Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

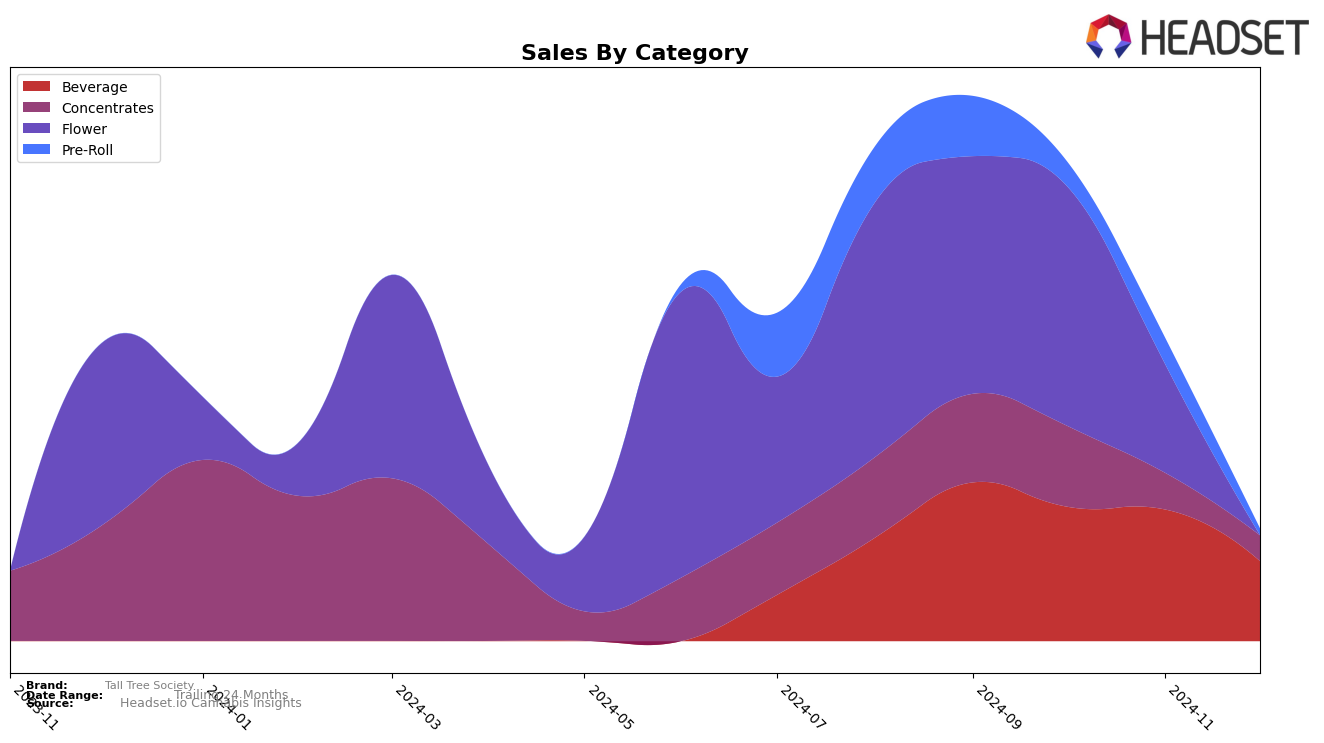

In the state of Maryland, Tall Tree Society has shown a consistent presence in the Beverage category throughout the fall months of 2024. The brand maintained a strong position at rank 5 in both September and October, before experiencing a slight drop to rank 6 in November. However, by December, the brand did not appear in the top 30 rankings, which could be a point of concern or a strategic shift in focus. The sales figures reveal a gradual decline from September to November, with October sales at $13,403, indicating a possible seasonal or competitive influence affecting their performance.

It's noteworthy that Tall Tree Society did not appear in the December rankings for Maryland, which might suggest a significant change in market dynamics or consumer preferences. This absence from the top 30 could highlight challenges the brand faces in maintaining its competitive edge or an opportunity for them to innovate and recapture market share. While the brand's performance in other states or categories isn't detailed here, the trends in Maryland provide a snapshot of the competitive pressures and consumer shifts that Tall Tree Society must navigate in the ever-evolving cannabis beverage market.

Competitive Landscape

In the Maryland beverage category, Tall Tree Society has experienced a slight decline in its competitive standing over the last few months of 2024, dropping from a consistent 5th place in September and October to 6th place in November, before falling out of the top 20 by December. This downward trend in rank is mirrored by a decrease in sales, which fell from $15,836 in September to $13,127 by November. In contrast, competitors like Tall and Tall have shown resilience, with Tall securing the 6th position in December, indicating a potential shift in consumer preferences or competitive strategies. The absence of Tall Tree Society from the top 20 in December highlights the need for strategic adjustments to regain market share and improve sales performance in the competitive Maryland beverage market.

Notable Products

In December 2024, Tall Tree Society's top-performing product was the Dark Berry Seltzer (5mg THC, 12oz) in the Beverage category, maintaining its consistent first-place ranking from previous months, despite a notable decrease in sales to 1763 units. The Sour Alpine Blueberries Infused Pre-Roll (1g) showed significant improvement, climbing to the second position in the Pre-Roll category, up from its steady fifth-place ranking in the prior months. Margalope Rosin (1g) emerged as a strong contender in the Concentrates category, debuting at third place. Mac Burger Live Resin (1g) and GMO Cold Cure Live Rosin (1g) followed closely, ranking fourth and fifth, respectively, indicating a competitive edge among concentrates. These shifts highlight a dynamic change in consumer preferences towards concentrates, while beverages and pre-rolls continue to hold their popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.