Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

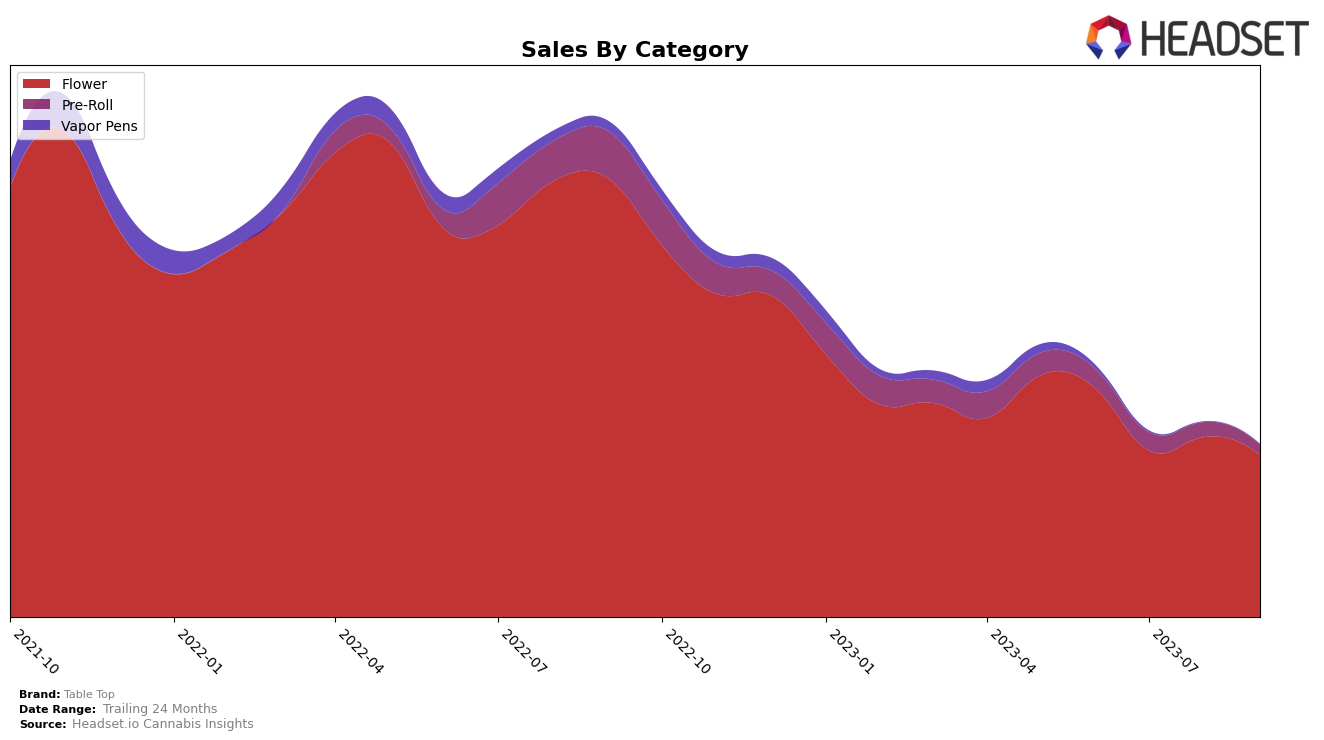

In the Flower category, Alberta and British Columbia have shown a consistent presence for Table Top in the top 20 brands, with rankings fluctuating slightly over the months. However, there's a noticeable drop in ranking in British Columbia from 8th in June to 16th in September. In Ontario, Table Top's ranking has seen a significant drop, from 58th in June to 94th in September. On the brighter side, Table Top's performance in the Flower category in Saskatchewan has improved, moving up from 19th in June to 7th in September.

When it comes to the Pre-Roll category, Table Top's performance has been more varied. In Alberta, Table Top didn't make it into the top 20 in August and September. In British Columbia, the brand's ranking has been dropping, moving from 67th in June to 90th in September. Ontario doesn't feature Table Top in the top 20 for this category. However, in Saskatchewan, Table Top has shown a slight improvement, moving from 58th in June to 41st in September. It's worth noting that Table Top also offers Vapor Pens in Ontario, but the brand didn't make it into the top 20 in August and September.

Competitive Landscape

In the Flower category within the Alberta province, Table Top has been experiencing a fluctuating rank over the past few months. In June 2023, it was ranked 10th, which slipped to 14th in July and August, and then slightly improved to 13th in September. This indicates a slight decline in its competitive position. Comparing with other brands, Tweed has been consistently ranked higher than Table Top, while Delta 9 Cannabis has shown a steady improvement in rank, surpassing Table Top in September. Shred has maintained a relatively stable rank, staying ahead of Table Top for most of the period. Interestingly, Versus has made a significant leap from 28th place in June to 15th in September, indicating a strong upward trend. In terms of sales, all these brands have shown varying degrees of growth, with Table Top's sales slightly decreasing over the period.

Notable Products

In September 2023, the top-performing product from Table Top was Sticky Buns (28g) in the Flower category, maintaining its top rank from August with sales of 3017 units. The second-best seller was Fuzzy Hammer (28g), also in the Flower category, which climbed two positions from its August rank. City Slicker (14g) moved up to the third position from its previous fourth rank in August. Allen Wrench (28g), despite a slight drop in sales to 1406 units, managed to hold onto the fourth position. The fifth position was taken by Yogurt (14g), which saw a dip from its second rank in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.