Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

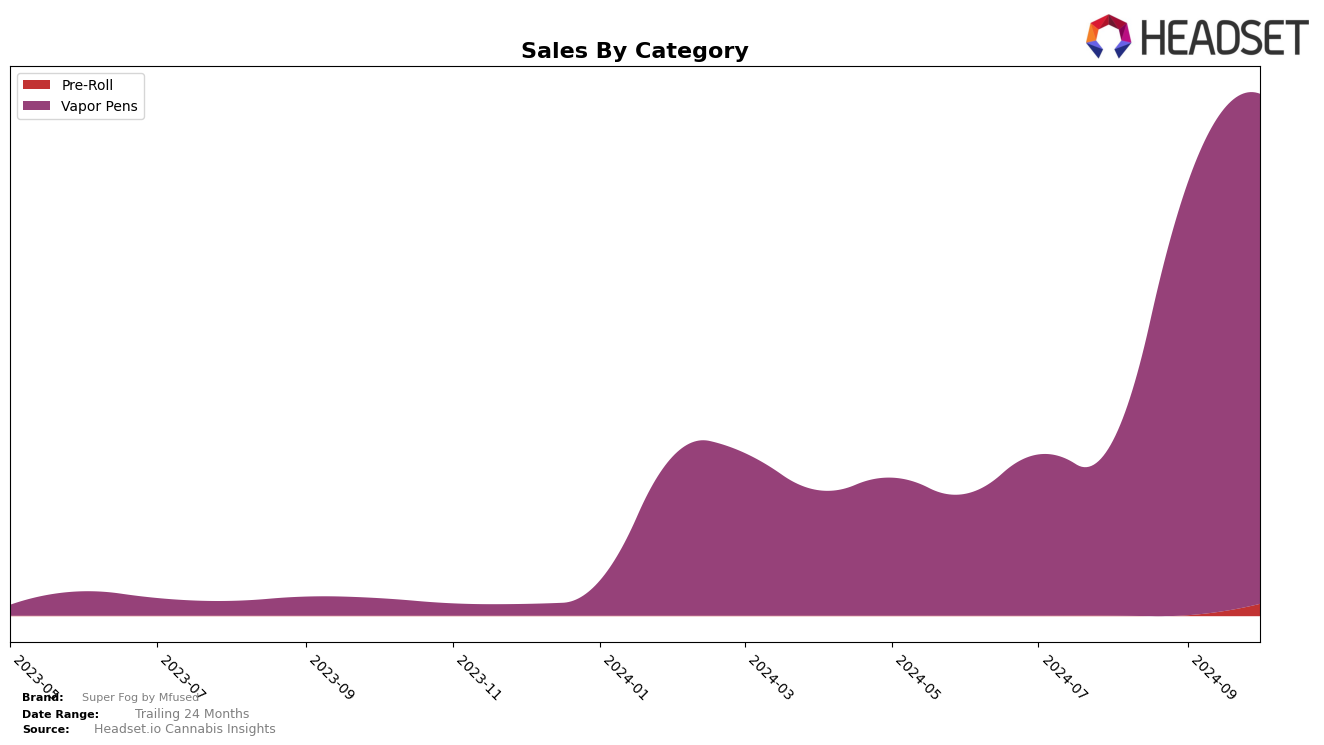

Super Fog by Mfused has shown significant movement in the Arizona market, particularly within the Vapor Pens category. Beginning in July 2024, the brand was ranked 11th and has impressively climbed to the 5th position by October 2024. This upward trajectory is indicative of a robust growth pattern, with sales figures reflecting a consistent increase, peaking in October. Conversely, in the Pre-Roll category, Super Fog made its debut in the rankings in October 2024, entering at the 24th position. This suggests a potential area of growth for the brand in Arizona, as they were previously not in the top 30 for this category.

In Washington, Super Fog by Mfused has maintained a strong presence in the Vapor Pens category, moving from 14th in July to an impressive 3rd place by October 2024. This steady climb highlights the brand's increasing popularity and market penetration in the state. Meanwhile, in New York, the brand entered the Vapor Pens rankings in September 2024 at 44th position and improved to 33rd by October. Although this shows positive movement, Super Fog is still working to establish a stronger foothold in New York compared to its performance in Washington and Arizona.

Competitive Landscape

In the Washington vapor pens category, Super Fog by Mfused has shown remarkable growth in recent months, climbing from a rank of 14th in July 2024 to 3rd by October 2024. This upward trajectory is indicative of a significant increase in market presence and consumer preference, as evidenced by a substantial rise in sales over the same period. Competing brands such as Crystal Clear and Sticky Frog have maintained their positions at the top, with Crystal Clear consistently holding the number one spot. However, Super Fog's rapid ascent suggests a strong competitive edge, potentially driven by innovative product offerings or effective marketing strategies. Meanwhile, Plaid Jacket and Micro Bar have remained stable in their rankings, indicating a more steady but less dynamic market performance compared to Super Fog's recent surge. This competitive landscape highlights Super Fog's potential to further challenge the market leaders if its current momentum continues.

Notable Products

In October 2024, the top-performing product for Super Fog by Mfused was the Twisted - Rainbow Cloud Liquid Diamonds Jefe Disposable (1g), which maintained its number one rank from previous months with sales of 6970 units. The Twisted - Wild Watermelon Natural Terpene Liquid Live Diamonds Disposable (1g) held steady in the second position, showcasing consistent performance. A notable shift occurred with the Mountain Apple Live Diamond Tanker Cartridge (1g), which climbed to the third rank, marking an improvement from its previous fifth position in August 2024. The Twisted - Baja Blazed Natural Terpene Liquid Diamonds Disposable (1g) and Twisted - Blue Magic Natural Terpene Liquid Diamonds Disposable (2g) secured the fourth and fifth spots respectively, with Blue Magic slightly dropping from its third position in September. Overall, the rankings indicate a stable top performer with some dynamic shifts in the lower ranks, reflecting changes in consumer preferences or marketing effectiveness.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.