Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

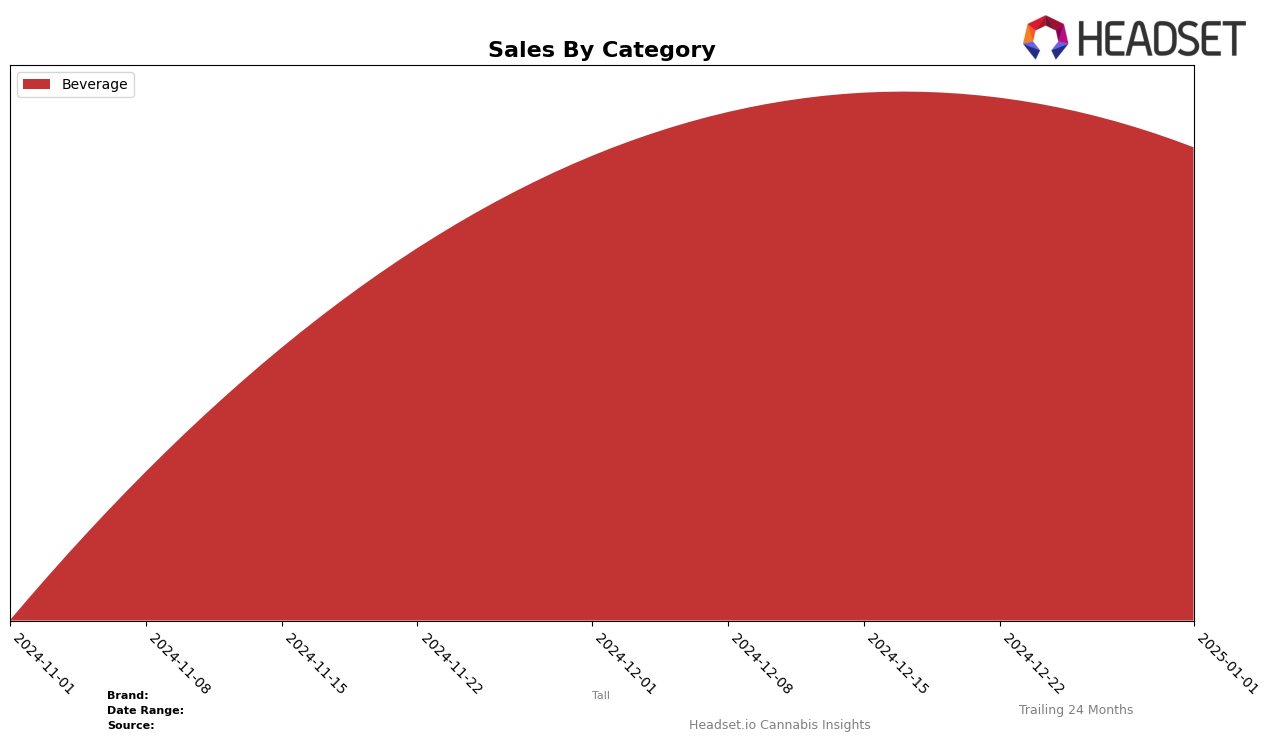

The performance of the cannabis brand Tall in the Beverage category shows a notable upward trajectory in Maryland. After not being in the top 30 for October and November 2024, Tall made a significant leap to secure the 6th position in December 2024, maintaining this rank through January 2025. This rise indicates a strong market penetration and growing consumer preference for their beverage offerings in the state. The consistent ranking suggests sustained demand and possibly effective marketing strategies or product innovation that resonated well with consumers.

While the data highlights Tall's success in Maryland, it's also important to note the absence of ranking information for other states or categories, suggesting that the brand may not have a significant presence or competitive edge elsewhere. This could be seen as an opportunity for growth or a challenge that needs addressing. The sales figures for Maryland, although not disclosed in detail, indicate a positive trend, supporting the brand's ranking improvement. Observing Tall's strategy in Maryland could provide insights into potential expansion tactics for other states or categories.

Competitive Landscape

In the Maryland beverage category, Tall has shown a consistent presence in the rankings, maintaining the 6th and 7th positions in December 2024 and January 2025, respectively. This stability suggests a steady demand for Tall's products, although it trails behind competitors like Dixie Elixirs, which consistently holds the 3rd rank with significantly higher sales. Meanwhile, Sunnies by SunMed has demonstrated notable growth, climbing from 5th to 4th place, indicating a potential threat to Tall's market share. The data suggests that while Tall maintains a solid position, it faces competitive pressure from brands that are either more established or rapidly gaining traction, highlighting the need for strategic marketing efforts to enhance its competitive edge in the Maryland beverage market.

Notable Products

In January 2025, Juicy Peach Seltzer (10mg THC, 12oz) maintained its position as the top-performing product for Tall, with sales reaching 2,593 units. This product has consistently held the number one rank since November 2024, indicating strong and stable consumer demand. The second top product, Pineapple Express Vape Cartridge, saw a notable improvement, climbing from the fourth position in December 2024 to second in January 2025. Meanwhile, the Lavender Dream Gummies experienced a slight dip, moving from third to fourth place. Overall, Tall's beverage category continues to dominate, with multiple products in the top five rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.