Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

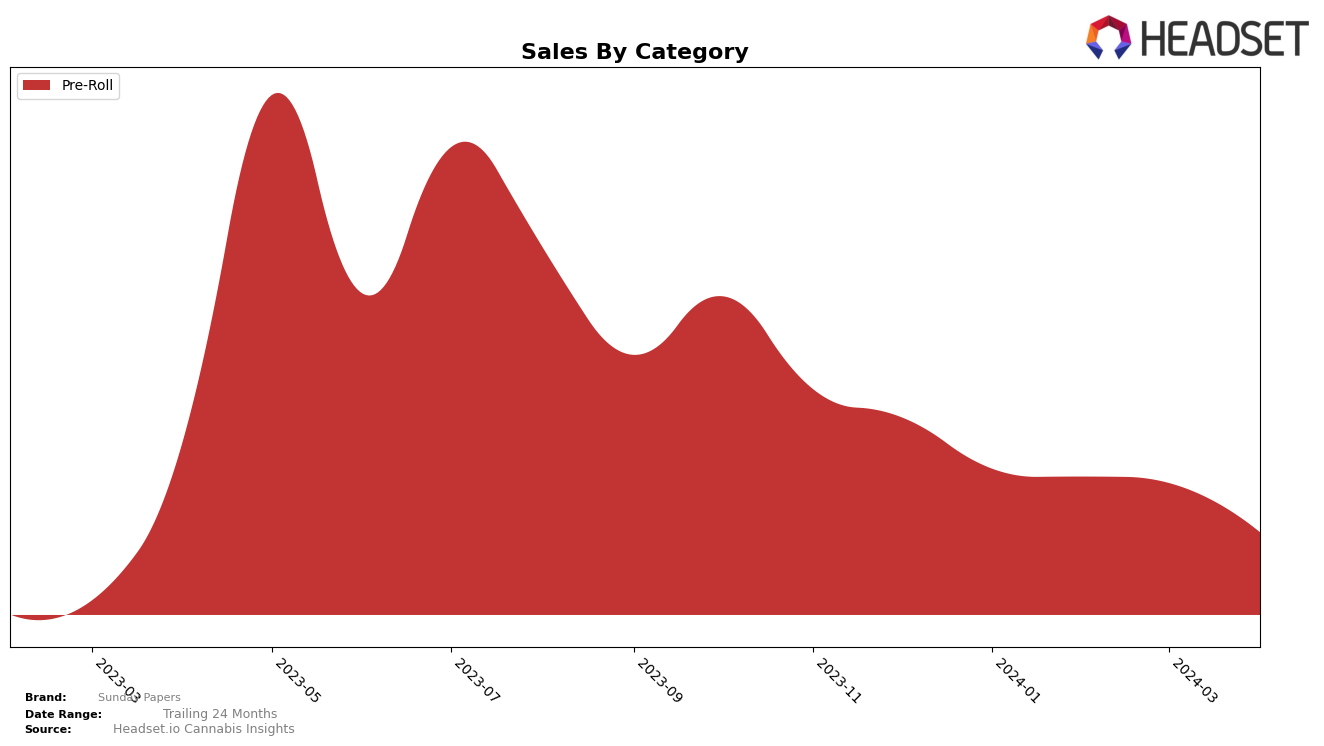

In the competitive landscape of the Missouri Missouri cannabis market, Sunday Papers has shown a consistent presence in the Pre-Roll category, albeit with a slight downward trend in its ranking over the first four months of 2024. Starting the year at rank 19 in January, the brand experienced a gradual decline, slipping to rank 23 by April. This movement suggests a need for strategic adjustments to counteract the slipping rankings, despite maintaining a spot within the top 30 brands throughout the observed period. Notably, sales in January were reported at $139,140, indicating a solid consumer base, but the subsequent months saw a decrease in sales figures, hinting at potential challenges in market positioning or consumer preferences shifting away from the brand.

The decline in rankings and sales for Sunday Papers in the Pre-Roll category reflects broader market dynamics and competitive pressures within the state of Missouri. The brand's ability to stay within the top 30 throughout these months, however, should not be overlooked as it underscores a level of resilience and ongoing consumer interest. The slight downward trend in rankings from January to April could be indicative of increased competition or changes in consumer buying habits, which are critical factors for the brand to address in its strategy moving forward. The absence of data from other states or provinces limits a comprehensive analysis of the brand's overall performance, focusing the attention on its operations and market reception within Missouri. This scenario presents an opportunity for Sunday Papers to reassess its market strategies, product offerings, and consumer engagement tactics to improve its standings and sales in the upcoming months.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Missouri, Sunday Papers has demonstrated a consistent performance, maintaining its position in the middle tier of the rankings from January to April 2024. Despite a slight fluctuation in rankings—moving from 19th in January to 23rd in April—Sunday Papers has shown resilience in a competitive market. Notably, its competitors have experienced more significant shifts in rankings and sales. For instance, FUBAR (MO) saw a decline from 6th to 24th place, indicating a potential opportunity for Sunday Papers to capture market share. Conversely, TRIP made a remarkable leap from not being in the top 20 to securing the 21st spot by March and maintaining it in April, suggesting a rapidly growing brand that Sunday Papers should monitor closely. Other competitors like Ostara Cannabis and Buoyant Bob have also seen fluctuations but remain in close contention with Sunday Papers. This analysis underscores the importance of strategic positioning and adaptability for Sunday Papers in navigating the dynamic Pre-Roll market in Missouri.

Notable Products

In April 2024, Sunday Papers saw Grape Kush Pre-Roll (0.75g) leading the sales chart within the Pre-Roll category, marking a consistent top position from March with significant sales figures, reaching 2697 units. Following closely, OG Wreck Pre-Roll 2-Pack (1.5g) made an impressive debut in the rankings, securing the second spot. Candied Grapefruit Pre-Roll 2-Pack (1.5g) experienced a slight dip, moving from the third position in March to fourth in April, showcasing a small fluctuation in its demand. Jadeonade Pre-Roll (0.75g) also saw a decrease, moving from third to fourth, indicating a competitive shift within the top products. Lastly, Kush Cake Pre-Roll (0.75g) entered the rankings at fifth place, rounding out the top performers for the month without prior visibility in the top rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.