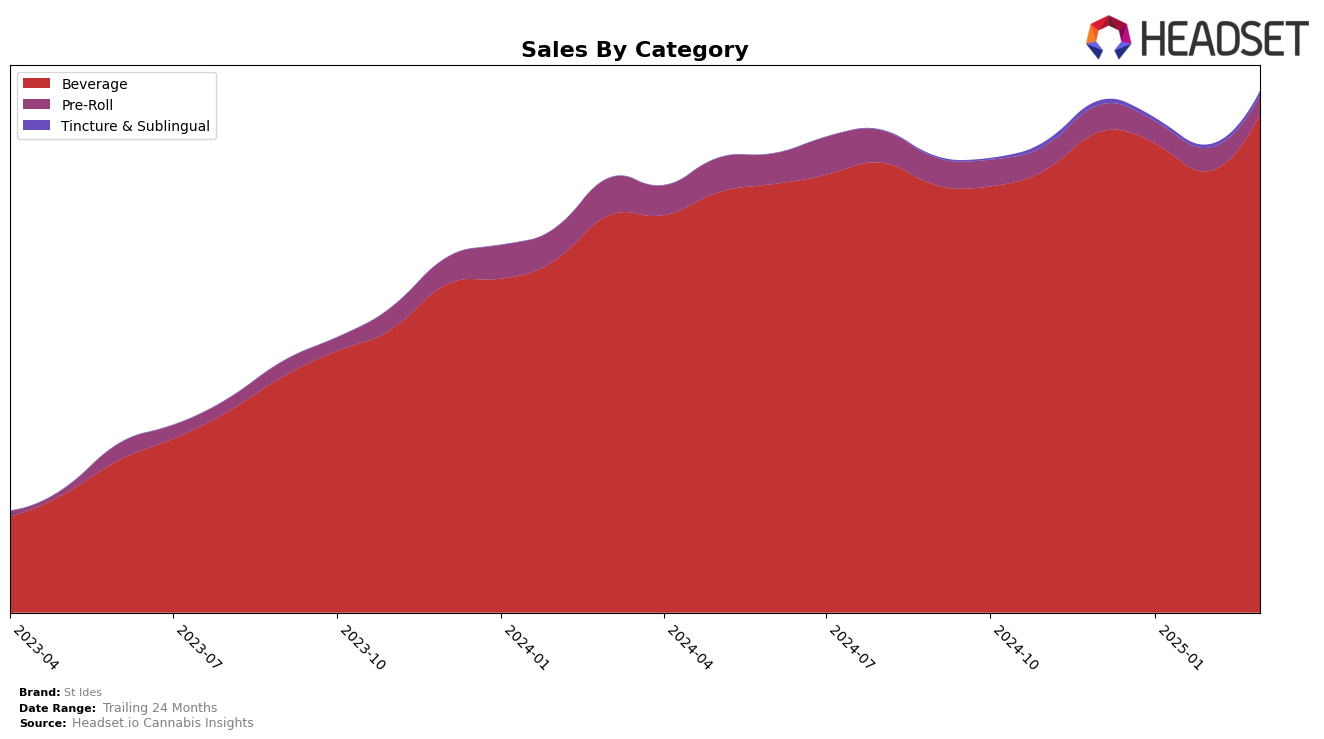

St Ides has shown remarkable consistency in the California beverage category, maintaining the top position from December 2024 through March 2025. This sustained leadership highlights the brand's strong presence and consumer preference within this segment. However, it's worth noting that despite this top ranking, there was a slight dip in sales between December and February, followed by a rebound in March. This trend suggests potential seasonal fluctuations or promotional impacts that could be influencing consumer purchasing behavior.

In contrast, St Ides' performance in the pre-roll category in California reveals a more challenging landscape. The brand did not break into the top 30 rankings from December 2024 to March 2025, indicating a less dominant position in this market. The rankings varied, with a peak at 64th position in December and February, but slipping to 82nd in March. This variance suggests that while St Ides is a leading player in beverages, it faces significant competition and possibly market penetration challenges within the pre-roll category.

Competitive Landscape

In the competitive landscape of the California cannabis beverage market, St Ides has maintained a stronghold as the top-ranked brand from December 2024 through March 2025. Despite a slight fluctuation in sales, with a notable dip in February 2025, St Ides has consistently outperformed its closest competitors. Uncle Arnie's, holding steady at the second rank, and CANN Social Tonics, consistently ranked third, both trail behind St Ides in terms of sales volume. This stability in rank suggests a strong brand loyalty and market presence for St Ides, even as it navigates the typical ebbs and flows of consumer demand. The consistent top ranking highlights St Ides' dominance and suggests that while competitors are steady, they have yet to close the significant sales gap with St Ides, indicating a robust market position for the brand.

Notable Products

In March 2025, Wild Raspberry Iced High Tea maintained its position as the top-selling product for St Ides, with a notable sales figure of 88,238 units. Georgia Peach High Tea and Maui Mango Infused High Tea continued to hold steady in second and third place respectively, showing consistent rankings since December 2024. High Punch High Tea remained in fourth place, while Lemonade High Tea also maintained its fifth position. All products in the Beverage category have consistently retained their rankings over the past four months, indicating stable consumer preferences. This consistency suggests a strong brand loyalty among customers for these top-performing products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.