Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

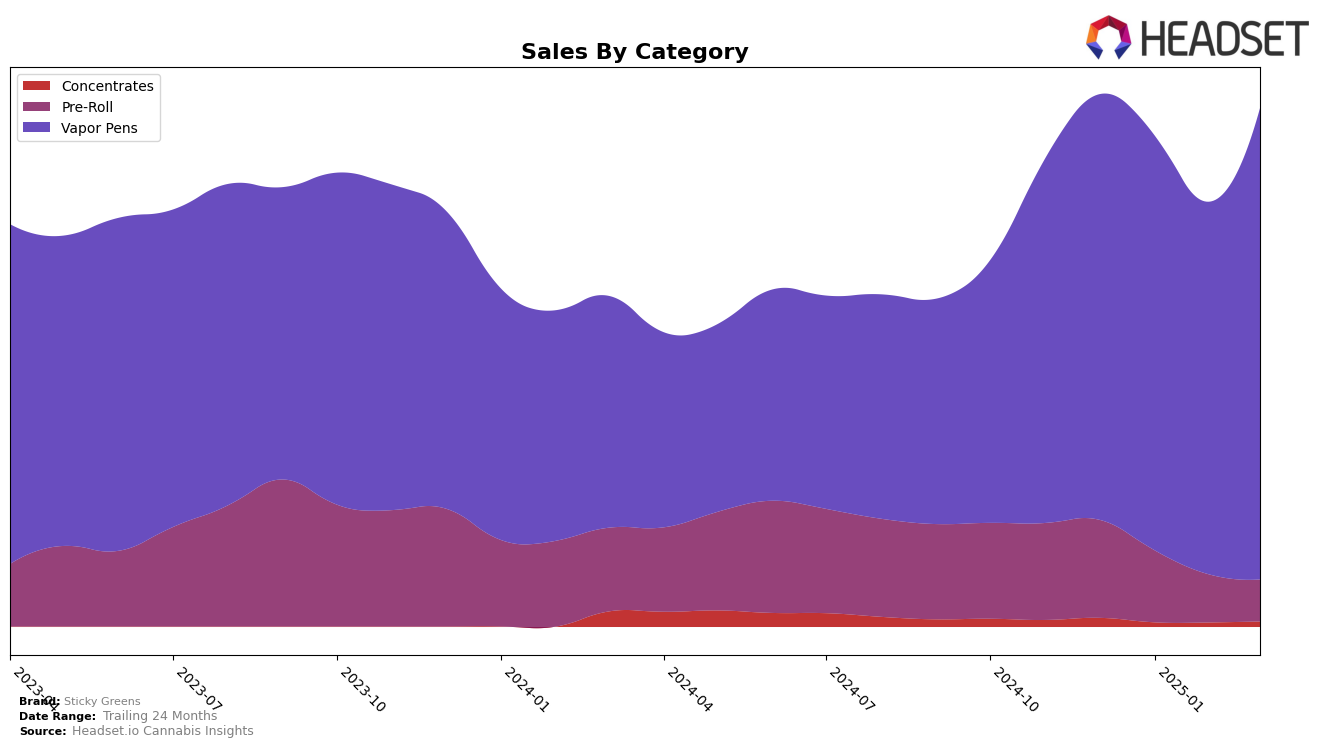

Sticky Greens has shown varied performance across different categories and provinces. In the Pre-Roll category, their presence in Alberta has been declining, as evidenced by their rank slipping from 34th in December 2024 to 65th by March 2025. This indicates a significant decrease in market competitiveness, possibly due to increased competition or shifting consumer preferences. In contrast, their Vapor Pens have performed remarkably well in Alberta, climbing to the 2nd position in March 2025 from the 5th in January, highlighting a strong consumer demand in this category. Meanwhile, in Ontario, Sticky Greens did not manage to break into the top 30 for Pre-Rolls, reflecting a challenging market environment, while their Vapor Pens maintained a more stable presence, hovering around the 20s in ranking.

In Saskatchewan, Sticky Greens' Pre-Roll category has experienced a downward trend, with their rank dropping from 8th in December 2024 to 15th by March 2025, which might suggest a need for strategic adjustments to regain market share. However, their Vapor Pens continue to perform strongly, consistently ranking in the top two positions over the same period. In British Columbia, the brand's Vapor Pens have seen a slight fluctuation, dropping from 4th in February to 6th in March, although they remain a strong competitor in this category. These movements across provinces and categories suggest that while Sticky Greens faces challenges in certain areas, particularly in Pre-Rolls, they continue to capitalize on the growing demand for Vapor Pens.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Sticky Greens has shown a remarkable turnaround in recent months. After holding steady at the 5th position in December 2024 and January 2025, Sticky Greens experienced a dip to 7th place in February 2025, only to surge to 2nd place by March 2025. This upward movement is significant, especially when compared to competitors like Spinach and General Admission, both of which have seen fluctuations in their ranks but have not managed to break into the top spot dominated by BoxHot. Sticky Greens' impressive sales growth in March 2025, which saw them surpass brands like General Admission, indicates a strong market response and potential for further gains in market share. This dynamic shift suggests that Sticky Greens is effectively capturing consumer interest and could be poised for continued success in the Alberta vapor pen market.

Notable Products

In March 2025, the top-performing product for Sticky Greens was the Baja Breeze Liquid Diamond Cartridge (1g) in the Vapor Pens category, maintaining its rank from February with a notable sales figure of 16,604 units. The Red Razzleberry Liquid Diamond Cartridge (1g) held steady in second place, closely following Baja Breeze in sales. Blue Shark Liquid Diamond Cartridge (1g) made its debut in the rankings at third place, indicating a strong market entry. Carnival Clouds Liquid Diamond Cartridge (1g) dropped one position to fourth, despite consistent sales figures over the months. Just Greens Liquid Diamond Cartridge (1g) remained in fifth place, showing a slight increase in sales compared to February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.