Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

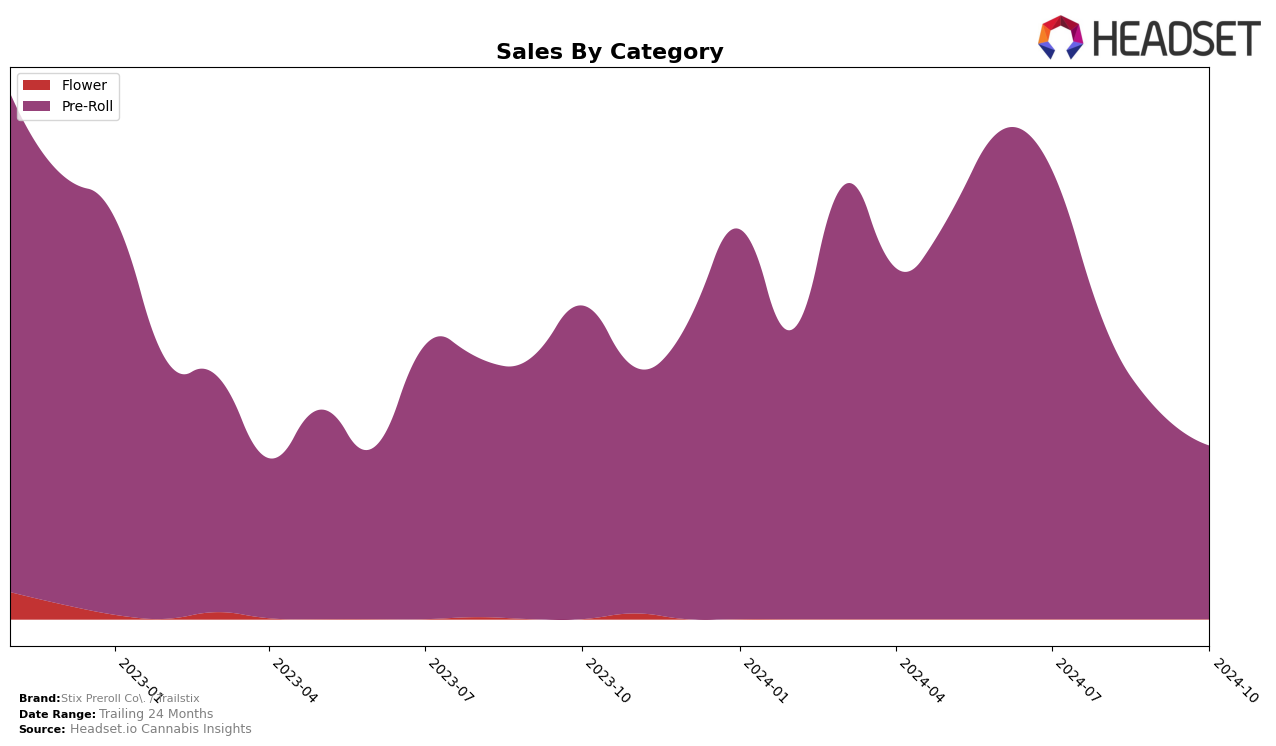

Stix Preroll Co. / Trailstix has shown varied performance across different states and categories. In Massachusetts, the brand maintained a presence in the Pre-Roll category, although its rank slipped from 18th in July 2024 to 26th by October 2024. This decline in ranking corresponds with a downward trend in sales, which fell from $410,085 in July to $197,184 in October. This suggests that while the brand remains in the top 30, it is experiencing challenges in maintaining its earlier momentum in this state.

In contrast, the performance of Stix Preroll Co. / Trailstix in Nevada has been more concerning. The brand started at 15th place in the Pre-Roll category in July 2024, but by August, it had dropped significantly to 47th, and by September, it was out of the top 30 altogether. This dramatic fall in rankings is mirrored by a sharp decline in sales, indicating potential market share losses in this region. The absence from the top 30 in October suggests that the brand faces significant competitive pressures or market challenges in Nevada.

Competitive Landscape

In the competitive landscape of pre-rolls in Massachusetts, Stix Preroll Co. / Trailstix has experienced notable fluctuations in its ranking and sales performance from July to October 2024. While maintaining a consistent presence within the top 30, the brand's rank shifted from 18th in July to 26th by October. This change suggests a competitive pressure from brands like Shaka Cannabis Company, which saw a significant improvement from 38th in August to 24th in October, and Glorious Cannabis Co., which also improved its rank from 35th in September to 25th in October. Despite these shifts, Stix Preroll Co. / Trailstix maintained a competitive edge over Strane, which dropped from 19th in August to 27th in October. The sales figures for Stix Preroll Co. / Trailstix, although declining from July to October, remained robust compared to some competitors, indicating a strong brand loyalty and potential for strategic growth in the Massachusetts pre-roll market.

Notable Products

In October 2024, the top-performing product for Stix Preroll Co. / Trailstix was Mass Super Skunk Pre-Roll (1g), which climbed to the number one rank from second place in September, boasting sales of 2079 units. Boom Stix - Indica Infused Pre-Roll (1g) entered the rankings at second place, showing a strong market presence. Mass Super Skunk Pre-Roll 7-Pack (3.5g) maintained its position at third, indicating consistent performance. Boom Stix - Hybrid Pre-Roll (1g) appeared at fourth place for the first time, while Boom Stix - Sativa Infused Pre-Roll (1g) dropped from third in August to fifth in October. This shift in rankings highlights the growing popularity of single pre-rolls over multi-pack options in the recent month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.