Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

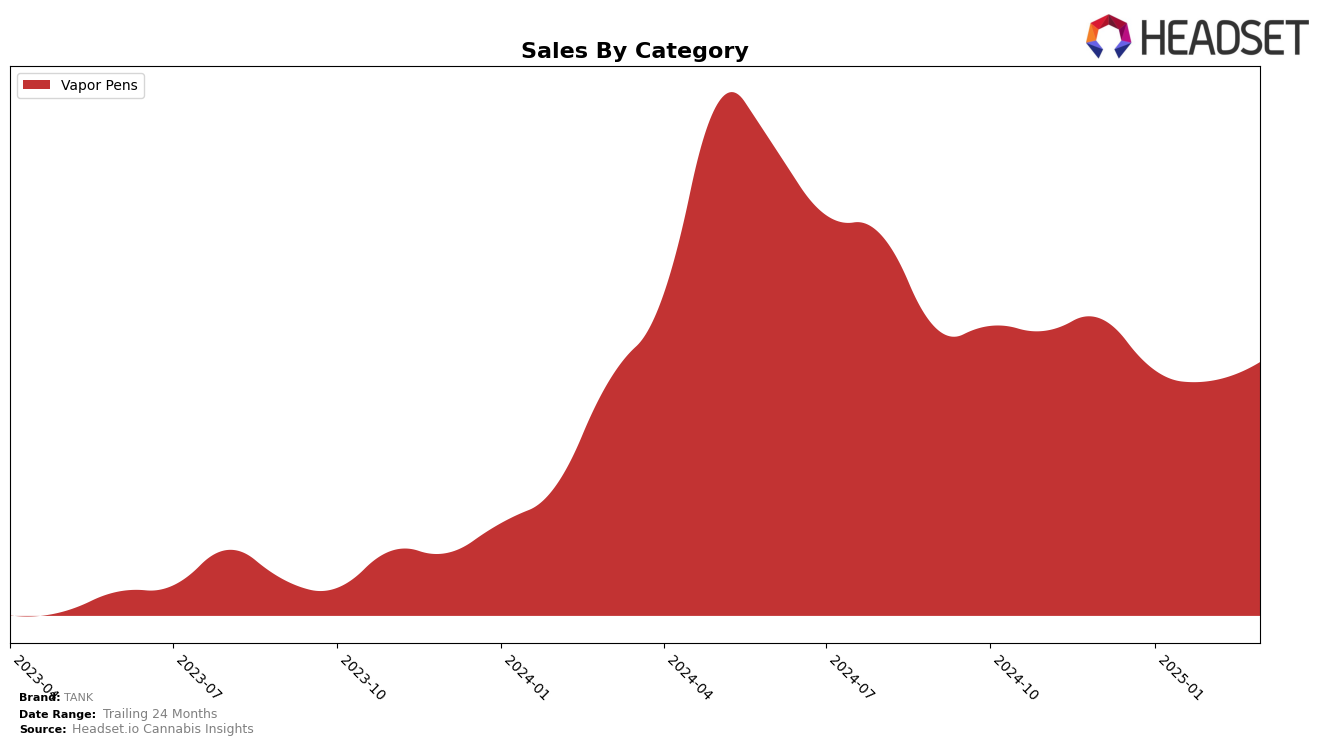

In the state of Missouri, TANK has shown a consistent presence in the Vapor Pens category, maintaining its position within the top 15 brands. Starting from a rank of 13 in December 2024, the brand experienced a slight decline to 15 by March 2025. This downward movement, while not drastic, suggests a competitive landscape in Missouri's Vapor Pens market. Despite the rank changes, TANK's sales figures indicate a slight recovery in March 2025 after a dip in January and February, which could be indicative of strategic adjustments or seasonal demand shifts.

While TANK's presence in Missouri's Vapor Pens category is notable, their absence from the top 30 rankings in other states and categories highlights areas for potential growth or challenges faced in expanding their market footprint. This absence can be viewed as a significant opportunity for TANK to explore new strategies or product innovations to capture market share in other regions. The brand's performance in Missouri could serve as a benchmark for identifying successful practices that might be replicated in other states or categories.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, TANK has shown a relatively stable performance, maintaining a consistent rank of 15th place in both February and March 2025. This steadiness contrasts with the fluctuating ranks of competitors such as AiroPro, which dropped from 10th in December 2024 to 17th by March 2025, and Ostara Cannabis, which experienced a significant rank drop from 6th in January 2025 to 14th in March 2025. Meanwhile, Buoyant Bob has been a consistent performer, holding the 13th position in both February and March 2025. Despite these shifts, TANK's sales have shown resilience, with a notable increase from February to March 2025, indicating a positive trend in consumer preference. This stability in rank and upward sales trajectory positions TANK as a reliable choice for consumers amidst a volatile competitive environment.

Notable Products

In March 2025, Lemon Whip Kush Distillate Cartridge (1g) emerged as the top-performing product for TANK, climbing from its previous fifth-place ranking in February to secure the number one spot with sales reaching 3023 units. Strawberry Brew BDT Distillate Cartridge (1g), which had held the top position in the previous months, fell to second place, maintaining strong sales figures of 2762 units. Blueberry Underground Distillate Cartridge (1g) consistently held its ground, ranking third, a slight drop from its second-place finish in February. Paradise Petrol BDT Distillate Cartridge (1g) remained steady at fourth place, showing a gradual increase in sales compared to previous months. Lemon Whip Kush BDT Distillate Cartridge (0.5g) re-entered the rankings at fifth, showcasing a modest recovery from its absence in the earlier months of 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.