Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

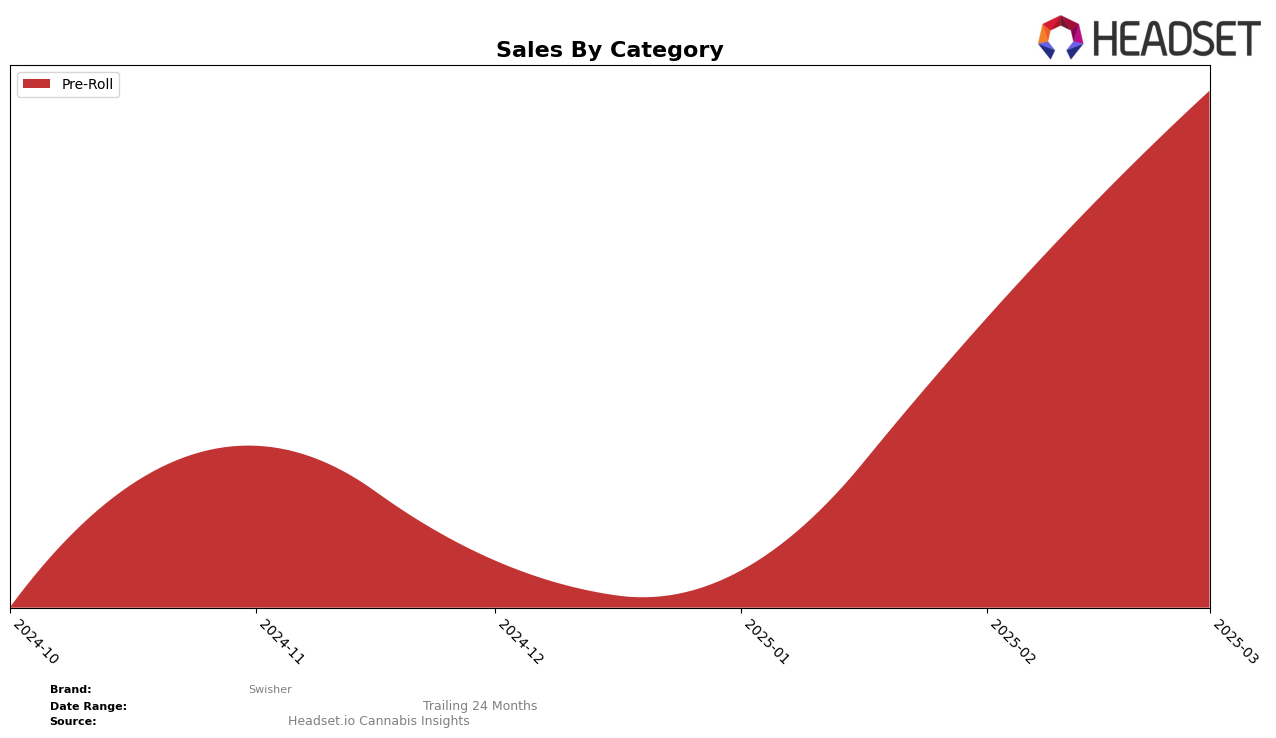

Swisher has shown a notable upward trend in the Pre-Roll category within the state of Michigan. Starting from a rank of 49 in December 2024, the brand has climbed significantly to reach the 16th position by March 2025. This impressive rise highlights Swisher's growing popularity and market penetration in Michigan's Pre-Roll segment. The sales figures reflect this positive trajectory, with a substantial increase from December to March, indicating strong consumer demand and effective market strategies. However, the absence of Swisher in the top 30 brands in other states and categories suggests that while they are making strides in Michigan, there is room for growth and expansion in other regions and product lines.

In terms of category rankings, Swisher's performance in Michigan's Pre-Roll market stands out, but their presence in other categories remains limited. The lack of top 30 rankings in additional categories or states might be seen as a missed opportunity or an area for potential development. This could imply that Swisher's focus or competitive edge is currently concentrated in the Pre-Roll segment within Michigan. For stakeholders and potential investors, understanding the dynamics behind Swisher's success in Michigan could provide insights into replicating such performance in other markets. Monitoring future movements and strategic pivots will be crucial in assessing Swisher's ability to capitalize on its current momentum and expand its market share across different regions and categories.

Competitive Landscape

In the competitive landscape of the Michigan Pre-Roll category, Swisher has demonstrated a remarkable upward trajectory in its rankings over the first quarter of 2025. Initially positioned at rank 49 in December 2024, Swisher made a significant leap to rank 18 by February 2025, and further improved to rank 16 in March 2025. This upward movement suggests a robust increase in market presence and consumer preference. In contrast, Doobies, which held a steady position in the top 10, experienced a decline to rank 17 in March 2025, indicating potential challenges in maintaining its market share. Meanwhile, Seed Junky Genetics showed a positive trend, moving up from rank 22 to 15, which could pose a future threat to Swisher if this trend continues. Additionally, Top Smoke and Galactic displayed fluctuating ranks, with Top Smoke dropping to 18 in March, suggesting volatility in their market positions. Swisher's sales growth, particularly the substantial increase from February to March 2025, underscores its successful strategies in capturing consumer interest and expanding its footprint in the Michigan Pre-Roll market.

Notable Products

In March 2025, the top-performing product for Swisher was the Classic Grape Infused Blunt 2-Pack (3g) in the Pre-Roll category, maintaining its first-place ranking for four consecutive months with sales reaching 2875.0. The Blueberry Pie Infused Blunt 2-Pack (3g) held steady at second place, showing consistent performance since February. The Strawberry Kiss Infused Blunt 2-Pack (3g) climbed to third place, a notable rise from its fifth-place ranking in February, indicating a surge in popularity. Tropical Bash Infused Blunt 2-Pack (3g) dropped one spot to fourth place after peaking at second in January. Lastly, the Irish Cream Infused Blunt 2-Pack (3g) retained its fifth-place position, consistently ranking within the top five since December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.