Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

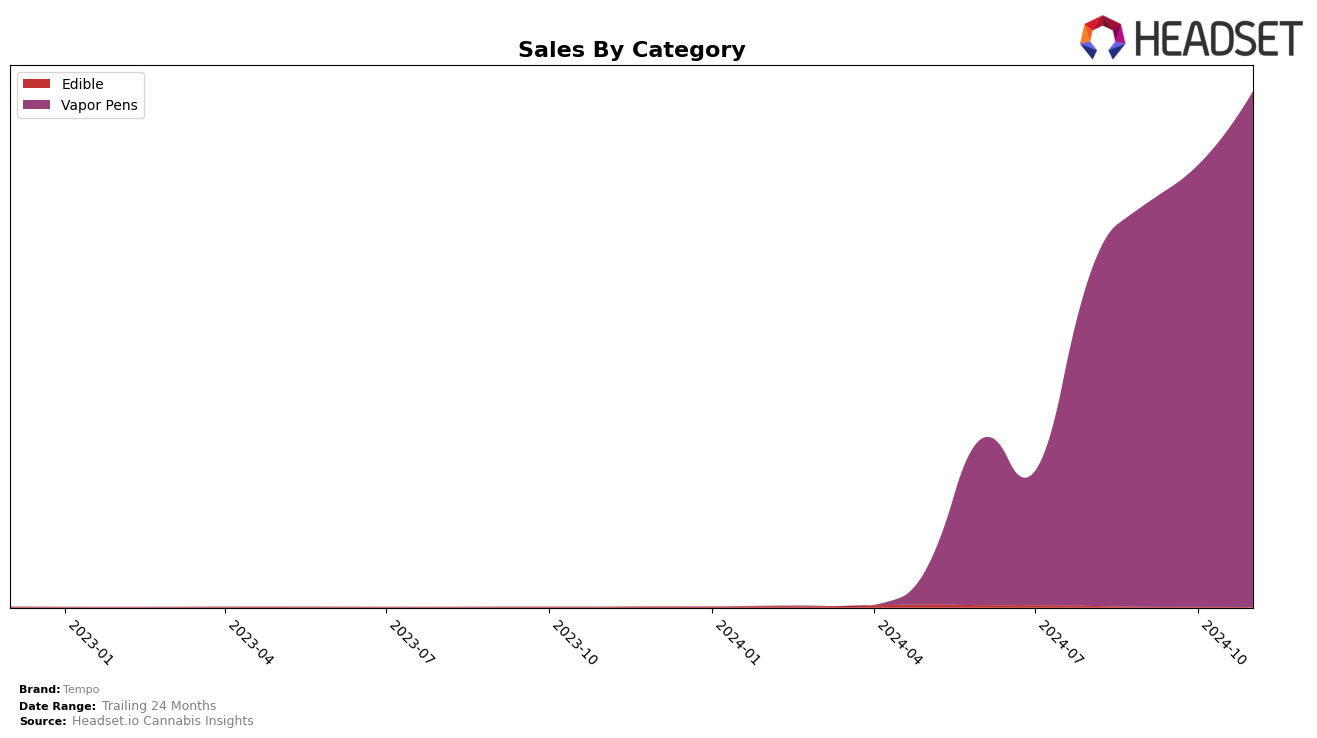

In the past few months, Tempo has demonstrated a notable upward trajectory in the Vapor Pens category within California. Starting from a rank of 45 in August 2024, Tempo has climbed steadily to secure the 30th position by November 2024. This consistent rise in rank indicates a strengthening presence in the market, driven by a significant increase in sales. This upward movement suggests a growing consumer preference for Tempo's offerings in this category, which could be attributed to various factors such as product innovation or effective distribution strategies.

Despite this progress in California, Tempo's absence from the top 30 rankings in other states or provinces for the Vapor Pens category highlights potential areas for growth and market penetration. The lack of presence in these markets could suggest either a focus on consolidating their position in California or challenges in expanding their brand visibility and consumer base elsewhere. Understanding the dynamics of these other markets could provide strategic insights for Tempo to replicate its success beyond California, potentially leading to a broader national or international footprint in the future.

Competitive Landscape

In the competitive landscape of vapor pens in California, Tempo has shown a notable upward trajectory in recent months. From August to November 2024, Tempo climbed from a rank of 45 to 30, indicating a significant improvement in market position. This rise is particularly impressive when compared to competitors like Connected Cannabis Co., which remained relatively stable, hovering around the 30th rank, and Almora Farms, which experienced a slight decline from 28 to 32. Tempo's sales growth has been robust, surpassing brands such as Sauce Essentials, which saw a sharp drop in rank from 17 to 29, reflecting a significant decrease in sales. Meanwhile, UP! has also seen a decline in rank, moving from 24 to 28, despite a temporary sales increase in October. Tempo's consistent rise in both rank and sales suggests a strengthening brand presence and an increasing consumer preference in the California vapor pens market.

Notable Products

In November 2024, the top-performing product for Tempo was the Strawberry Beltz Distillate Disposable (1g) in the Vapor Pens category, maintaining its consistent number one rank from previous months with an impressive sales figure of 4670 units. The Kiwi Kush Distillate Disposable (1g) rose to the second position, recovering its previous standing from August and September after a slight dip in October. OG Grape Live Resin Disposable (1g) held the third rank, showing a slight decline from its second position in October but an improvement from September. Mystic Mango Distillate Disposable (1g) slipped to fourth place, marking a consistent performance trend over the months. Meanwhile, Huckleberry Ice Distillate Disposable (1g) maintained its fifth position, indicating steady but lower sales compared to the top four products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.