Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

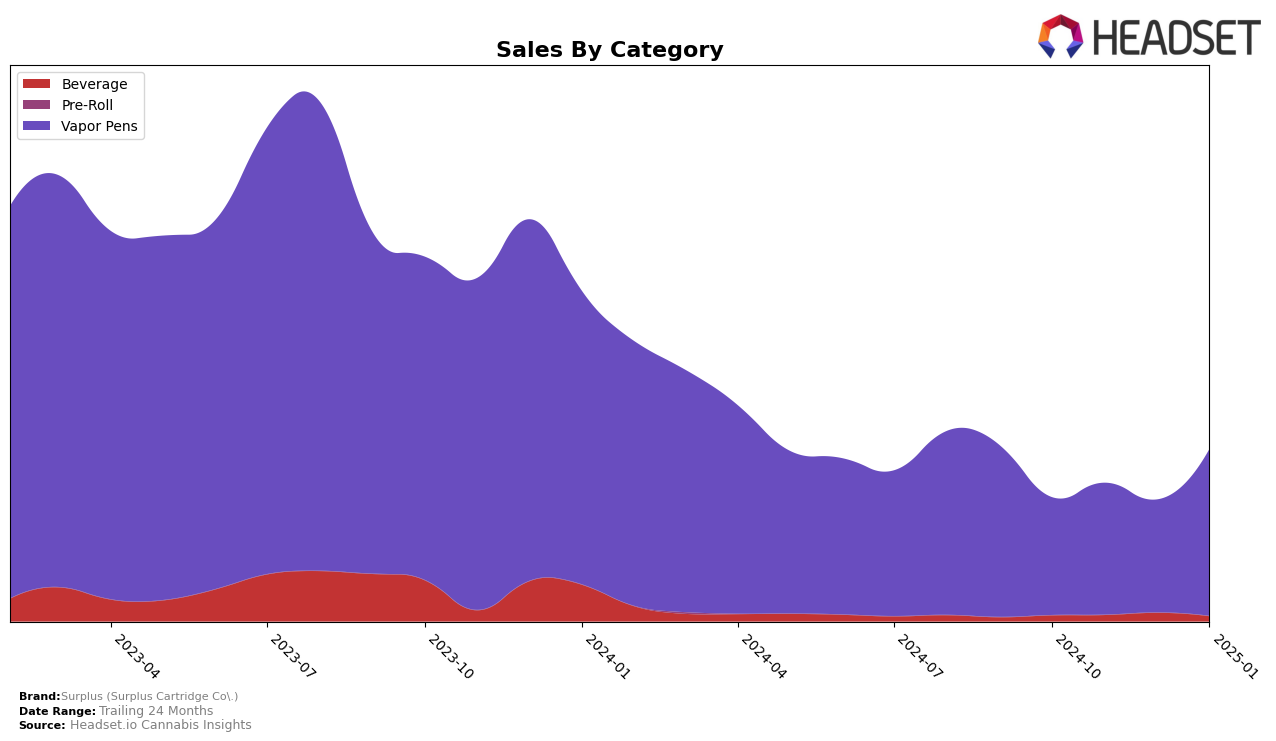

Surplus (Surplus Cartridge Co.) has shown notable progress in the Vapor Pens category within California. Over the last few months, the brand has made significant strides in its rankings, moving from the outskirts of the top 100 in October 2024 to securing the 70th position by January 2025. This upward trajectory is indicative of a strong market presence and growing consumer preference, as seen in the increase in sales from October to January. However, it's important to note that despite this progress, Surplus has not yet broken into the top 30 brands, suggesting there is still room for growth and further market penetration.

While Surplus has made headway in California, the absence of rankings in other states and categories suggests that their influence might be more localized or concentrated. This could either be a strategic focus on strengthening their position in California or a potential area of opportunity for expansion into other regions. The lack of top 30 placements in other states or categories could be seen as a challenge to overcome or a potential growth avenue. Understanding the dynamics of their success in California could provide insights into how Surplus might replicate this performance across different markets.

Competitive Landscape

In the competitive landscape of vapor pens in California, Surplus (Surplus Cartridge Co.) has demonstrated notable resilience and growth. From October 2024 to January 2025, Surplus improved its rank from 93rd to 70th, indicating a significant upward trajectory in a highly competitive market. This improvement is particularly impressive when compared to competitors like Care By Design, which moved from 78th to 67th, and Platinum Vape, which fluctuated but ended at 73rd. Although Time Machine consistently ranked higher, ending at 64th, Surplus's sales surge in January 2025 suggests a growing consumer preference that could further enhance its market position. Meanwhile, CannaBiotix (CBX) only appeared in the rankings starting December 2024, indicating that Surplus has maintained a more consistent presence. This data highlights Surplus's potential for continued growth and increased market share in the California vapor pen category.

Notable Products

In January 2025, the top-performing product for Surplus (Surplus Cartridge Co.) was the Trainwreck Distillate Cartridge (1g) in the Vapor Pens category, which climbed to the number one rank with sales of 644 units. Following closely was the Green Crack Distillate Cartridge (1g), which dropped to second place after maintaining the top spot for three consecutive months. The Tropics - Blueberry Bliss Distillate Cartridge (1g) made a notable entry at third place, showcasing a strong performance in its debut month. The Blackberry Kush Distillate Cartridge (1g) and Tropics - Grape Crush Distillate Cartridge (1g) both tied for fourth place, maintaining consistent sales figures from December. Overall, the rankings in January indicate a dynamic shift in consumer preferences, with new entries and changes in the leading positions compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.