Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

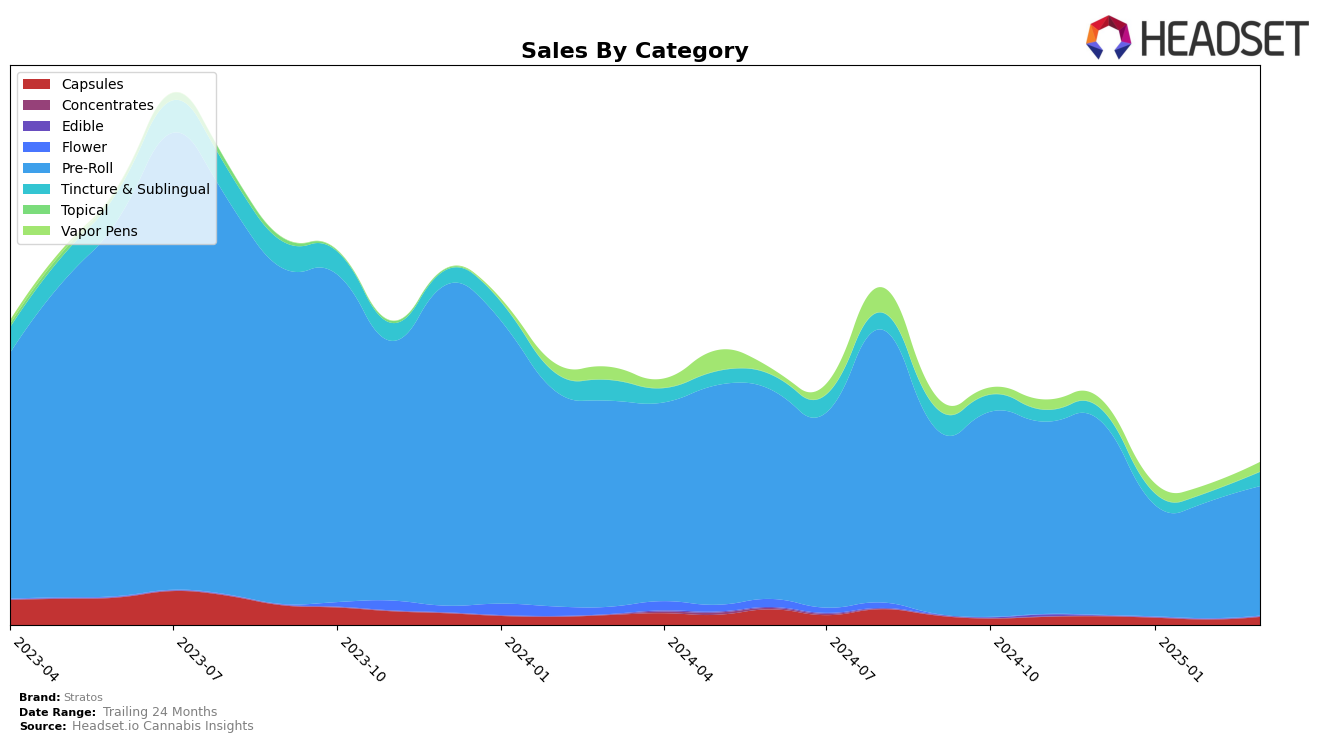

Stratos has shown notable performance fluctuations across various product categories in Colorado. In the Capsules category, Stratos held a strong position in December 2024, ranking fourth, although subsequent months did not see them in the top 30, indicating a potential decline or increased competition in the market. In contrast, the Pre-Roll category witnessed a consistent presence with Stratos maintaining a position within the top 20 from January to March 2025, despite a gradual decline from ninth to eighteenth place. This suggests a potential need for strategic adjustments to regain higher rankings amidst a competitive landscape.

The Tincture & Sublingual category remains a stable area for Stratos, with the brand consistently holding the fifth position from December 2024 through March 2025 in Colorado. This consistency could indicate a loyal consumer base or effective product differentiation. However, the Vapor Pens category presents a more challenging scenario, where Stratos did not appear in the top 30 for February 2025, though they were ranked 83rd in March 2025. The absence from the top 30 in February may highlight a need for innovation or marketing efforts to enhance visibility and sales in this segment. Overall, the brand's performance indicates areas of strength and potential opportunities for growth in a competitive market.

Competitive Landscape

In the competitive landscape of the Colorado Pre-Roll category, Stratos has experienced a notable shift in its market position from December 2024 to March 2025. Initially ranked 9th, Stratos saw a decline to 18th by March 2025, indicating a downward trend in its rank despite a slight recovery in sales from January to March. This decline in rank is contrasted by the performance of LoCol Love (TWG Limited), which maintained a relatively stable position, peaking at 10th in January before slightly dropping to 17th in March. Meanwhile, Billo showed a positive trend, moving up from 20th in December to 16th in March, suggesting a stronger market presence over the same period. Fuego Farms (CO), despite not being in the top 20 in January, managed to climb back to 20th by March, demonstrating resilience. These dynamics highlight the competitive pressures Stratos faces, as brands like Billo and LoCol Love (TWG Limited) exhibit more stable or improving ranks, potentially impacting Stratos's market share and necessitating strategic adjustments to regain its competitive edge.

Notable Products

In March 2025, the top-performing product from Stratos was Jupiter Joint - Pandora's Peach Infused Pre-Roll, maintaining its number one rank from February with sales of 1606 units. Jupiter Joints - Space Cowboy Infused Pre-Roll rose to second place, up from fourth in February, indicating a significant increase in popularity. Jupiter Joint- Moon Melon Infused Pre-Roll dropped to third, continuing its downward trend from being first in January. Notably, Jupiter Joint - Forbidden Space Fruit Infused Pre-Roll entered the rankings at fourth place, showing promising potential. Slow Bun - Blue Garlic Infused Pre-Roll remained stable at fifth place, consistent with its February ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.